Featured

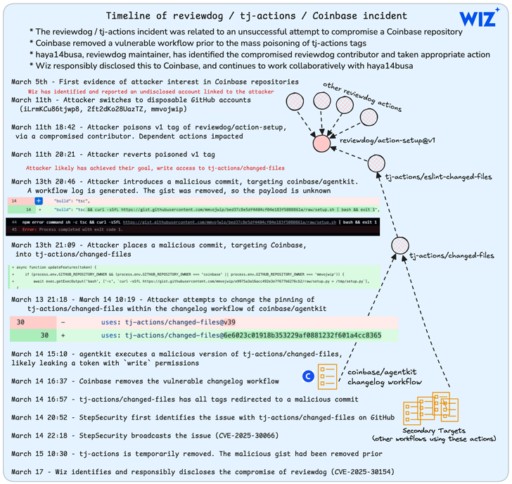

GitHub Supply Chain Attack Targets Coinbase's Open-Source Project

A sophisticated cyberattack targeting Coinbase's AgentKit repository through GitHub Actions put over 23,000 repositories at risk. While Coinbase successfully defended against the intrusion, at least 218 other repositories were compromised, exposing various access tokens.

Crypto.com and Trump Media Join Forces to Launch 'Made in America' ETFs

Crypto.com partners with Trump Media & Technology Group to create innovative ETFs focused on American investments through the Truth.Fi brand. The collaboration will offer Bitcoin and traditional asset funds to over 140 million users globally, pending regulatory approval.

U.S. Treasury Lifts Controversial Tornado Cash Sanctions After Court Ruling

The U.S. Treasury has removed sanctions against cryptocurrency mixer Tornado Cash following a court ruling that challenged OFAC's authority. While celebrating innovation in digital assets, officials maintain vigilance against illicit activities as legal proceedings continue against platform founders.

Bitcoin's Record High Sparks Debate on Next Crypto Bear Market Timeline

As Bitcoin reaches an unprecedented $108,786 in January 2025, experts analyze whether traditional market cycles still apply in an era of institutional adoption. The interplay between historical patterns and new market forces from ETFs and major investors could reshape crypto's trajectory.

Federal Authorities Open $7M Recovery Process for Cryptocurrency Fraud Victims

U.S. authorities have secured $7 million from cryptocurrency fraudsters who used fake trading platforms and social engineering to scam investors. Victims can now reclaim their lost funds through a formal government petition process to verify their claims.

Trump's Gold-to-Bitcoin Proposal: A New Era for US Reserve Assets?

Former President Trump's administration proposes converting government gold reserves to Bitcoin through a 'budget-neutral' approach, marking a significant shift in cryptocurrency policy. The controversial plan could reshape national reserve asset management while facing implementation challenges and market implications.

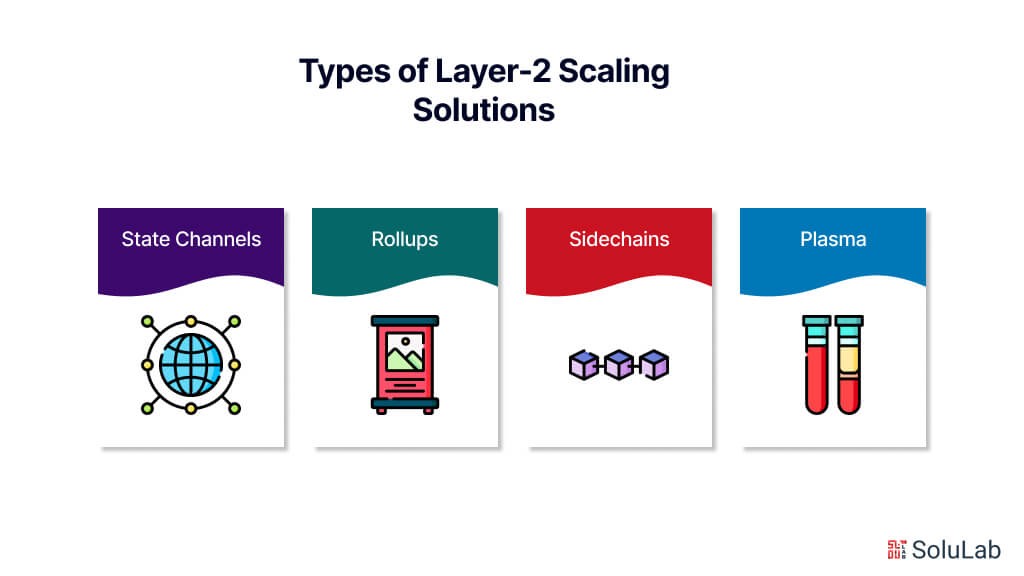

Solana Co-Founder Ignites Debate Over Blockchain Scaling Solutions

Anatoly Yakovenko, Solana's co-founder, sparks controversy by challenging Layer 2 scaling solutions and defending Layer 1 architectures. The dispute highlights fundamental challenges in balancing blockchain scalability, security, and decentralization as the industry seeks optimal solutions for mainstream adoption.

Crypto Security Arms Race: Ledger Warns of Evolving Threats in Digital Asset Protection

Ledger's chief experience officer highlights the ongoing battle between wallet providers and cybercriminals, with neither side gaining a clear advantage. As cryptocurrency adoption grows, scammers continue to succeed with both basic tricks and sophisticated schemes, resulting in billions in losses.

OneKey Hardware Wallet Unveils Major Update with Enhanced Solana Support

OneKey Classic releases firmware update 3.11.0 with expanded Solana blockchain capabilities and FIDO2 integration. The comprehensive update introduces new network support, improved Bluetooth connectivity, and German language localization while strengthening security features.