Long-term Bitcoin investors have sold over 500,000 BTC during the latest market rally, according to new data from crypto analytics company Glassnode.

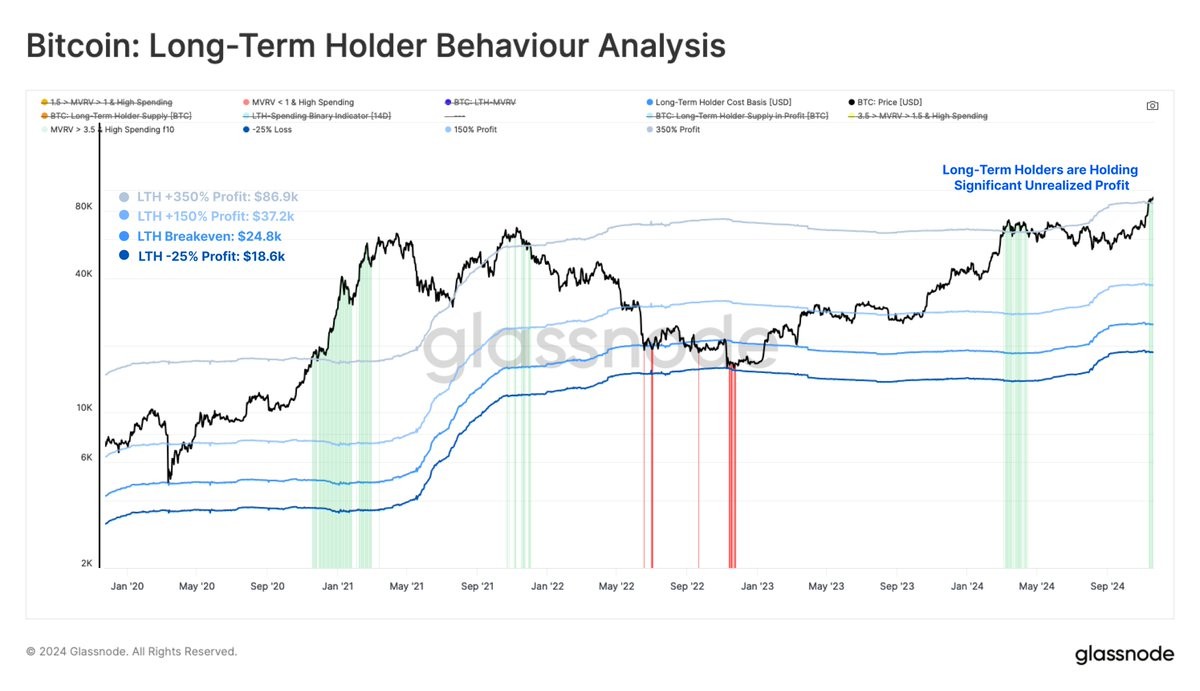

The analysis reveals that long-term holder Bitcoin supply peaked in September before entering a distribution phase as prices climbed higher. These experienced investors have since reduced their positions by approximately 507,000 BTC.

While substantial, the current selling volume remains notably lower than the previous cycle, which saw long-term holders offload 934,000 Bitcoin during the rally leading up to March 2024's all-time high.

Despite the ongoing distribution, these veteran holders are experiencing unprecedented profit levels. Glassnode reports that long-term investors are currently realizing profits of $2.02 billion per day - a new all-time high that surpasses previous records set in March.

The analytics firm emphasizes that long-term holders play a central role in price discovery by introducing previously inactive supply back into circulation. As prices continue rising, their trading activity typically increases.

For the rally to maintain momentum, strong buyer demand must absorb this increased supply. Glassnode suggests a period of consolidation may be needed to process the current selling pressure from long-term holders.

At the time of reporting, Bitcoin is trading at $96,303, showing a 3% increase over the past 24 hours as it inches closer to the psychological $100,000 mark.