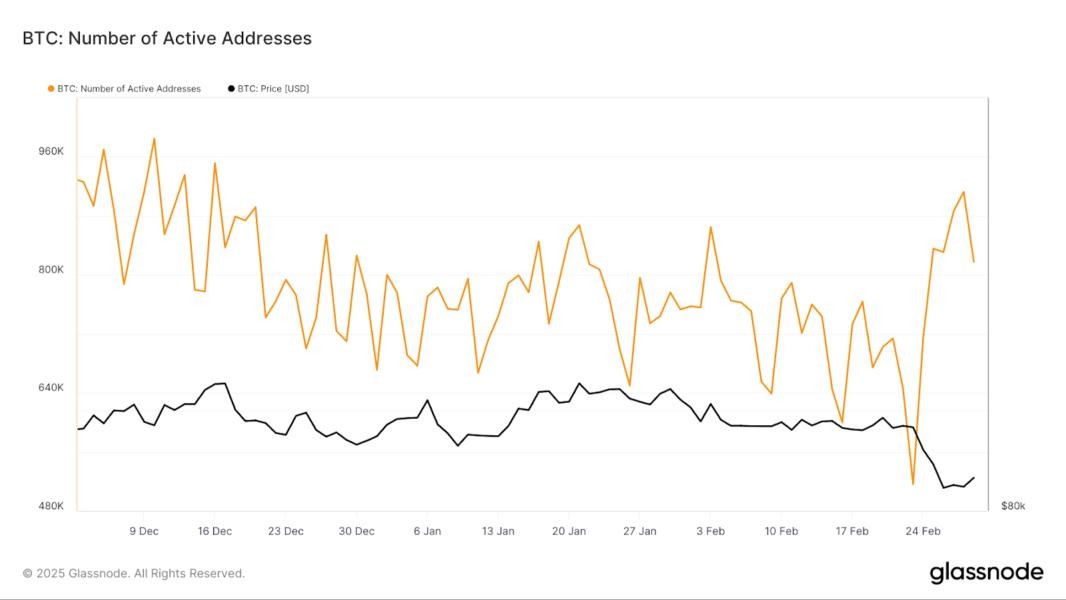

Bitcoin's network activity has reached a notable milestone, with active addresses climbing above 912,300 on February 28 - the highest level observed since mid-December 2023 when Bitcoin was trading around $105,000.

This surge in network activity could indicate a potential market bottom following recent price corrections, according to crypto analytics experts. Historically, spikes in on-chain activity have coincided with both market peaks and bottoms, often driven by a combination of panic selling and strategic buying opportunities.

The current data suggests the market may be experiencing a "capitulation moment" - a period when investors rapidly sell their positions, typically marking the end of a downward trend before prices begin to recover.

Market analysts are closely watching the $80,500 price level, which appears to be a critical threshold for Bitcoin's near-term trajectory. According to Stella Zlatareva from Nexo, maintaining this support level could help stabilize the market, while failing to hold it might trigger further downside testing.

Options market data reveals that a drop below $84,000 could potentially trigger over $1 billion in leveraged long liquidations across cryptocurrency exchanges, adding another layer of complexity to current market dynamics.

Technical indicators, specifically the Market Value to Realized Value (MVRV) Z-score, currently at 2.01, suggest Bitcoin may be approaching oversold territory. This metric has historically helped identify potential market bottoms and buying opportunities.

The combination of increased network activity, technical indicators, and market sentiment paints a picture of possible price stabilization, though traders remain cautious given the volatile nature of cryptocurrency markets.