In a striking contrast of market dynamics, Bitcoin's price surge and silver's suppressed valuation reveal an intriguing tale of two assets under Blackrock's influence.

Blackrock, the world's largest asset manager overseeing $11.5 trillion in client assets, has made dramatic moves in both markets. Their Bitcoin ETF (IBIT) has accumulated an astounding 521,164 BTC - representing 2.6% of all existing Bitcoin - in less than 12 months since early 2024. This acquisition rate outpaces annual Bitcoin mining production by 160%.

Meanwhile, Blackrock's iShares Silver Trust (SLV), despite its 18-year history, holds 474 million ounces of silver - merely 1.9% of above-ground silver stocks and 58% of annual mining output.

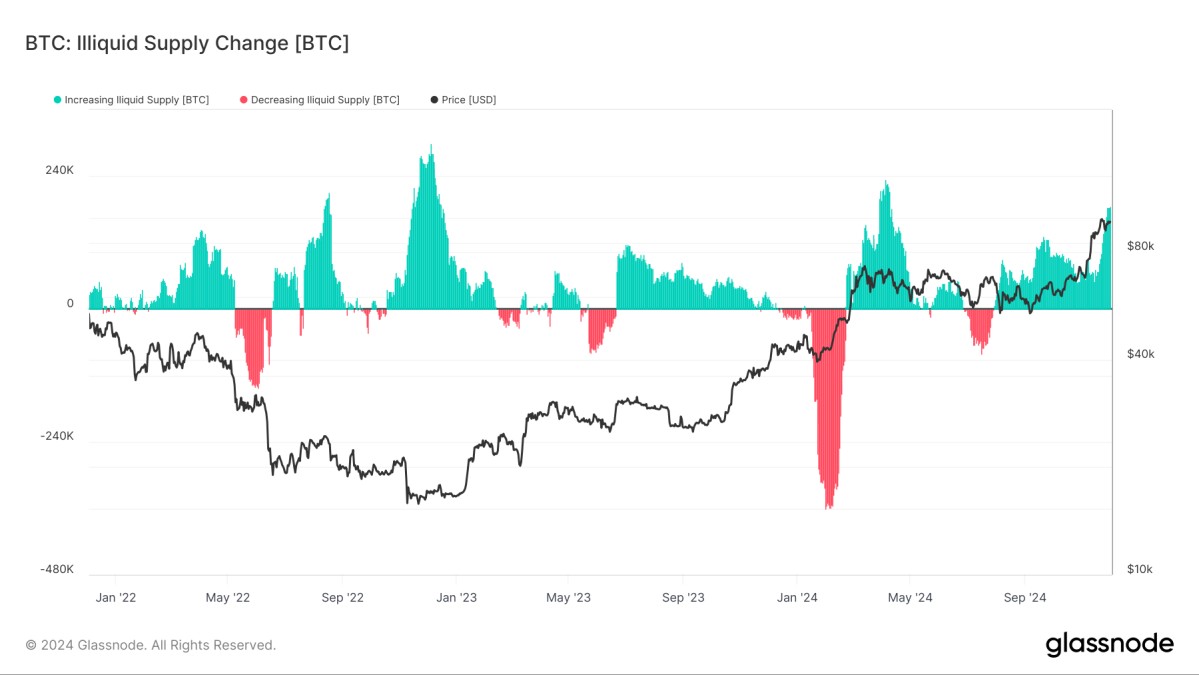

The stark difference in market impact is notable. Bitcoin's price has skyrocketed 132% since early February 2024, driven by IBIT's aggressive buying in an illiquid market where 92.5% of Bitcoin is held by just 1.86% of wallet addresses.

The silver market tells a different story. Market observers point to substantial dilution through paper trading, with estimates suggesting 4.2-6.4 billion ounces of silver traded through promissory notes in London's spot market - far exceeding the estimated 2 billion ounces of global silver bullion holdings.

Adding to silver's price suppression, former Goldman Sachs Global Head of Commodity Research Jeff Currie has alleged that some silver ETFs secretly short their clients' silver holdings multiple times, artificially inflating supply.

A warning comes from fund manager John Paulson, who describes cryptocurrencies as "a limited supply of nothing" predicted to eventually "go to zero." This raises questions about whether investors are being led into a structured mania in Bitcoin while silver remains artificially subdued through virtual metal trading.

The contrasting treatment of these assets under institutional management presents a compelling case study in market manipulation and asset valuation, with potentially serious implications for investors in both spaces.