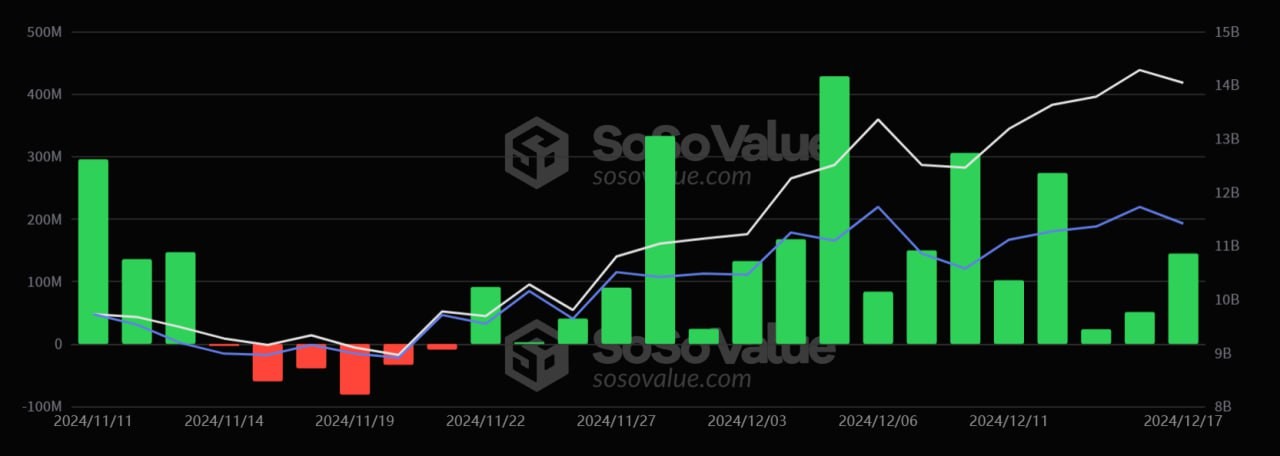

Institutional investors are showing increased confidence in Ethereum-based financial products, with spot ETFs recording a substantial $145 million net inflow on December 17, according to data from SoSoValue.

BlackRock's ETHA emerged as the day's top performer, attracting $135 million in new investments and reaching a total net inflow of $3.365 billion. Grayscale's ETH also saw positive movement with $4.45 million in new capital, bringing its total net inflow to $616 million.

While Grayscale's ETHE ETF maintains its market leadership with $5.72 billion in total net assets, the fund experienced no new inflows yesterday and continues to show a cumulative net outflow of $3.517 billion.

The combined net asset value of all Ethereum spot ETFs now stands at $14.04 billion, representing nearly 3% of Ethereum's total market capitalization of $461.51 billion.

The growing institutional participation in Ethereum-based investment products is reflected in the total net inflow across all Ethereum spot ETFs, which has exceeded $2.46 billion. This trend suggests increasing institutional trust in Ethereum's technology and its expanding ecosystem.

These inflows indicate that professional investors are actively seeking regulated exposure to the second-largest cryptocurrency, as Ethereum continues to establish its position in the digital asset landscape.