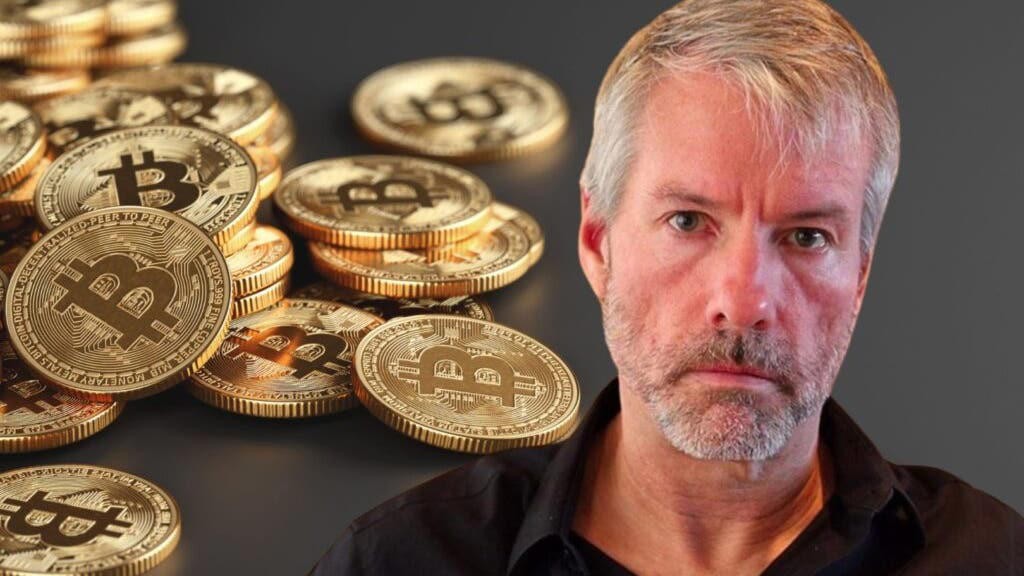

MicroStrategy's Executive Chairman Michael Saylor continues to champion a straightforward approach to Bitcoin investment strategy as the cryptocurrency reaches new heights, surpassing $100,000.

In a recent Yahoo Finance interview, Saylor reaffirmed his unwavering stance on Bitcoin investment strategy. "Every day for the past four years, I've said buy Bitcoin, don't sell the Bitcoin," he stated, emphasizing the simplicity of his approach.

The tech executive recommends investors use their spare capital to accumulate Bitcoin regularly, suggesting quarterly purchases to average out the entry price. He views Bitcoin as a long-term investment vehicle, advising people to only invest money they won't need for four to ten years.

Under Saylor's leadership, MicroStrategy has demonstrated remarkable success with this strategy. The company's stock has recorded an impressive 476% gain year-to-date, while continuing to expand its Bitcoin holdings.

Looking ahead, Saylor maintains an optimistic outlook for Bitcoin's future. He projects the cryptocurrency could reach $13 million per coin by 2045, positioning it as a transformative force in global wealth storage and transfer.

The cryptocurrency recently achieved a historic milestone by crossing the $100,000 mark, a development that sparked celebration throughout the crypto community. As of the latest market data, Bitcoin trades at $99,308, showing a 1.7% increase over 24 hours.

Saylor's message remains consistent: "Just keep buying Bitcoin with your spare capital. It's going to appreciate against the dollar forever." This approach has resonated with many investors, as Bitcoin continues to gain recognition as a mainstream investment asset.

The MicroStrategy chairman suggests that investors need not fully understand Bitcoin's technical aspects to benefit from its potential, emphasizing instead the importance of consistent investment and long-term holding strategy.