A massive liquidation event has struck the cryptocurrency derivatives market, with over $200 million in long positions being forcefully closed as major altcoins faced a sharp decline to begin the week.

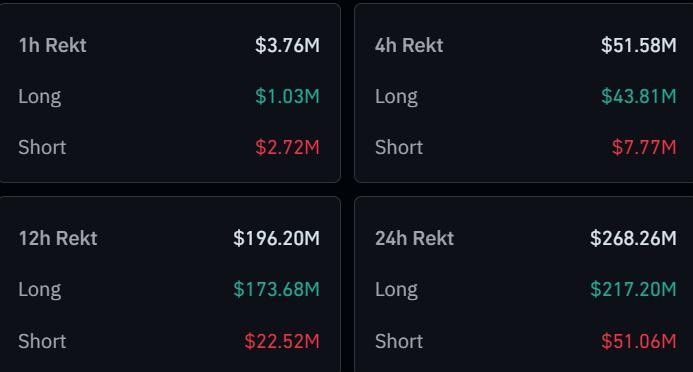

Data from crypto analytics platform CoinGlass reveals that in the past 24 hours, the total liquidations in the crypto futures market reached $268 million, with long positions accounting for $217 million of that figure.

Ethereum led the liquidation cascade, contributing $56 million to the total as its price dropped 4% to $2,700. Solana followed with $33 million in liquidations after experiencing a 6% decline - the steepest fall among top 10 cryptocurrencies.

The massive wipeout occurred due to a combination of market volatility and leveraged trading positions. In derivatives trading, traders can borrow multiple times their initial investment through leverage, amplifying both potential profits and losses. When prices move against heavily leveraged positions beyond certain thresholds, these positions are automatically closed - or "liquidated."

Notably, Bitcoin remained relatively stable during this market movement, resulting in fewer liquidations compared to altcoins. This pattern breaks from the usual trend where Bitcoin typically leads liquidation events in the crypto derivatives market.

The weekend's brief recovery in Ethereum prices proved short-lived as the new week began with renewed selling pressure across the altcoin market. This sudden reversal triggered the cascade of forced position closures, primarily affecting traders who had placed bullish bets using leverage.

This event serves as another reminder of the inherent risks in leveraged crypto trading, where rapid price movements can lead to substantial losses through forced liquidations.