MicroStrategy has expanded its Bitcoin holdings with a massive purchase of 15,350 BTC worth approximately $1.5 billion, just days before its inclusion in the prestigious Nasdaq-100 index.

The business intelligence company funded the acquisition through the sale of nearly 3.9 million shares between December 9-15, according to regulatory filings. This latest purchase brings MicroStrategy's total Bitcoin holdings to 439,000 BTC, currently valued at $45 billion and representing over 2% of Bitcoin's total supply.

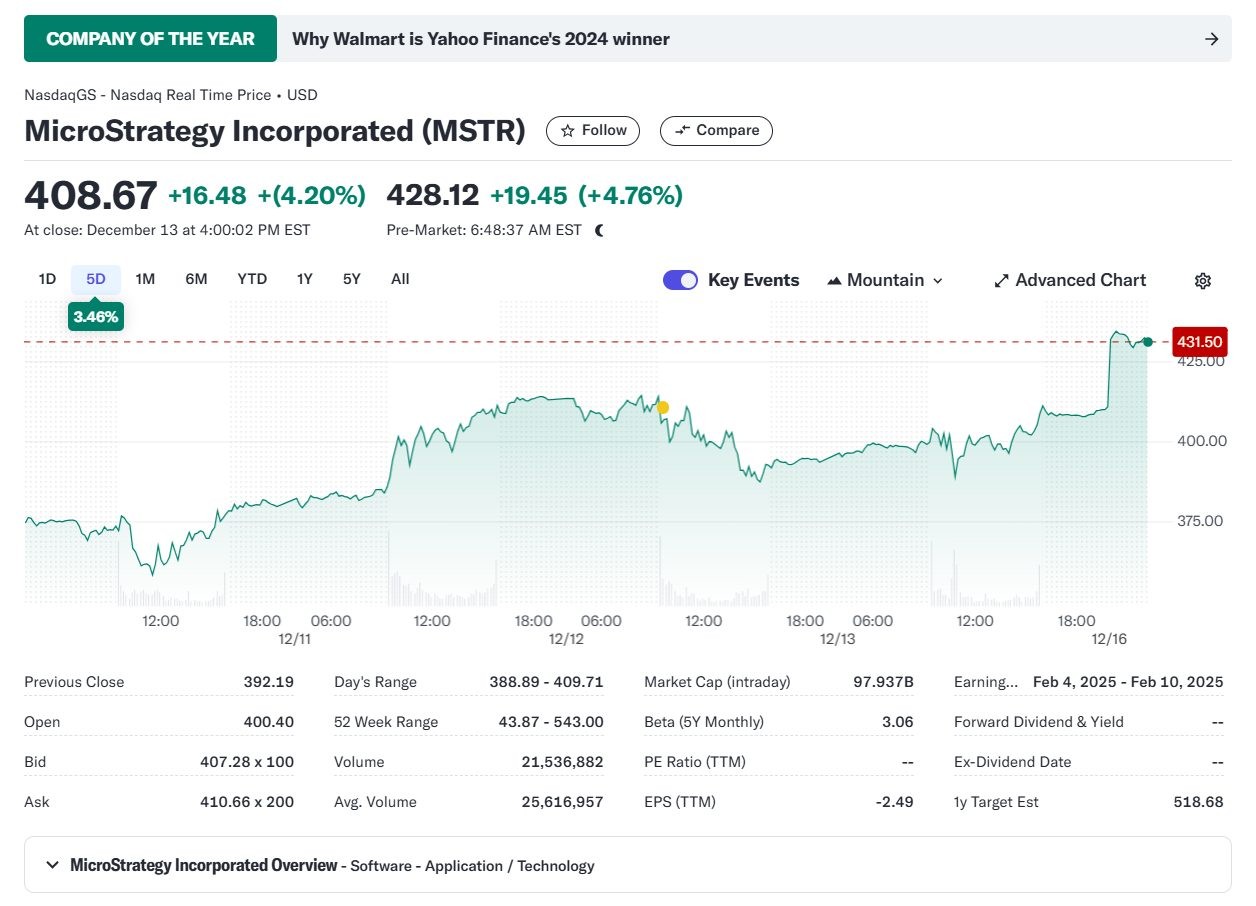

The company's aggressive Bitcoin acquisition strategy has proven successful, with a 72.4% yield year-to-date as of December 15. MicroStrategy's stock performance has been equally impressive, surging 547% this year and securing its spot in the Nasdaq-100 index.

The market responded positively to news of the Nasdaq-100 inclusion, with MicroStrategy shares climbing from $411 to $434 in pre-market trading. The company joins Palantir Technologies and Axon Enterprise as new additions to the index, effective next Monday.

MicroStrategy maintains substantial buying power for future Bitcoin purchases, with $7.6 billion still available from its $21 billion at-market share sale facility. The company's inclusion in the Nasdaq-100 is expected to enhance its financial capabilities as it pursues its target of accumulating $42 billion worth of Bitcoin.

The latest transaction demonstrates MicroStrategy's unwavering commitment to its Bitcoin strategy, which has transformed the company into one of the largest corporate holders of the cryptocurrency.