Ethereum's supply dynamics are approaching a notable milestone as the cryptocurrency inches closer to reaching pre-merge supply levels, marking a shift from its previously deflationary trajectory.

According to recent analysis by ITC founder Benjamin Cowen, Ethereum's supply is expanding at approximately 45,000 ETH per month, with only 32,000 ETH remaining before hitting pre-merge levels. This development represents a reversal from the deflationary period that followed the 2022 Merge.

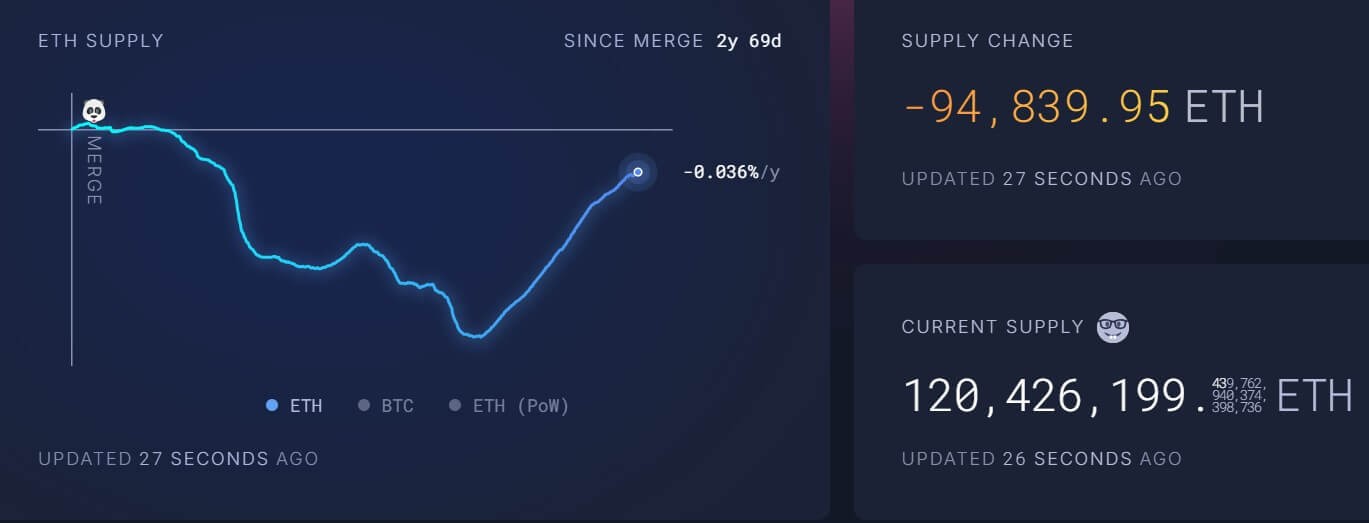

The current total supply stands at 120.4 million ETH, showing a 0.35% increase over the past nine months. This inflationary trend began in April 2024, contrasting with the period immediately following the Merge when supply decreased by nearly 0.4%.

Market observers note that low demand has been a key factor in the supply expansion. The fee-burning mechanism implemented through EIP-1559, which was expected to keep supply deflationary, has not been able to offset new ETH production under current market conditions.

The price action reflects these fundamentals, with ETH experiencing an 11% decline over the past week. The cryptocurrency is currently trading below $3,200, down from its 2024 peak of $3,700. The market appears to be in a consolidation phase at these levels.

Despite supply concerns, some analysts maintain bullish outlooks. Various market commentators on social media platforms have projected ambitious price targets, ranging from $8,000 to $20,000 for the current market cycle.

The ETH/BTC ratio has reached a three-year low of 0.034, prompting discussions about potential market shifts and alternative cryptocurrency season predictions among traders and analysts. The Ethereum to Bitcoin (ETH/BTC) trading pair has hit a notable milestone, dropping to 0.03508 - its lowest point in over three years. This dramatic decline has ignited discussions among cryptocurrency analysts and investors about Ethereum's market cycle and its potential future trajectory.