The cryptocurrency market is witnessing a remarkable shift as Ethereum positions itself for a potential surge to $5,000, driven by a unique combination of supply constraints and growing institutional interest.

Recent market data shows Ethereum's circulating supply has hit historic lows as more tokens get locked in staking contracts and DeFi protocols. Over 20% of all ETH is now staked in the Ethereum 2.0 deposit contract, effectively removing these tokens from active trading circulation.

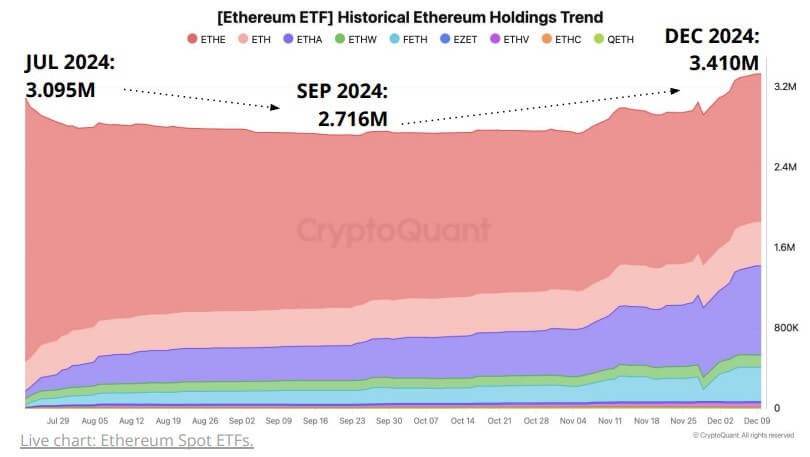

This supply squeeze coincides with mounting anticipation of spot Ethereum ETF approvals in 2024, following Bitcoin's ETF breakthrough. Major asset managers, including BlackRock and Fidelity, have already filed for Ethereum ETF applications, signaling strong institutional appetite.

Market analysts point to the supply-demand dynamics creating upward price pressure. The reduced available supply, combined with potential ETF-driven demand, could trigger a substantial price appreciation toward the $5,000 target.

Trading volumes on regulated exchanges have notably increased, indicating growing mainstream acceptance and institutional participation in Ethereum trading. This shift toward regulated platforms suggests a maturing market infrastructure capable of handling increased institutional capital flows.

The current market structure bears similarities to Bitcoin's pre-ETF approval phase, where supply constraints and institutional interest preceded major price movements. However, Ethereum's unique position as both a store of value and utility token for the decentralized economy adds another dimension to its potential value proposition.

While price predictions remain speculative, the fundamental metrics point to strengthening market conditions for Ethereum. The combination of structural supply limitations and expanding institutional access channels creates a compelling case for upward price momentum in the coming months.