The path for Bitcoin ETF options trading has moved one step closer to reality as the U.S. Commodities and Futures Trading Commission (CFTC) grants its approval. This marks a key development in bringing more sophisticated Bitcoin investment products to Wall Street, with just one final regulatory approval remaining.

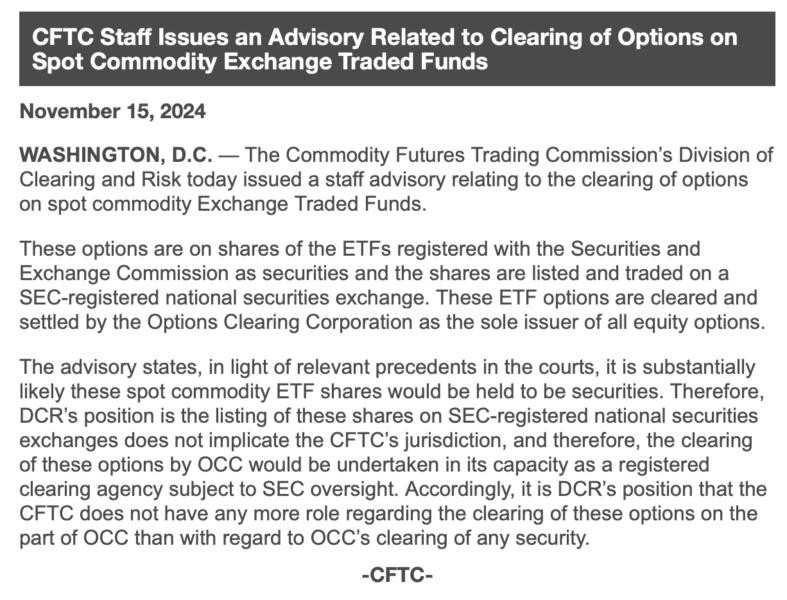

The CFTC's Division of Clearing and Risk (DCR) completed its review process, determining that listing these shares on SEC-registered national security exchanges falls outside CFTC jurisdiction. The final regulatory green light now rests with the Office of the Comptroller of the Currency (OCC).

This approval builds on the U.S. Securities and Exchange Commission's earlier decision to permit options trading of spot Bitcoin ETFs on NYSE and Cboe platforms. The development opens new possibilities for institutional investors seeking advanced trading strategies.

Bitcoin ETF options will enable traders to:

- Make directional bets on Bitcoin prices with lower capital requirements

- Implement risk management strategies

- Generate additional income through options writing

- Access predetermined price levels for buying or selling

While this regulatory milestone advances, market activity shows mixed signals. Recent data indicates spot Bitcoin ETFs experienced outflows approaching $400 million over two days, with Fidelity's FBTC recording the largest withdrawals. Despite these outflows, Bitcoin's price demonstrated strength, climbing 3.79% within 24 hours to surpass $91,000.

The introduction of Bitcoin ETF options represents another step in the maturation of cryptocurrency markets, providing traditional investors with familiar tools to engage with digital assets through regulated channels.