MicroStrategy's Nasdaq 100 Entry Could Drive Up to $2B in Fund Flows

MicroStrategy Inc. is poised to join the prestigious Nasdaq 100 index after December 20, a move that could trigger massive fund inflows of up to $2 billion as passive investment vehicles adjust their holdings to match the index.

The business intelligence company, which holds nearly 2% of the global Bitcoin supply, will bring unprecedented cryptocurrency exposure to passive index investors through its inclusion in major funds like the Invesco QQQ Trust and Invesco Nasdaq 100.

With a market capitalization of $94 billion, MicroStrategy's entry will force index-tracking funds to rebalance their portfolios by the December 20 deadline. This mechanical buying pressure could create notable market movements and potential trading opportunities.

The company's aggressive Bitcoin acquisition strategy has propelled its stock price up 465% year-to-date. Investment firm Bernstein recently labeled MicroStrategy as a "Bitcoin magnet," predicting it could control 4% of global Bitcoin supply by 2033.

Co-founder Michael Saylor reported the company is generating approximately $500 million in daily profits as Bitcoin approaches $100,000. MicroStrategy's recent $3 billion offering of zero-interest convertible senior notes was quickly absorbed by investors, demonstrating strong market confidence in its cryptocurrency-focused approach.

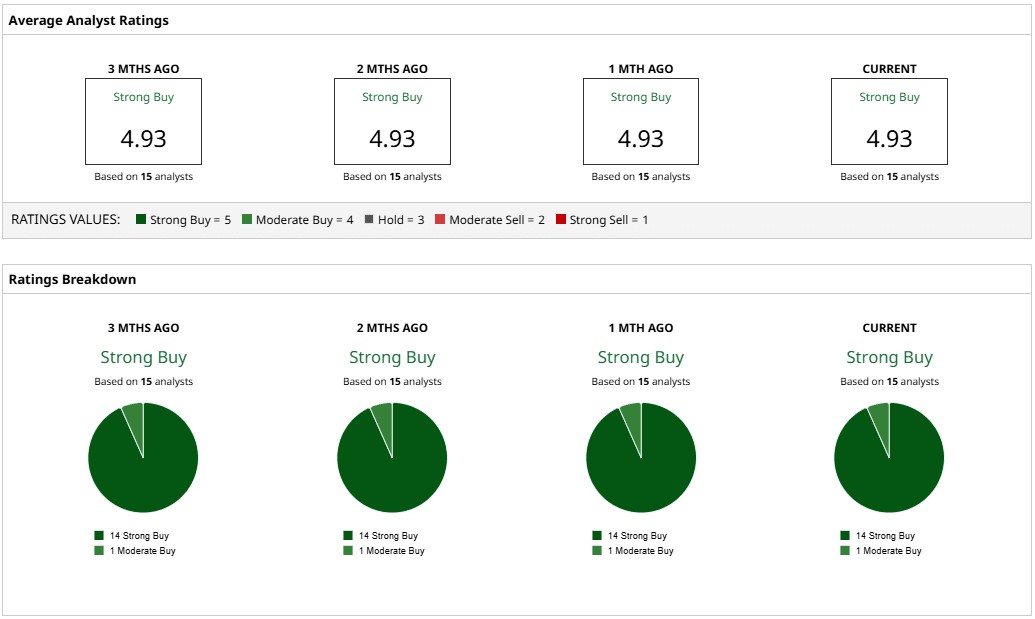

The stock currently trades around $387.47, with analysts maintaining a "Buy" consensus rating and a median price target of $449.50, suggesting a potential 16% upside. The highest analyst price target stands at $690.

This index inclusion represents a milestone for cryptocurrency adoption in traditional financial markets, as MicroStrategy's Bitcoin holdings will now indirectly influence one of the world's most-watched stock indices.