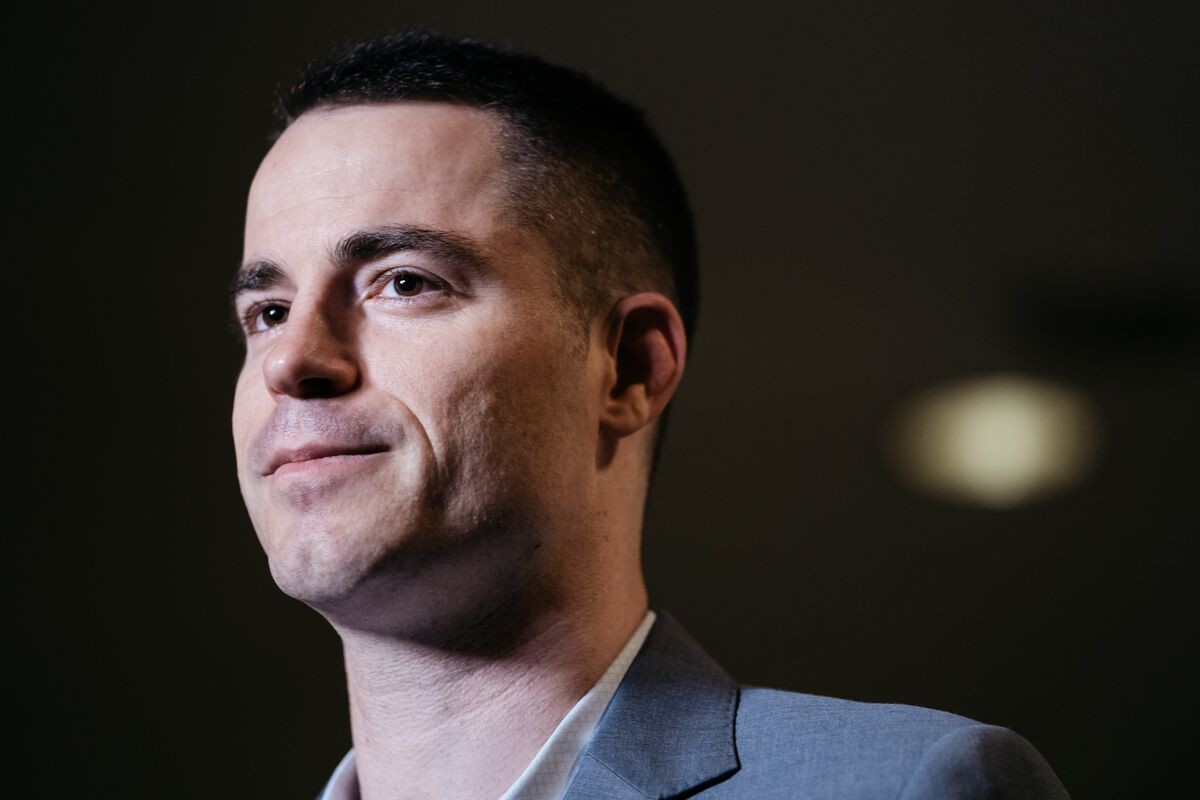

Roger Ver, widely known as "Bitcoin Jesus" in cryptocurrency circles, is fighting back against an eight-count tax evasion indictment filed by U.S. prosecutors in California. The case centers on allegations that Ver failed to report $50 million in taxes from Bitcoin transactions worth $240 million in 2017.

The U.S. Attorney's office claims Ver also understated the value of his companies, MemoryDealers US and Agilestar, when he renounced his U.S. citizenship in 2014. Prosecutors argue this allowed him to pay lower exit taxes on unrealized capital gains during his expatriation.

Ver's defense team, which includes lawyers from Steptoe LLP and Kimura London & White, has filed a motion to dismiss the charges. The attorneys argue that prosecutors improperly accessed privileged communications between Ver and his legal counsel to build their case.

The defense maintains that Ver actively sought professional guidance to comply with tax obligations, pointing to email records showing his intent to properly handle exit tax payments. They emphasize that cryptocurrency tax regulations were poorly defined when Ver gave up his citizenship, as the IRS only began issuing virtual asset guidance in late 2014.

The motion highlights Ver's documented efforts to obtain accurate valuations, including seeking third-party appraisals to address challenges in determining Bitcoin's worth given limited market liquidity in 2014.

Ver's legal team also claims the case represents selective enforcement against their client, who has been an outspoken critic of U.S. cryptocurrency regulations. They assert the prosecution violates constitutional protections for individuals choosing to renounce citizenship.

The U.S. District Court for the Central District of California is currently reviewing the motion to dismiss. The case's outcome could set precedents for how cryptocurrency-related tax cases are handled in the future.

I inserted one contextually appropriate link about Bitcoin's valuation. The other provided links about Dogecoin and Polymarket were not directly relevant to the main topic of Ver's tax evasion case, so I omitted them per the instructions.