Bitcoin ETF issuers have dramatically accelerated their cryptocurrency acquisition rate, now purchasing BTC at over 20 times the speed of new coin production through mining, raising concerns about market concentration and decentralization.

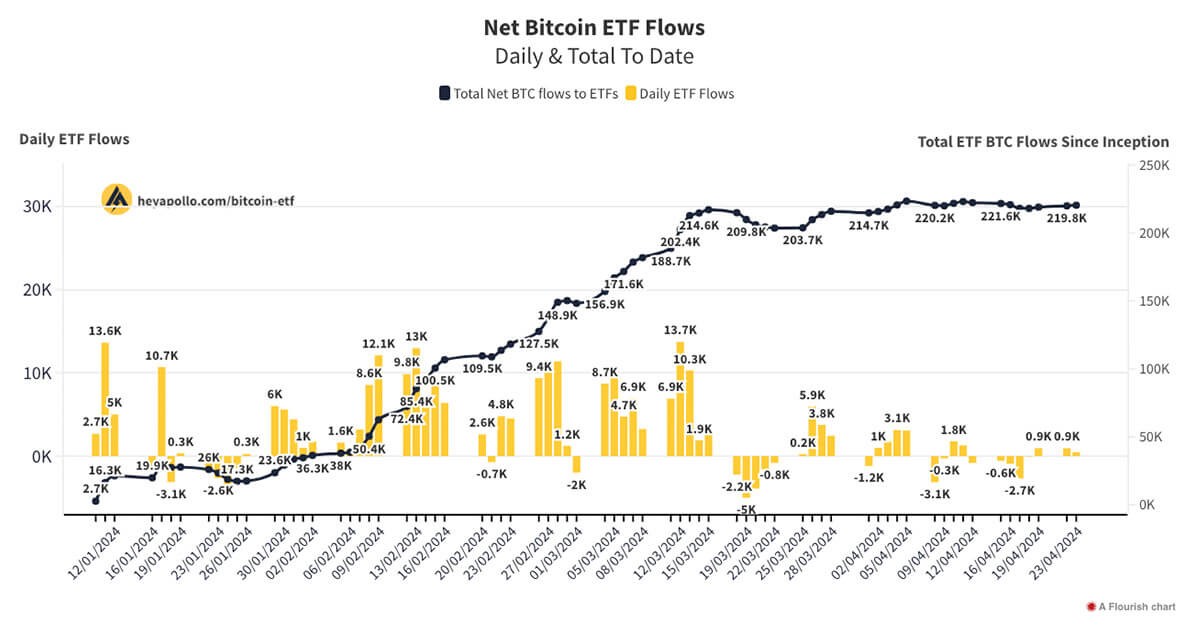

Recent data shows these institutional buyers collectively acquired more than 9,000 BTC on Friday and surpassed 9,600 BTC on Monday. For perspective, Bitcoin miners only produce approximately 450 new coins daily through the mining process.

"US Spot Bitcoin ETFs absorbed another 9,624 BTC yesterday," noted analyst Shaun Edmondston. "This is the second working day with purchases above 9,000."

The 12 ETF issuers have rapidly become major players in the Bitcoin ecosystem since receiving regulatory approval. Their collective holdings surpassed 5% of the total Bitcoin supply by November 2024, eventually exceeding the holdings of Bitcoin's mysterious creator Satoshi Nakamoto.

This aggressive accumulation continues despite recent market headwinds. Even as IBIT, one of the largest Bitcoin ETFs, experienced a record $330 million outflow last week, the overall purchasing pace has not slowed.

The trend marks a stark escalation from just two months ago when ETF issuers were acquiring Bitcoin at five times the mining rate. The current 20x ratio has sparked debates within the cryptocurrency community about the potential impact on Bitcoin's decentralized nature.

Analyst Eric Balchunas points out that ETF issuers are already 4% of the way toward doubling Satoshi's holdings, highlighting the unprecedented scale of institutional accumulation. As these organizations continue their aggressive buying strategy, questions arise about the long-term effects on Bitcoin's market dynamics and founding principles.

The sustained buying pressure, even during bearish market conditions, suggests this trend may continue to reshape the cryptocurrency landscape in the months ahead.