Bitcoin continues to demonstrate remarkable strength after a brief 9% pullback from its recent all-time high of $99,800. Despite retracing to $90,700 on Tuesday, the leading cryptocurrency has shown resilience by quickly rebounding and maintaining levels above $90,000.

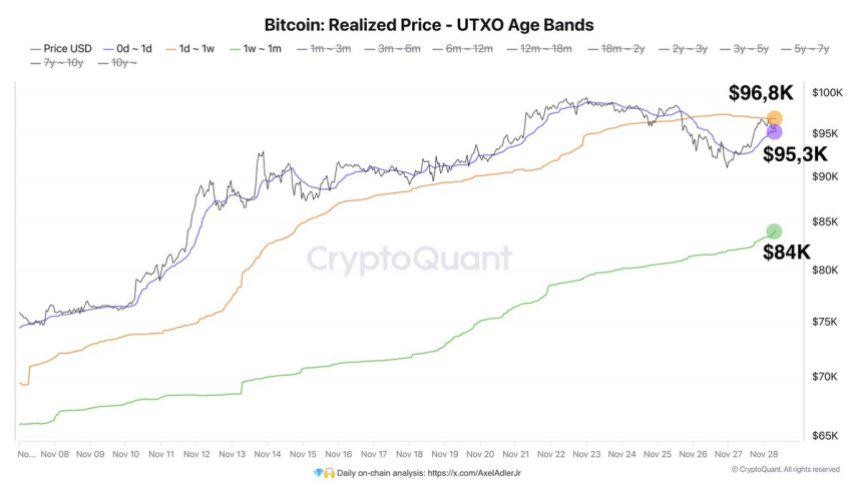

According to CryptoQuant analyst Axel Adler, strong buyer demand reveals two major investor groups actively accumulating: those with an average entry at $96,800 (1-day holders) and others at $95,300 (1-day to 1-week holders).

A deeper support zone exists around $84,000, representing the average purchase price for investors holding between one week to one month. This multi-layered support structure suggests Bitcoin has established solid demand foundations for its current price range.

Bitcoin currently trades at $95,200, with the next major resistance level at $98,800. Breaking above this threshold could catalyze a push past the highly anticipated $100,000 mark. However, if selling pressure increases, the $85,500 level serves as critical support to maintain the overall bullish market structure.

The recent pullback appears to have attracted buyers who view price dips as accumulation opportunities. This buying behavior indicates sustained confidence in Bitcoin's growth potential, even as it trades near all-time highs.

Market participants remain focused on Bitcoin's next moves, particularly its potential to breach $100,000 for the first time. While short-term volatility continues, the strong demand levels revealed by on-chain data suggest Bitcoin's upward trajectory remains intact.