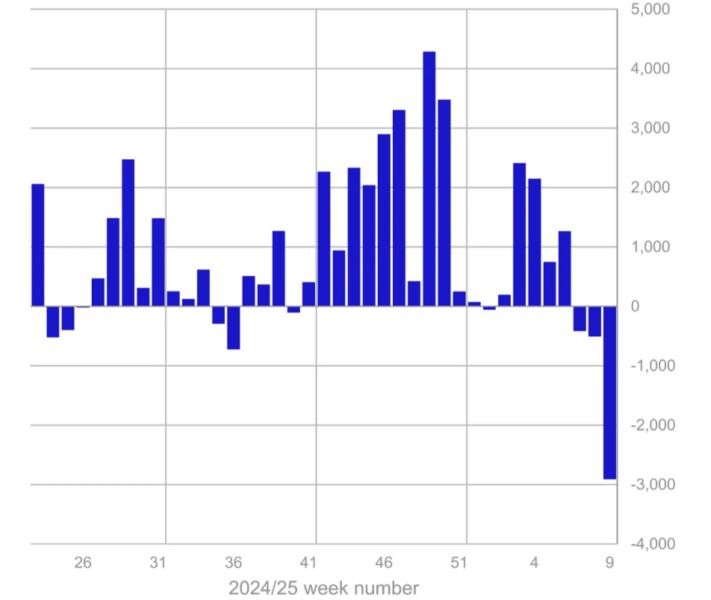

Cryptocurrency exchange-traded products (ETPs) experienced their largest weekly sell-off on record, with outflows reaching $2.9 billion last week according to data from CoinShares.

The massive exodus of funds marked the third consecutive week of outflows, bringing the total withdrawal amount to $3.8 billion. This sharp reversal comes after a 19-week streak of inflows that had added $29 billion to crypto ETPs.

Bitcoin, as the dominant asset in crypto ETPs, suffered the heaviest losses with $2.6 billion in outflows last week alone. The leading cryptocurrency's month-to-date outflows reached $3.2 billion, while short Bitcoin products saw minor inflows of $2.3 million.

Ethereum-based products also faced selling pressure, with $300 million leaving ETH ETPs last week. The overall crypto ETP market saw its total assets under management drop to $138.8 billion, down from January's record high of $173 billion.

James Butterfill, CoinShares' head of research, attributed the sell-off to multiple factors, including the recent $1.5 billion Bybit hack, hawkish statements from the Federal Reserve, and investors taking profits after the extended period of inflows.

Among major ETP providers, BlackRock's iShares funds recorded their largest weekly outflow of $1.3 billion, while Grayscale's ETFs saw $421 million in withdrawals. ProShares stood out as the only provider avoiding outflows, attracting $76 million in new investments.

In contrast to the broader market trend, some smaller cryptocurrencies showed resilience. Sui-based ETPs led with $15.5 million in inflows, followed by XRP products which attracted $5 million in new investments.