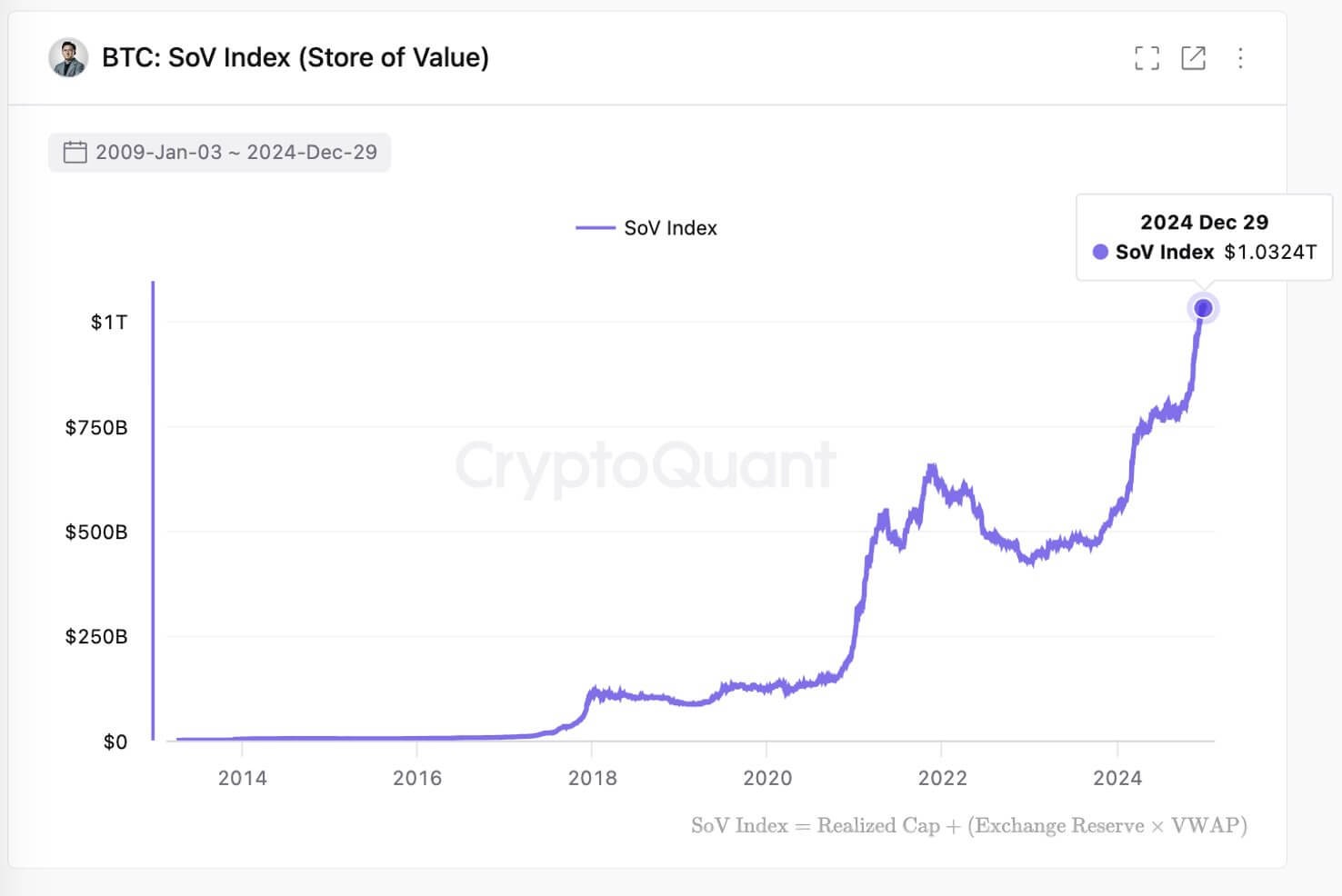

Bitcoin's actual stored value has reached $1.03 trillion, marking an 85% increase since the start of 2024, according to new analysis from CryptoQuant CEO Ki Young Ju.

This metric provides a more nuanced view of Bitcoin's true value compared to its $2 trillion market capitalization, by measuring real capital invested in the network rather than theoretical value based on current prices.

The stored value calculation combines both on-chain and off-chain data points. The methodology examines exchange reserves multiplied by average prices for off-chain assessment, while utilizing "realized cap" metrics that track Bitcoin's most recent price movements for on-chain evaluation.

This comprehensive approach aims to capture a more accurate picture of actual investment flows into Bitcoin by incorporating over-the-counter trading activity and exchange movements. The substantial increase in stored value suggests growing confidence among investors in Bitcoin as a long-term store of value asset.

The stark difference between Bitcoin's stored value and market cap highlights the importance of looking beyond surface-level metrics when evaluating cryptocurrency markets. While market cap remains a commonly cited figure, stored value analysis provides deeper insights into genuine investor commitment and capital allocation.

This dramatic rise in Bitcoin's stored value through early 2024 points to sustained institutional and retail investor interest, despite ongoing market volatility.