Featured

Justin Sun's Strategic $209M Ethereum Withdrawal from Lido Finance Yields $349M Profit

Crypto entrepreneur Justin Sun requests withdrawal of 52,905 ETH from Lido Finance, following successful accumulation strategy that netted $349M in profits. The move marks another significant market influence from Sun, whose previous large-scale withdrawals have historically impacted ETH prices.

Trump-Backed Crypto Project Acquires $250K in ONDO Tokens Amid $44.7M Buying Spree

World Liberty Financial, supported by the Trump family, has purchased over $44.7 million in various cryptocurrencies, including a significant acquisition of ONDO tokens. The project's strategic investments and partnerships, including Justin Sun joining as advisor, are creating waves across the crypto market.

Robinhood's Crypto Trading Volume Soars 529% as Platform Adds 420,000 New Users

Robinhood Markets saw explosive growth in November 2024, with crypto trading volumes surging 529% to $35.2 billion and 420,000 new funded accounts. The platform's remarkable expansion reflects growing mainstream crypto adoption while its stock trades near $41, up significantly from previous lows.

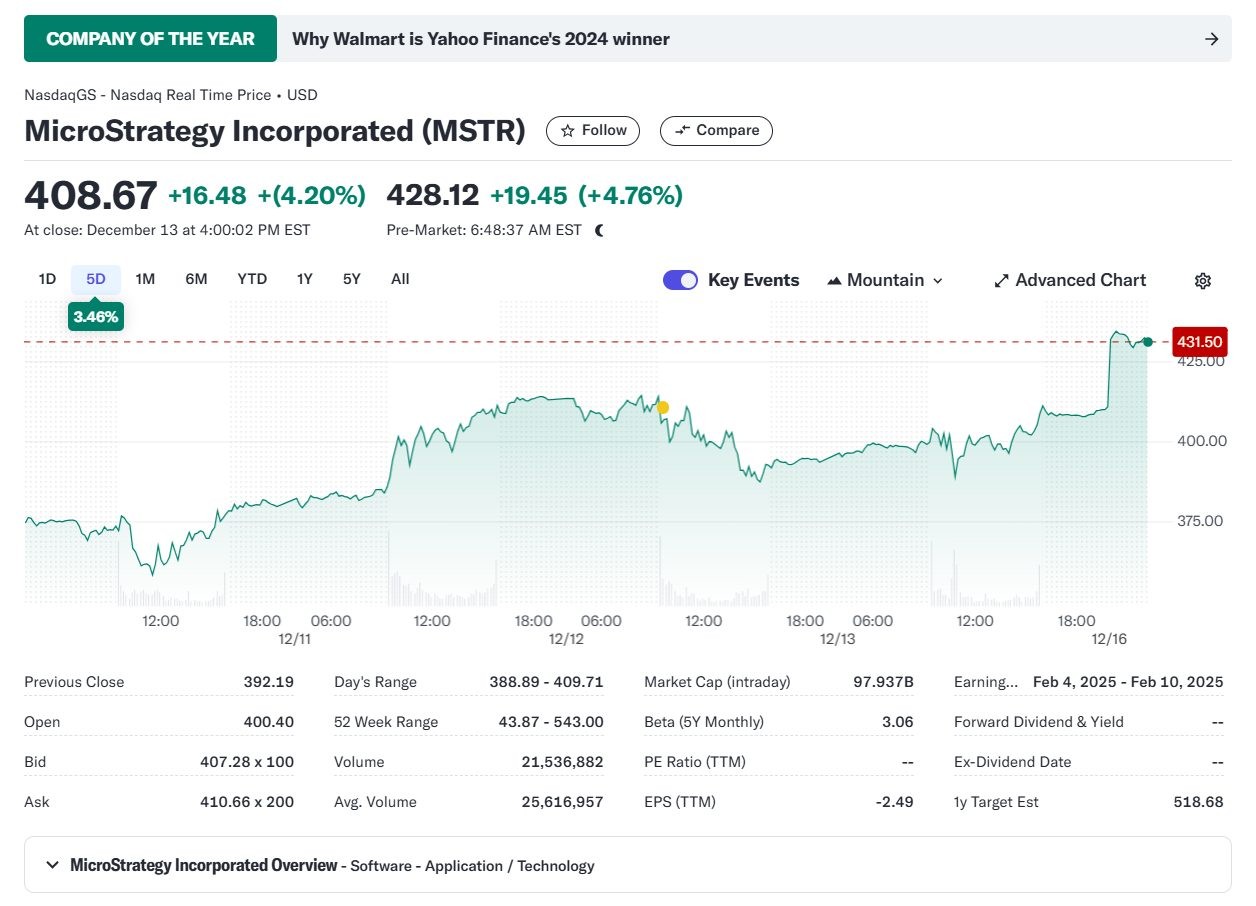

MicroStrategy's $1.5B Bitcoin Purchase Precedes Landmark Nasdaq-100 Inclusion

MicroStrategy acquires 15,350 BTC worth $1.5 billion through share sales, bringing total holdings to 439,000 BTC ahead of joining Nasdaq-100 index. The company's Bitcoin strategy yields 72.4% returns YTD while stock surges 547%, with substantial buying power remaining for future purchases.

MicroStrategy Poised for Historic Bitcoin Purchase Above $100K

MicroStrategy, led by CEO Michael Saylor, signals readiness to make its first Bitcoin acquisition above the $100,000 mark, potentially expanding its massive 423,650 BTC holdings. The company's aggressive crypto strategy has driven a 500% stock surge this year, earning it a spot in the Nasdaq-100 index.

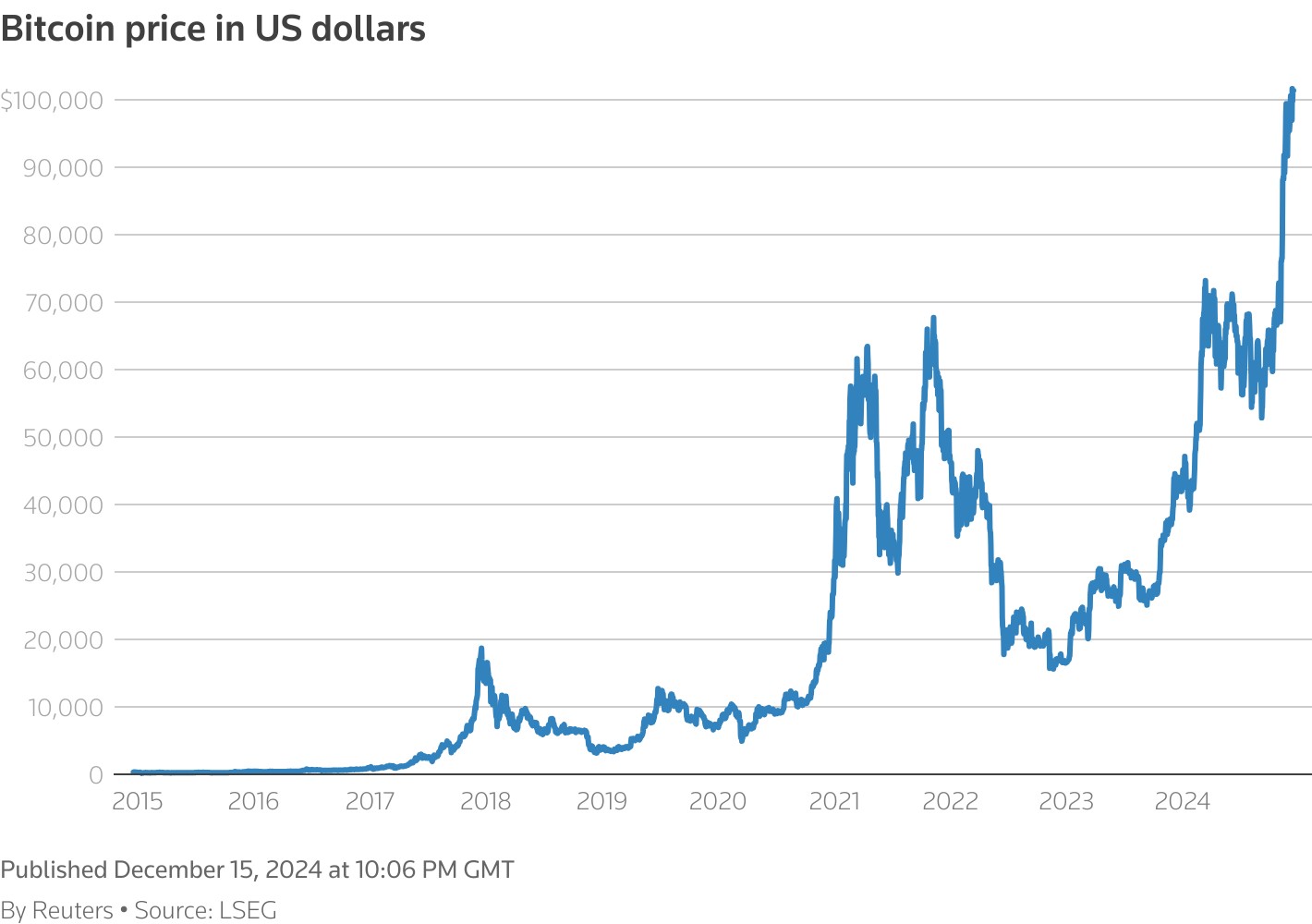

Trump's Strategic Bitcoin Reserve Plan Propels BTC to Record $106,000

Bitcoin surges past $106,000 as Donald Trump proposes creating a U.S. cryptocurrency strategic reserve, marking a dramatic shift in his stance on digital assets. The rally coincides with MicroStrategy's upcoming Nasdaq 100 inclusion and growing government adoption worldwide.

China's Bitcoin Strategy: Scaramucci Predicts National Reserves by 2025

Former White House official Anthony Scaramucci forecasts China's return to cryptocurrency, predicting the establishment of Bitcoin reserves and legal mining operations by 2025. The projection aligns with growing global adoption trends and recent legislative movements toward Bitcoin integration in national financial frameworks.

Bitcoin Millionaire Launches $2M National Treasure Hunt with Historical Artifacts

A Bitcoin millionaire has hidden five treasure chests worth $2 million across America, containing priceless historical artifacts like ancient Greek gold and Jackie O's jewelry. Jon Collins-Black's treasure hunt aims to get people outdoors while offering clues through his new book.

MetaMask Expands Crypto Payment Services Across Latin America with New Debit Card

MetaMask launches its cryptocurrency-enabled debit card in Brazil, Mexico, and Colombia, allowing users to spend digital assets wherever Mastercard is accepted. The expansion follows successful pilots in Europe and includes integration with major mobile payment platforms, marking a significant step toward mainstream crypto adoption in Latin America.