Robinhood's stock soared 14% in early trading Thursday, reaching its highest level since 2021, as the company reported exceptional growth in cryptocurrency trading revenue. The surge added approximately $6 billion to the company's market value.

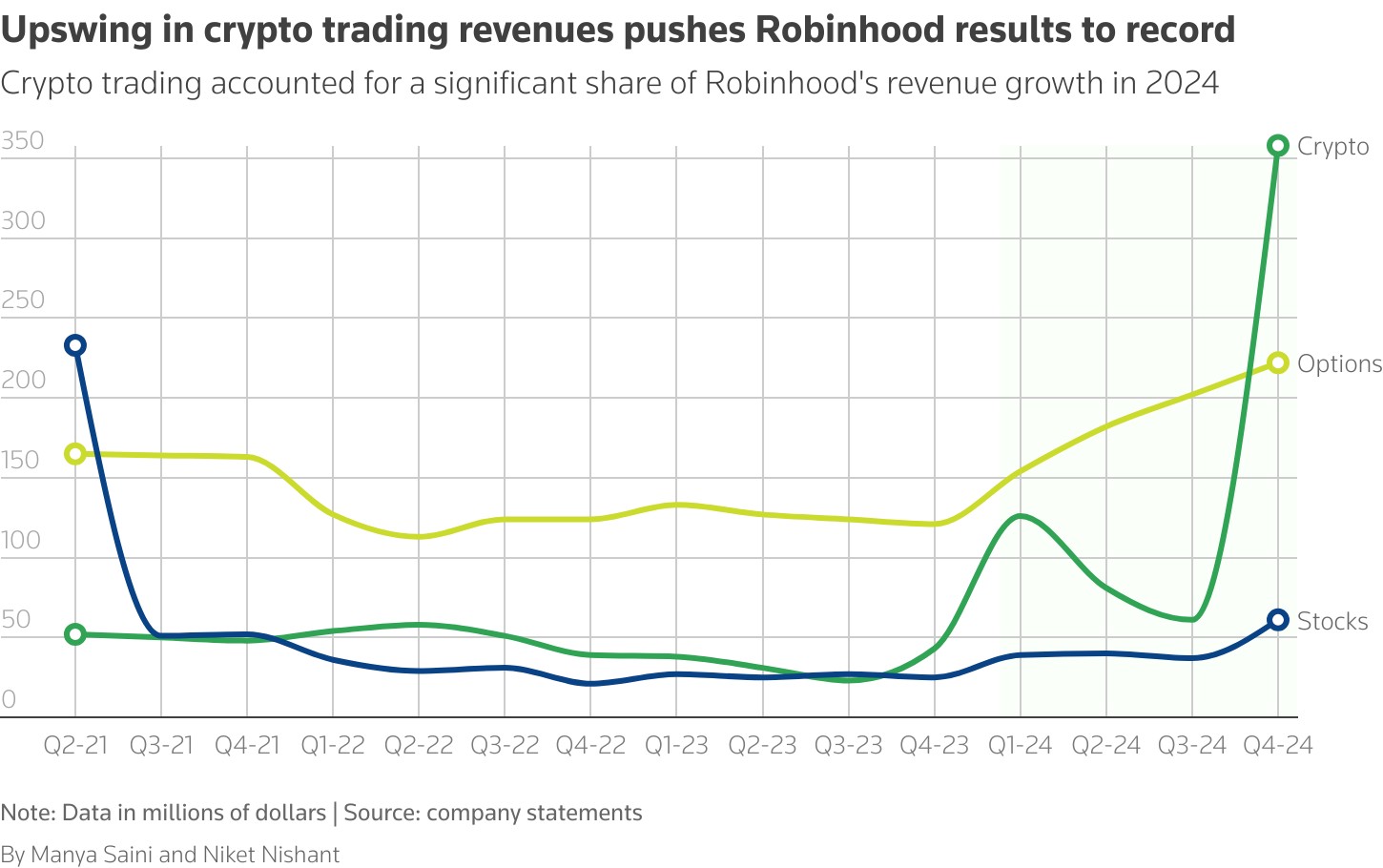

The commission-free trading platform saw an eight-fold increase in crypto-related transaction revenue during the fourth quarter, outperforming Wall Street's expectations. This growth comes as bitcoin crossed the $100,000 mark for the first time in Q4 2024.

Industry experts at Bernstein have named Robinhood their "best idea for 2025," anticipating continued strength in crypto prices and record trading volumes. While the platform currently offers fewer tokens compared to competitors like Coinbase, it has steadily captured market share through its user-friendly, commission-free model.

Paul Marino, Chief Revenue Officer at Themes ETFs, noted that increased trading volumes across equities, options, and crypto indicate growing retail trader confidence. The platform's success extends beyond cryptocurrency, demonstrating strong performance across all risk markets.

However, competing with established crypto exchanges presents challenges. Kadan Stadelmann, CTO at Komodo Platform, points out that crypto-native exchanges like Coinbase, Kraken, and Binance operate in more jurisdictions and cater to specialized crypto traders. Coinbase currently lists over 200 tokens, while Robinhood offers around 22.

Despite these challenges, Robinhood's history of market disruption since introducing commission-free trading in 2013 suggests potential for continued growth. The platform's recent success reflects its appeal to a new generation of traders and its ability to adapt to changing market demands.

The company's performance indicates broader market confidence and highlights the growing mainstream adoption of cryptocurrency trading platforms. As competition intensifies in the crypto trading space, Robinhood's latest results demonstrate its ability to attract and retain price-conscious customers while expanding its service offerings.