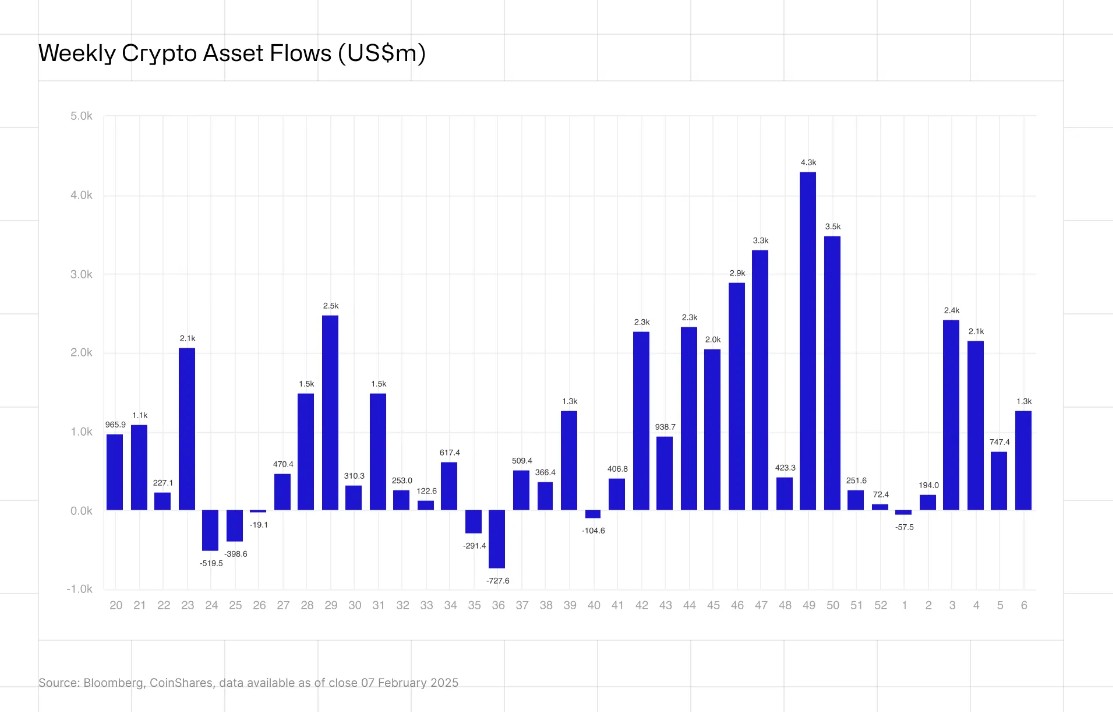

Crypto investment products continued their strong momentum with $1.3 billion in inflows last week, marking the fifth straight week of positive flows according to the latest CoinShares report. The surge comes even as markets grapple with former President Trump's trade tariff rhetoric.

The latest weekly inflows pushed the year-to-date total to $7.3 billion, though recent price declines have pulled total assets under management in crypto ETPs down to $163 billion from January's peak of $181 billion.

Ethereum led individual asset flows with $793 million in new investments as prices dipped to around $2,100, suggesting investors viewed the pullback as a buying opportunity. Bitcoin attracted $407 million in inflows, with exchange-traded products now representing 7.1% of Bitcoin's total market cap.

The U.S. dominated regional flows, accounting for $1 billion of the total. European nations also saw healthy activity, with Germany and Switzerland recording $61 million and $54 million in inflows respectively, while Canada added $37 million.

Other cryptocurrencies also drew investor interest, with XRP receiving $21 million and Solana gaining $11 million in new investments. Blockchain-related equities continued their positive trend with $33 million in inflows, bringing their 2024 total to $194 million.

Despite Trump's comments creating some market uncertainty, weekly crypto trading volumes held steady at $20 billion, indicating sustained investor engagement in the digital asset space.

CoinShares Head of Research James Butterfill noted that while Trump's tariff rhetoric may be a negotiating tactic, the possibility of escalating trade tensions remains a key market consideration, with Bitcoin's 24/7 trading already reflecting these concerns.