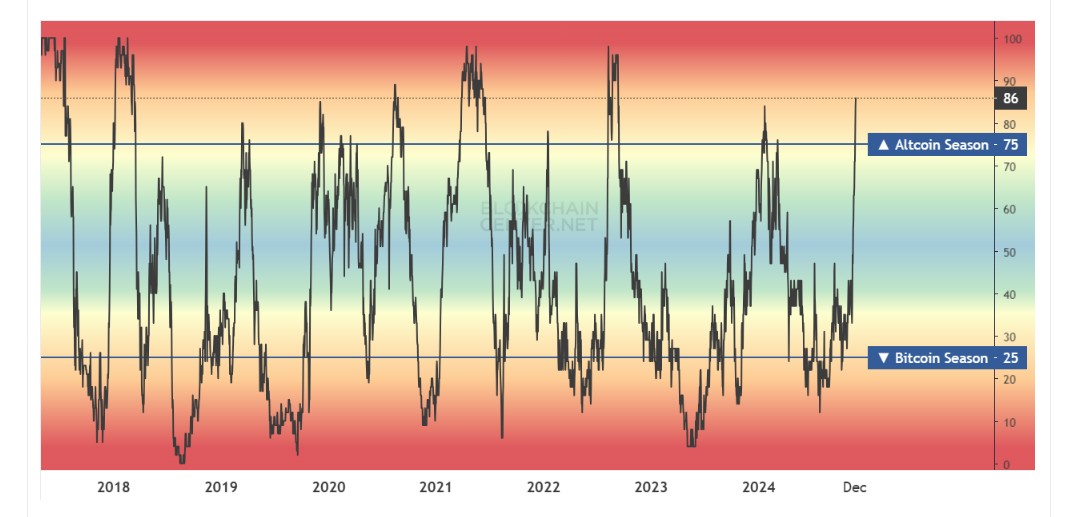

The cryptocurrency market is witnessing a remarkable shift as the Altcoin Season Index reaches 89 out of 100, marking its highest level this year and indicating a potential altcoin bull market.

Recent data shows that 89 of the top 100 cryptocurrencies are currently outperforming Bitcoin over a 90-day period. This surge mirrors the market conditions seen during the explosive crypto rally of 2021.

Several major altcoins have posted impressive gains recently. XRP broke past $2.50, Hedera (HBAR) doubled in value, and Ethereum reached its highest point in six months. The total market capitalization of altcoins has jumped 74.5% in just 30 days, reaching $1.369 billion.

The current market dynamics show striking similarities to the first half of 2021, when altcoins gained 174% while Bitcoin surged to just 2%. During that period, Bitcoin's market dominance fell from 61.9% to 40%.

Key market trends emerging in this altcoin season include:

- Real World Asset (RWA) Tokens

- Artificial Intelligence & Big Data Tokens

- Meme Coins

- Modular Blockchain Tokens

- Layer 1 Platforms

Bitcoin's current market dominance stands at 54.8%, and if historical patterns repeat, this could decrease to around 40% as altcoins continue to gain momentum.

Market analysts note that while the overall trend is bullish, investors should remain cautious and set clear entry and exit targets. Historical data suggests that altcoin seasons typically last only a few months, though top performers may continue outperforming Bitcoin for extended periods.

The surge in the Altcoin Season Index coincides with increased public interest, as reflected in Google Trends data showing search volumes for 'altcoins' approaching peak levels after a prolonged period of low activity throughout 2022 and most of 2023.