The cryptocurrency market is experiencing unprecedented growth as Bitcoin aims for new heights, backed by record-breaking stablecoin liquidity that signals robust market demand and increased capital inflows.

Stablecoin market capitalization has reached a historic $204 billion, showing a remarkable $37 billion increase since November 2024. Leading stablecoins Tether (USDT) and USD Coin (USDC) have seen substantial growth, with USDT's market cap rising 15% to $139 billion and USDC surging 48% to $52.5 billion.

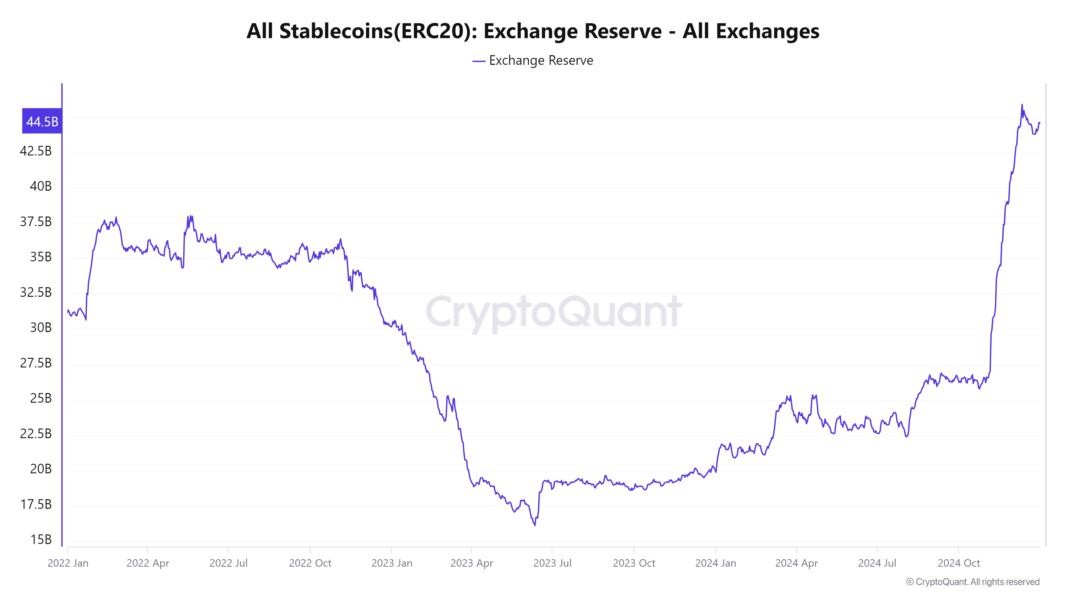

The influx of stablecoins into centralized exchanges points to growing buying power in the crypto market. Since November, USDT presence on trading platforms has jumped 41%, from $30.5 billion to $43 billion. This surge typically precedes stronger price movements in Bitcoin and other cryptocurrencies.

Market analyst Tech Killa notes that Bitcoin's recent price action, supported by strong demand zones above $98,500 and $104,985, suggests potential movement toward $117,000. Some analysts project even higher targets, with predictions reaching $168,600 based on balanced price models.

The rally gains additional support from institutional interest and favorable macroeconomic conditions. The Federal Reserve's steady interest rates and potential rate cuts in 2025 have created a positive environment for risk assets. Meanwhile, growing ETF adoption and supportive regulatory developments have strengthened Bitcoin's position among institutional investors.

MicroStrategy's ongoing Bitcoin acquisition strategy reinforces institutional confidence in the cryptocurrency as a long-term investment vehicle. Despite market fluctuations, the company continues to expand its Bitcoin holdings, reflecting broader institutional trust in the digital asset.

The combination of record stablecoin liquidity, institutional backing, and positive market sentiment positions Bitcoin for potential new all-time highs as the cryptocurrency market maintains its upward trajectory in 2025.