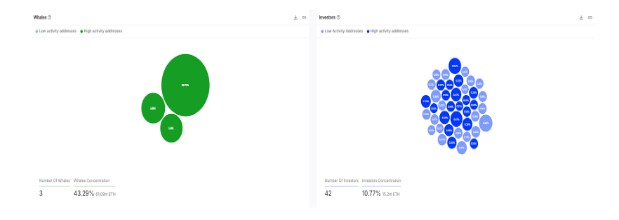

A dramatic shift in Ethereum ownership has emerged, with whale addresses now controlling 43% of the total ETH supply - nearly double their holdings from early 2023. This concentration of power raises questions about market dynamics and implications for everyday traders.

According to data from blockchain analytics firm IntoTheBlock, whale addresses (those holding more than 1% of total supply) now possess 61.09 million ETH. This surge stems primarily from two key developments: the Ethereum merge to proof-of-stake in 2022 and the growing popularity of ETH staking for rewards.

The concentration appears less concerning than initial numbers suggest, as much of these whale holdings represent ETH locked in staking protocols rather than actively traded coins. This staking activity effectively reduces available supply while supporting price stability.

Current ownership breakdown:

- Whales (>1% holdings): 43% of supply

- Retail traders (<0.1%): 46% of supply

- Mid-sized investors (0.1-1%): ~11% of supply

The 42 mid-sized investor addresses warrant particular attention from traders, as their 15.2 million ETH remains liquid and capable of triggering notable price movements through coordinated selling.

For retail traders who make up over 99% of Ethereum addresses, the concentrated ownership means operating in a market with reduced available supply. While this could support long-term price appreciation, it also creates potential for increased volatility when large holders make moves.

This evolving dynamic requires retail traders to closely monitor whale behavior and staking trends while maintaining disciplined position sizing given the possibility of sharp price swings initiated by larger players.

At press time, Ethereum trades at $3,225, down 2% over the past 24 hours.