The cryptocurrency market received encouraging news as the Coinbase Premium Index turned positive for the first time in 2025, indicating renewed buying pressure from US-based investors.

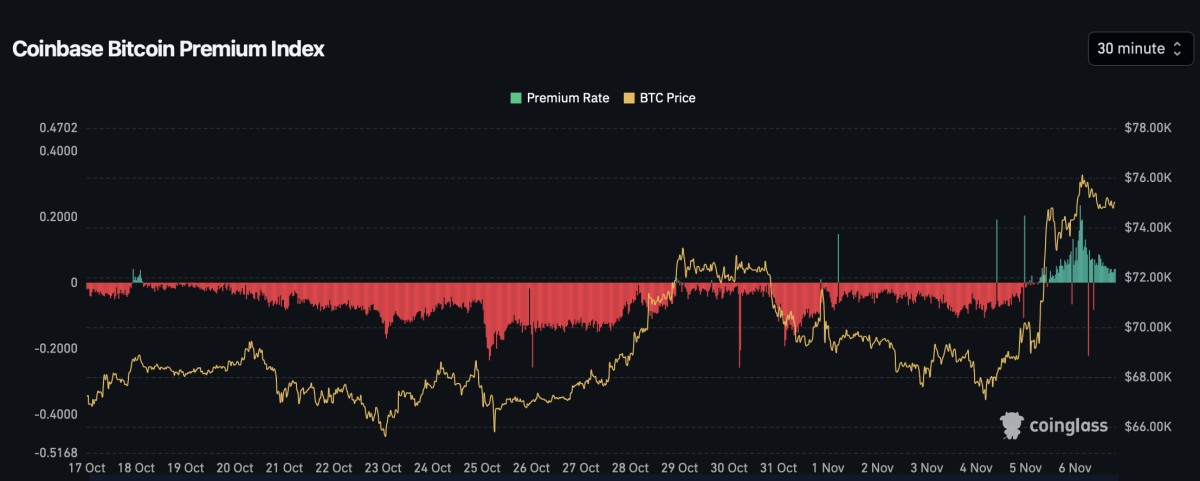

The index, which measures the price difference between Bitcoin on Coinbase versus other exchanges, had previously hit a 12-month low of -0.237 in late 2024. The recent flip to positive territory suggests institutional investors in the United States are showing fresh interest in accumulating Bitcoin.

Data from analytics firm CryptoQuant reveals the index has now risen to approximately 0.001, coinciding with Bitcoin's surge above $102,000. The timing is noteworthy, as US investor behavior has emerged as a key market indicator since the approval of Spot Bitcoin ETFs.

Adding weight to the bullish signal, Coinbase reported a substantial single block outflow of 4,012 BTC, reinforcing the observation that buying pressure is becoming dominant among US market participants.

The positive premium comes after months of decline, during which the index had fallen to -0.200 in October 2023 amid pre-election uncertainty. Market analysts suggest this reversal could help sustain Bitcoin's current upward momentum.

This development arrives as Bitcoin tests critical technical levels, with some experts pointing to a potential breakout from the Power Law Corridor trend - a pattern historically associated with sustained price increases.

The combination of positive Coinbase premium and strong technical indicators has sparked optimism among market participants regarding Bitcoin's near-term trajectory, particularly as institutional involvement in the cryptocurrency market continues to grow.