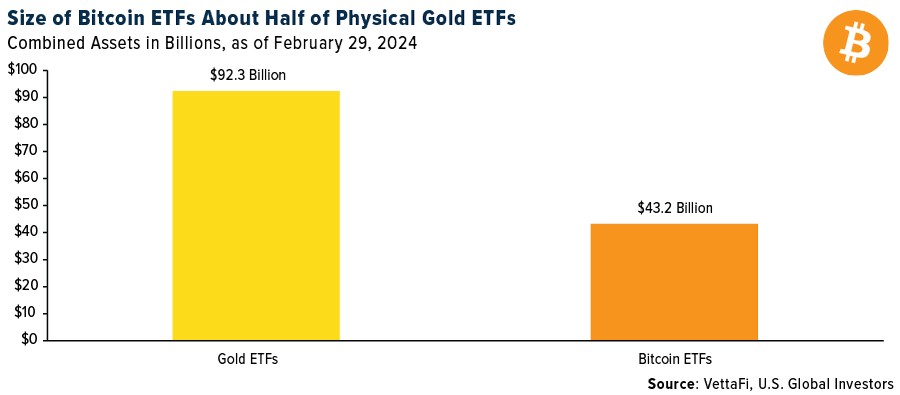

US Bitcoin exchange-traded funds (ETFs) are rapidly gaining ground on gold ETFs and may soon become the larger asset class, according to industry experts. Bloomberg ETF analyst Eric Balchunas predicts Bitcoin ETFs could surpass gold ETFs by Christmas, with only a $23 billion gap remaining between the two.

As of November 23, Bitcoin ETFs in the US have amassed $107 billion in assets, representing approximately 86% of gold ETFs' total net assets. The rapid growth has been fueled by strong investor demand, with US spot Bitcoin ETFs attracting $3.3 billion in net inflows in just one week.

BlackRock's iShares Bitcoin Trust (IBIT) has emerged as the dominant player, capturing 62% of recent inflows. IBIT now holds $48.4 billion in Bitcoin, already exceeding its sister gold product, the iShares Gold Trust (IAU), which manages around $34 billion.

The surge in Bitcoin ETF assets comes amid Bitcoin's remarkable rally, with the cryptocurrency recently hitting an all-time high of $99,500. Investment firm VanEck maintains an optimistic outlook, projecting Bitcoin could reach $180,000 in the current market cycle.

However, some traditional finance veterans urge caution. George Milling-Stanley, chief gold strategist at State Street Global Advisors, warns that investors may be overlooking gold's proven stability in favor of Bitcoin's explosive returns. While gold has delivered a 30% return year-to-date, Bitcoin has soared 160%.

"Bitcoin is purely a return play," Milling-Stanley told CNBC, questioning the comparisons between Bitcoin mining and gold mining. He argues that calling computational operations 'mining' creates misleading parallels with gold's established role as a store of value.

The rapid rise of Bitcoin ETFs also puts them on track to surpass Satoshi Nakamoto's estimated Bitcoin holdings next week, potentially making these investment vehicles the world's largest Bitcoin holders.

As institutional adoption grows through ETFs, the competition between Bitcoin and gold as investment assets continues to intensify, marking a potential shift in how investors approach portfolio diversification and store of value assets.