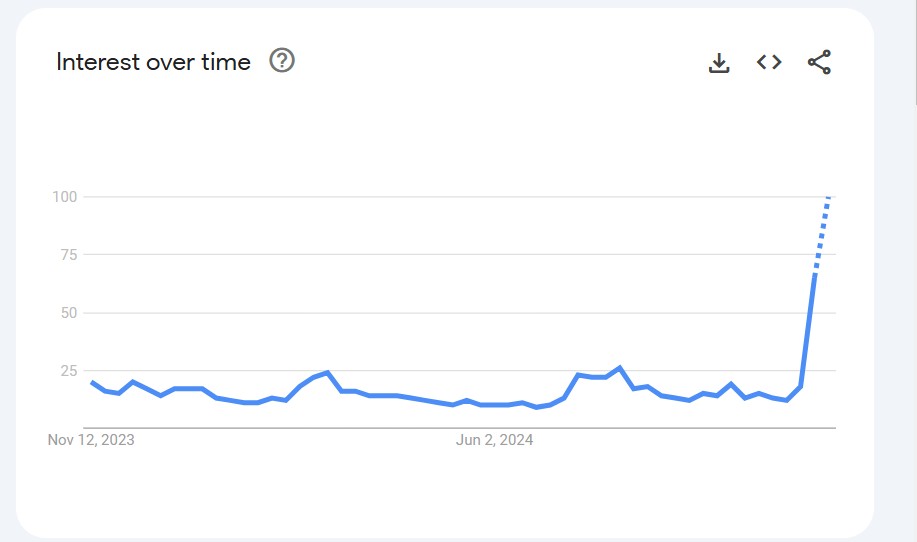

Public interest in alternative cryptocurrencies has surged to levels not seen since the 2021 crypto boom, according to recent Google Trends data.

Searches for "altcoins" reached a score of 88 out of 100 on December 4, nearly matching the peak levels observed during the previous altcoin season in 2021. This marks a dramatic reversal from the crypto winter period between January 2022 and November 2023, when search interest had plummeted to a five-year low of 5.

The renewed enthusiasm appears linked to recent market developments, including Donald Trump's election victory in early November, which coincided with Bitcoin reaching new highs of $99,600. Ethereum's rise above $3,800 has further fueled interest in the broader cryptocurrency market.

Market indicators support this trend, with the CoinMarketCap Altcoin Season Index hitting 89 on Wednesday - a strong signal of altcoin market dominance compared to Bitcoin. Scores above 75 on this index typically confirm an active altcoin season.

Notable performers include Virtuals Protocol, an AI agent deployment ecosystem reaching a $1.4 billion market cap. Meme tokens like PNUT, DOGE, PEPE, and BRETT have also gained traction amid the increased trading activity.

However, market observers note that altcoin seasons often bring both opportunities and risks. The heightened volatility during these periods requires careful risk management from investors.

The upcoming Federal Reserve interest rate decision meeting on December 17-18 could impact market dynamics, along with other factors like macroeconomic conditions and geopolitical events such as South Korea's recent emergency martial law declaration.

As the crypto market enters what appears to be a new altcoin season, both retail and institutional investors are closely monitoring these developments while navigating the characteristic market swings of the digital asset space.