Leading cryptocurrency exchanges, one of the world's leading cryptocurrency exchanges, unveiled its new Coinbase 50 Index today, establishing a comprehensive benchmark for tracking the broader digital asset market performance.

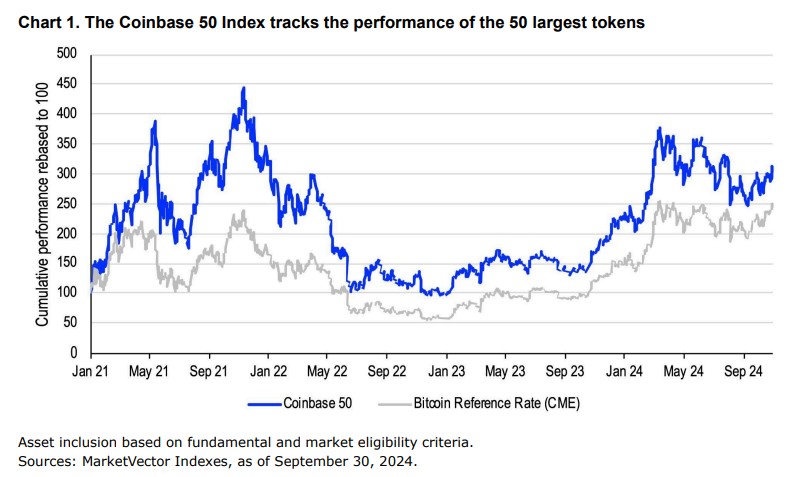

The index tracks the top 50 crypto assets by market capitalization listed on Coinbase, representing approximately 95% of the total cryptocurrency market value. This new offering provides investors with a reliable metric to gauge overall crypto market trends and compare individual asset performance.

"The Coinbase 50 serves as the S&P 500 equivalent for the crypto economy," said Brett Tejpaul, Head of Institutional Sales at Coinbase. "It offers both retail and institutional investors a standardized way to measure crypto market movements."

The index employs market-cap weighting, meaning larger cryptocurrencies like Bitcoin and Ethereum carry more influence on the overall index value. Assets must meet strict eligibility criteria, including minimum trading volumes and market capitalization requirements, to be included.

Unlike existing crypto indices, the Coinbase 50 updates in real-time and rebalances monthly to reflect market changes. This dynamic approach helps capture the rapidly evolving nature of digital assets while maintaining stability.

The launch comes as traditional financial institutions increasingly seek exposure to cryptocurrency markets. The index provides these institutions with a trusted benchmark for developing crypto investment products and measuring portfolio performance.

"We designed the Coinbase 50 to bridge the gap between traditional finance and digital assets," explained Surojit Chatterjee, Chief Product Officer at Coinbase. "It gives market participants a transparent and reliable tool for understanding crypto market behavior."

The index data will be freely available through Coinbase's website and major financial data providers, allowing widespread access for market participants globally.

This development marks another step in cryptocurrency's maturation as an asset class, providing much-needed standardization in a market known for its complexity and fragmentation.