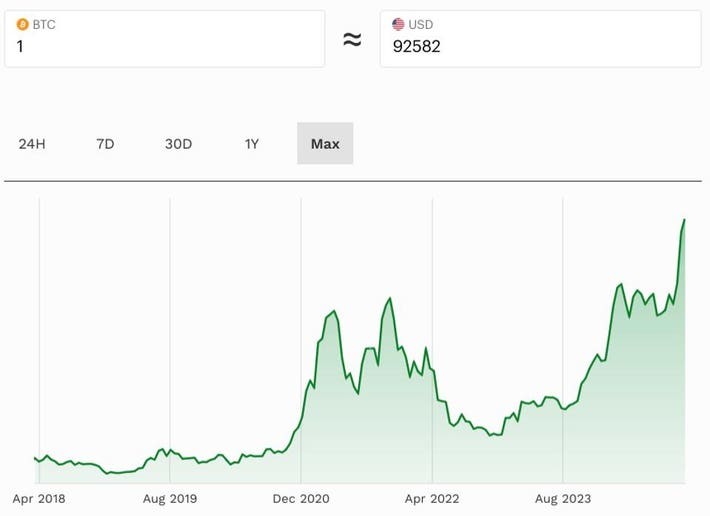

Bitcoin's recent price turbulence has captured market attention as the cryptocurrency dropped sharply from its near $100,000 peak to around $90,000, triggering a broader crypto market correction that erased approximately $200 billion in value.

Despite the sell-off, major industry players remain optimistic about Bitcoin's long-term trajectory. Pantera Capital founder Dan Morehead made headlines with a bold prediction that Bitcoin could reach $740,000 by April 2028 - implying a $15 trillion market cap. Morehead noted this target is reasonable given the $500 trillion size of global financial assets.

The current market volatility comes in the wake of Donald Trump's U.S. election victory, which initially drove prices higher on expectations of crypto-friendly regulation. However, crypto billionaire Michael Novogratz cautions that high leverage in the system could drive Bitcoin down to $80,000 before recovering.

"The crypto community is levered to the gills, and so there will be a correction," Novogratz told CNBC. He remains confident Bitcoin will eventually break above $100,000, citing limited supply and strong institutional adoption.

Market analysts are closely monitoring key technical levels. FxPro's Alex Kuptsikevich identifies $91,800 as a critical support zone, warning that failure to hold could see prices retreat to $87,000.

The incoming Trump administration's apparent openness to digital assets has created optimism among crypto advocates. According to Novogratz, "The entire cabinet almost owns bitcoin, and are proponents of digital assets," suggesting a possible shift toward more accommodative oversight.

While short-term price action remains volatile, major investors are positioning for substantial long-term appreciation. Pantera Capital's own Bitcoin fund has generated returns exceeding 131,000% since 2013, demonstrating the potential for transformative gains in the crypto market.