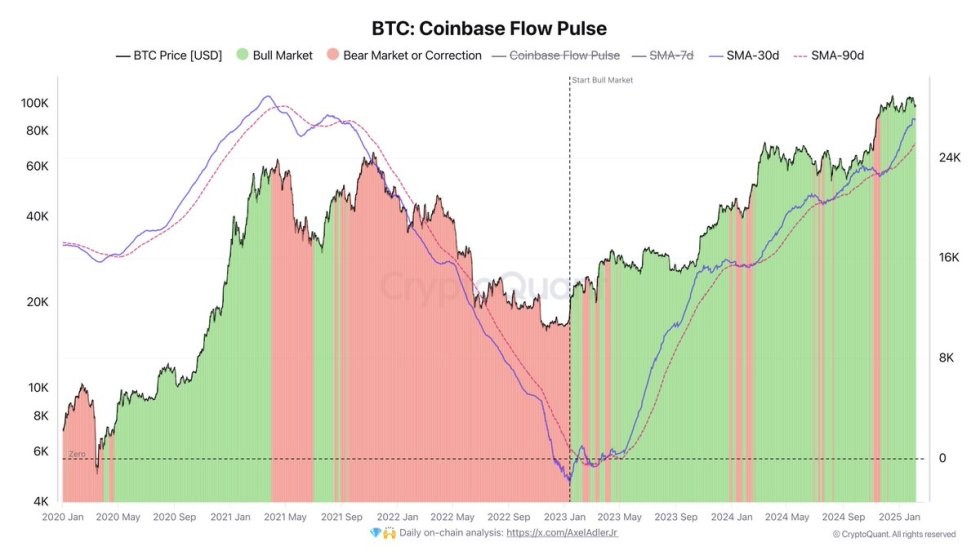

Bitcoin's latest market dynamics reveal a strong institutional appetite despite recent price volatility, according to renowned analyst Axel Adler's assessment of the Bitcoin Coinbase Flow Pulse metric.

The leading cryptocurrency, currently trading at $98,500, experienced turbulent price action with a 9% drop followed by an 11% recovery in a single day. However, the Coinbase Flow Pulse indicator suggests major institutional players continue to accumulate rather than distribute their holdings.

"The absence of large-scale outflows, typically seen during bear markets, indicates institutional investors are maintaining their Bitcoin positions," notes Adler in his recent analysis shared on X. This behavior pattern stands in stark contrast to previous market downturns when capital regularly shifted from spot markets to futures.

The current trading range places Bitcoin between support at $96,000 and resistance at $100,000, with the latter emerging as a key psychological barrier. Market observers note that breaking above $100,000 could trigger renewed upward momentum toward the all-time high of $109,000.

However, traders remain cautious as losing the $96,000 support could spark additional selling pressure, potentially pushing prices toward the $92,000-$94,000 range. The market appears particularly sensitive to ongoing trade war concerns, adding another layer of complexity to Bitcoin's price action.

Despite short-term uncertainties, the Coinbase Flow Pulse data paints an optimistic longer-term picture. The metric, which tracks Bitcoin movements across exchanges, particularly among major U.S. participants, suggests underlying strength in institutional demand.

As the market navigates through this consolidation phase, all eyes remain on whether Bitcoin can maintain its position above key support levels and potentially challenge new highs, backed by sustained institutional interest.