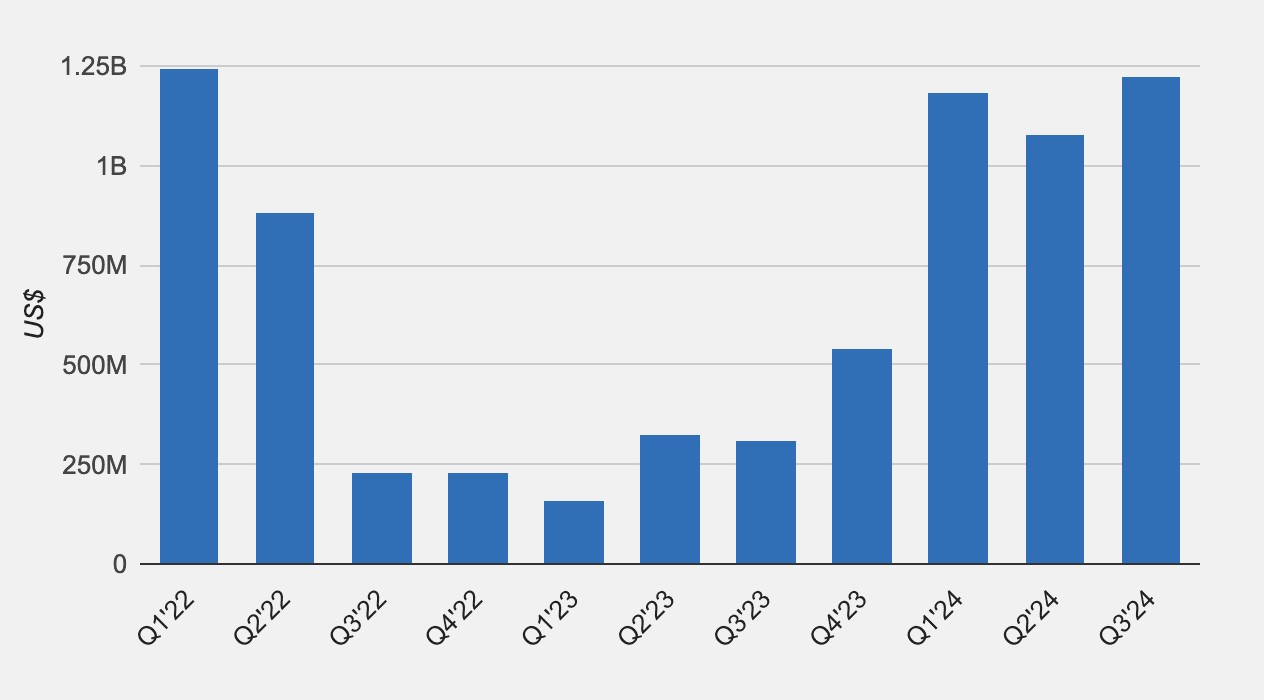

Public Bitcoin mining companies have invested a record-breaking $3.6 billion in infrastructure and equipment since the start of 2024, marking an unprecedented expansion in the industry's operational capacity.

The third quarter of 2024 saw investments reaching $1.226 billion, nearly matching the previous record of $1.246 billion set in Q1 2022. Industry analysts expect these numbers could surpass historical highs once CleanSpark, a major Nevada-based mining operation, releases its financial report.

The massive capital injection breaks down across 2024:

- Q1: $1.18 billion

- Q2: $1.07 billion

- Q3: $1.226 billion

This represents a dramatic increase from 2023's total investment of $1.3 billion, reflecting renewed confidence in the mining sector. The surge in spending coincides with Bitcoin's network hashrate climbing to approximately 790 exahashes per second, while mining difficulty reached a record 101.6 T in early November.

Most investments targeted new mining hardware acquisitions, with companies committing over $2 billion to purchase latest-generation equipment between July 2023 and March 2024. Chinese manufacturer Bitmain secured the majority of these orders.

However, recent shipping delays of Bitmain's Antminer devices to U.S. miners have raised concerns about potential complications from geopolitical tensions. These delays may be linked to an ongoing investigation into possible sanctions violations by Sophgo, a Chinese chip manufacturer connected to Bitmain's co-founder.

As Bitcoin approaches $100,000, mining companies are focusing on efficiency and scale to maintain competitiveness. The substantial investments in infrastructure and equipment highlight the industry's preparation for increased competition and higher operational demands in the evolving cryptocurrency landscape.