Cryptocurrency exchange-traded funds (ETFs) reached unprecedented heights in November, with Bitcoin and Ethereum ETFs collectively attracting $7.6 billion in net inflows amid growing investor confidence and market optimism.

Bitcoin ETFs led the charge with $6.5 billion in net inflows, while Ethereum ETFs contributed $1.1 billion, marking historic highs for both cryptocurrencies. The surge coincides with President-elect Donald Trump's pro-cryptocurrency stance and promises of friendlier digital asset regulations.

Market analysts report that Bitcoin's price has doubled since the start of 2024, experiencing a 45% increase following the US presidential election. Currently trading at $95,721, Bitcoin maintains a market capitalization of $1.9 trillion, though it continues to face resistance at the $100,000 mark.

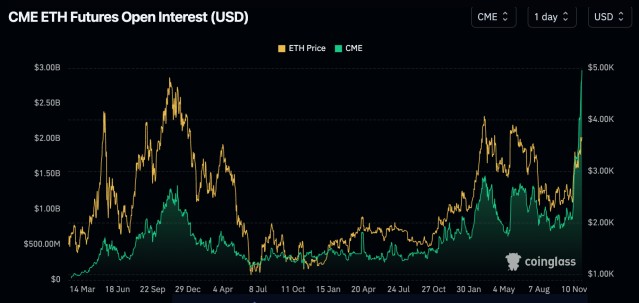

Ethereum has shown exceptional performance, outpacing Bitcoin in recent gains. On November 29 alone, nine Ether ETFs recorded net inflows of $333 million, with BlackRock's ETHA product accumulating $2.1 billion in total inflows. The leading altcoin currently trades at $3,619, commanding a market cap exceeding $435 billion.

Digital asset analyst Markus Thielen points to declining Bitcoin inventory on cryptocurrency exchanges, noting that only Bitfinex, Binance, and Coinbase maintain substantial Bitcoin reserves. While the overall market capitalization grows, Bitcoin's market dominance has decreased from 60% to 56%.

Industry experts, including author Robert Kiyosaki, project ambitious price targets, with some forecasting Bitcoin to reach $250,000 by 2025. The sustained ETF inflows reflect growing institutional interest and mainstream adoption of digital assets in the investment landscape.