Bitcoin mining pools are grappling with an unexpected challenge - paying their miners in Bitcoin (BTC), despite operating entirely within the Bitcoin ecosystem. Pool operators have begun exploring alternative payment solutions due to various complications with BTC payouts.

The core issue stems from the complex nature of mining pool operations. When miners contribute computational power to a pool, they expect proportional rewards from successfully mined blocks. However, the standard 10-minute block intervals and volatile transaction fees make immediate BTC payments difficult.

Under common payout schemes like "pay per last N shares" (PPLNS), miners may wait days or weeks before receiving their first payment. The situation becomes more complicated when transaction fees spike unexpectedly, making routine payouts cost-prohibitive.

Pool operators face additional challenges with work allocation and value fluctuations. When pools assign mining tasks based on potential block rewards, dramatic changes in Bitcoin's price or transaction fees can occur before the block is actually mined. This leaves operators struggling to fairly compensate miners for their work.

In response, developers are discussing alternative payment solutions, including new electronic cash tokens that would represent claims on future Bitcoin earnings. These proposed tokens would offer faster transaction times and improved liquidity compared to direct Bitcoin payments.

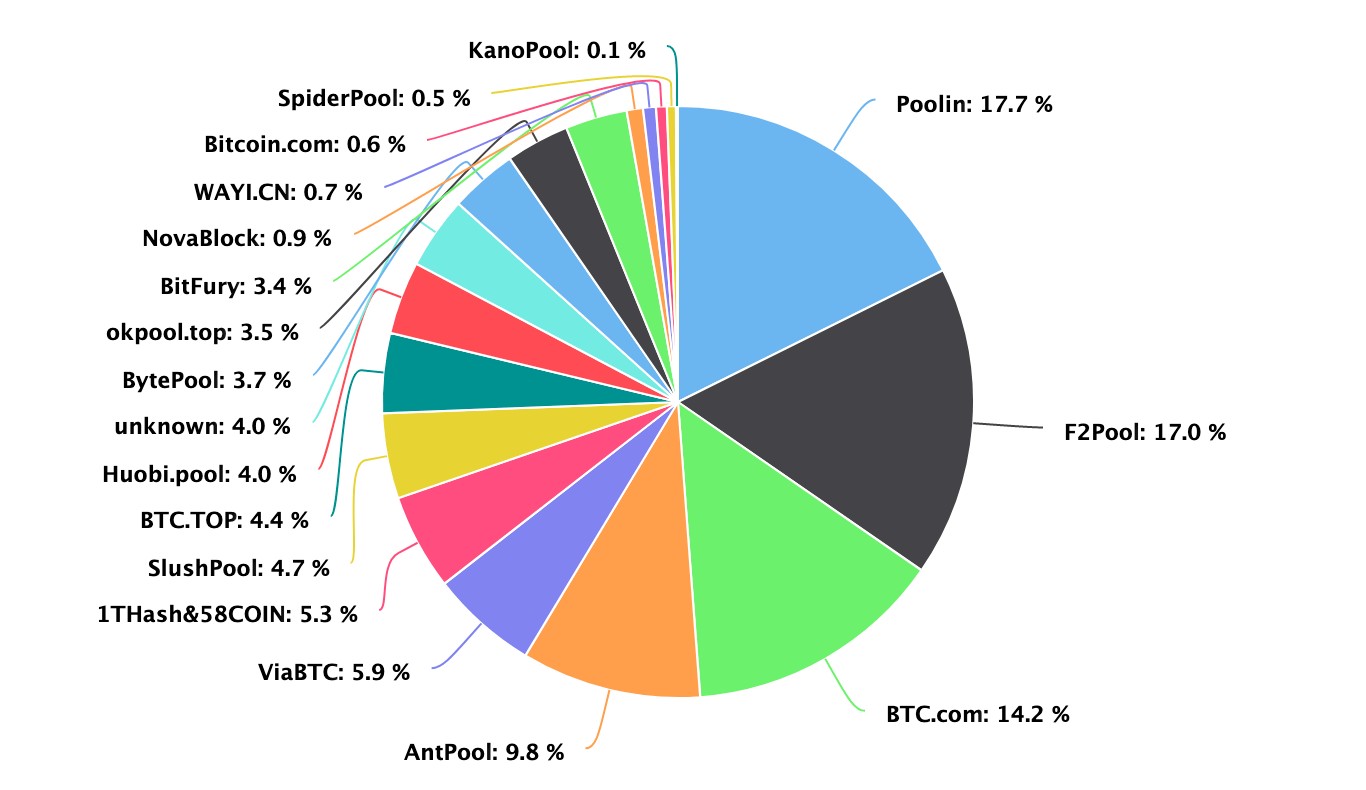

The discussions highlight an unexpected paradox - Bitcoin, designed as peer-to-peer digital cash, is proving challenging as a payment method within its own mining industry. While major mining pools currently maintain Bitcoin-based payouts, some are beginning to consider alternative cryptocurrencies for more efficient payment processing.

Industry experts emphasize that any new payment tokens would function purely as operational tools rather than speculative assets, serving only to streamline the payout process for mining pool participants.