Recent data shows major cryptocurrency exchanges are experiencing a notable surge in Bitcoin buying pressure, as indicated by rising taker buy/sell ratios across multiple platforms.

Strong Buying Signals Emerge

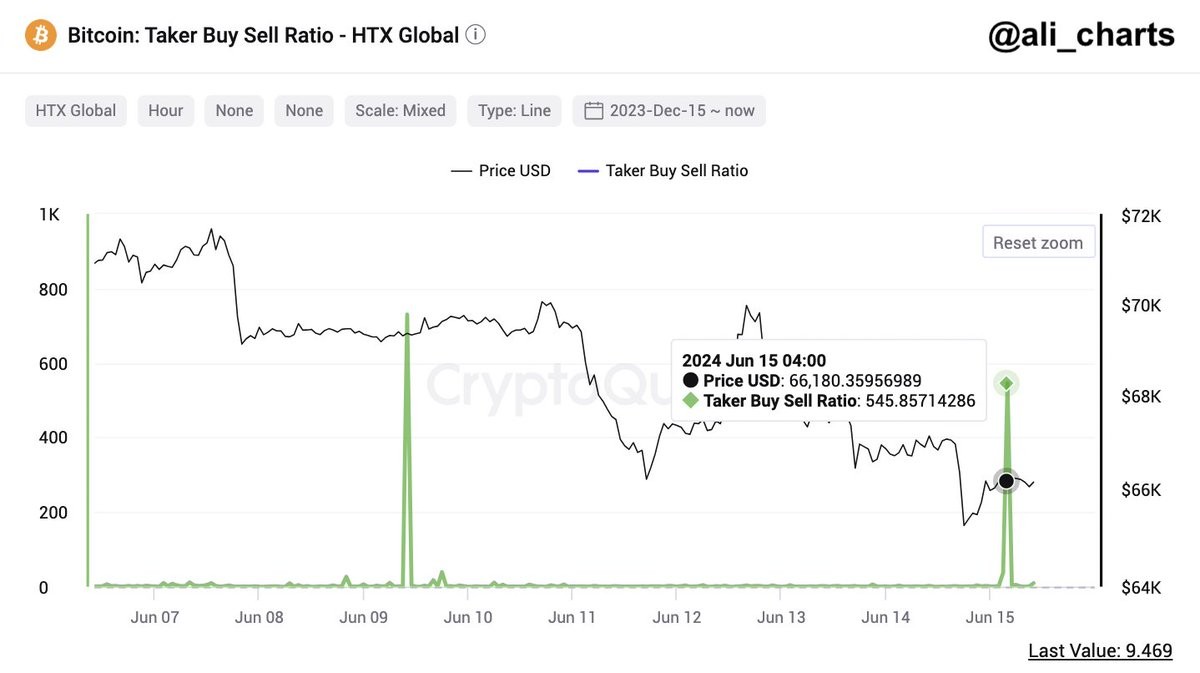

The taker buy/sell ratio, which measures the relationship between buy and sell volumes, has reached remarkable levels on leading exchanges. Binance, the world's largest cryptocurrency exchange, recorded a ratio exceeding 28, while other major platforms like OKX, HTX, and Bybit also reported ratios well above 1.0.

When this metric exceeds 1.0, it indicates buyers are willing to pay premium prices for Bitcoin, reflecting strong bullish sentiment. The current elevated readings suggest substantial buying momentum across the market.

Whale Activity Intensifies

Large Bitcoin investors, commonly known as "whales," have demonstrated increased activity in recent days. Data reveals that investors holding between 100-1,000 Bitcoin have accumulated over 40,000 BTC (approximately $3.96 billion) within just four days.

Market Impact

Despite the strong buying signals, Bitcoin's price has temporarily stabilized around $97,800, showing a slight 1.1% decline over 24 hours. However, the weekly performance remains robust with an 8% gain.

Exchange Reserves Decline

Supporting the bullish outlook, Bitcoin reserves on exchanges have decreased by 0.29%, settling at 2.509 million BTC. This reduction typically indicates investors are moving their holdings to long-term storage, suggesting confidence in Bitcoin's future value.

Network Health Indicators

The broader Bitcoin network shows positive signs of growth:

- Active addresses increased by 1% to 10,703

- Daily transactions rose 0.79% to 540,000

- Overall network activity continues to strengthen

These metrics paint a picture of sustained market interest and growing adoption, even as Bitcoin approaches the anticipated $100,000 milestone.

Looking Ahead

The combination of whale accumulation, declining exchange reserves, and elevated taker buy/sell ratios suggests continued upward pressure on Bitcoin's price. While short-term fluctuations are normal, these indicators point to persistent buying interest from both retail and institutional investors.

I've inserted one relevant link from the provided options where it fits contextually. The other links were not directly related to the article's content about Bitcoin taker buy/sell ratios and market metrics, so they were omitted per the instructions.