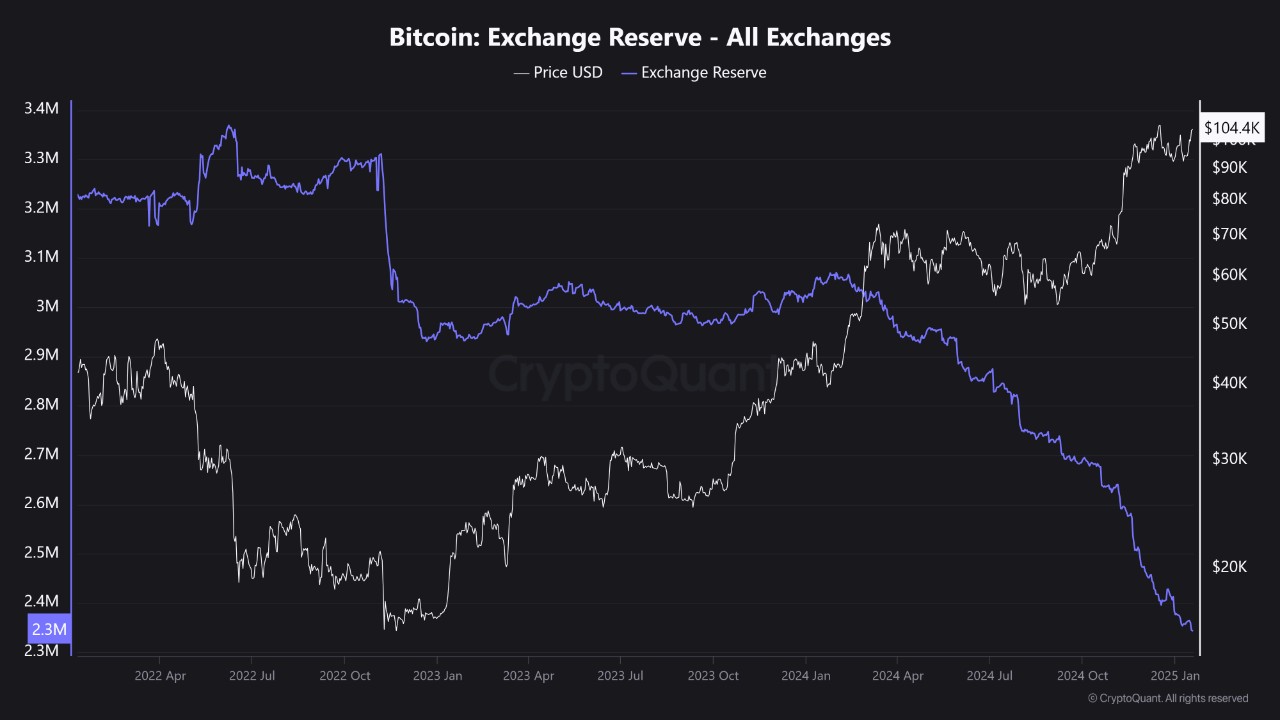

Recent analysis reveals a remarkable trend in the cryptocurrency market - approximately one million Bitcoin (BTC) have been withdrawn from exchanges over the past three years, pointing to evolving investor behavior and potential market implications.

According to CryptoQuant analyst Gaah, this massive exodus of Bitcoin from exchanges reflects growing confidence in the cryptocurrency as a long-term store of value. The trend began gaining momentum in November 2022, when investors started accumulating Bitcoin during a period of market weakness.

The withdrawal pattern has continued even as Bitcoin trades near historic highs, recently surpassing $109,000. This sustained movement of Bitcoin off exchanges suggests investors are increasingly favoring self-custody and long-term holding strategies over active trading.

Market experts note two key implications of this trend:

- Reduced selling pressure, as fewer Bitcoin are readily available for trading on exchanges

- Potential for increased price volatility due to limited market liquidity

The timing of these withdrawals is particularly noteworthy. While the initial wave occurred during a bearish market in late 2022, the current withdrawals are happening amid Bitcoin's bullish run. This contrast highlights how investor behavior has evolved as the cryptocurrency market has matured.

Bitcoin's recent performance reflects this changing dynamic. After experiencing corrections earlier this year, the cryptocurrency has rebounded strongly, though it currently trades at $104,782, showing a slight 0.1% decrease over the past 24 hours.

This massive withdrawal of Bitcoin from exchanges represents a clear shift in how investors approach cryptocurrency holdings, potentially setting the stage for new market dynamics in the coming months.