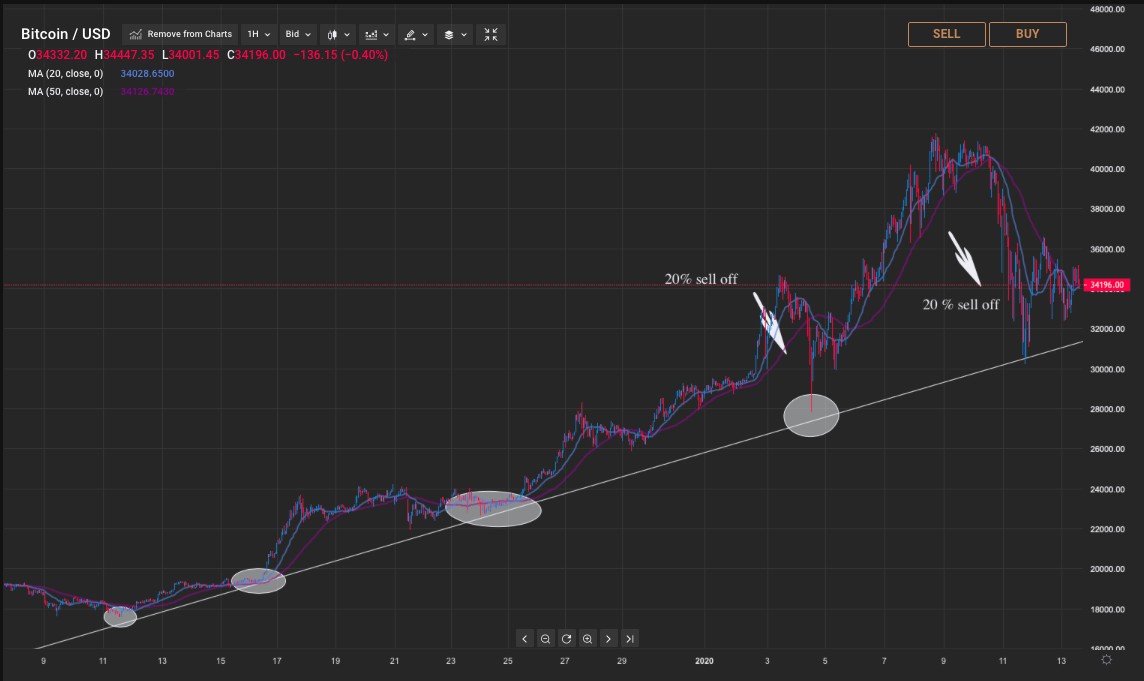

The cryptocurrency market experienced a sharp downturn as leading digital assets faced significant selling pressure. Shows early signs of bull run Solana (SOL), which ranks as the fifth-largest cryptocurrency, dropped 20% from its recent peak, with its market capitalization falling to $102 billion.

The decline wasn't isolated to Solana - popular meme coins in its ecosystem like Dogwifhat, Bonk, Popcat, and Peanut the Squirrel saw drops exceeding 20% within 24 hours. The total value of Solana-based meme coins has contracted to $17.7 billion.

Other major cryptocurrencies including Avalanche, Ethereum, Arbitrum, and BNB also recorded notable losses, highlighting the interconnected nature of crypto asset movements during market corrections.

Despite the sharp pullback, several analysts remain optimistic about Solana's prospects. Crypto analyst McKenna, who has over 93,000 followers, maintains a strongly bullish outlook, projecting a potential rise to $500 based on technical chart patterns. Another prominent analyst, Jelle, suggests an even higher target of $600, which would represent a 200% increase from current levels.

The optimism stems from Solana's strong underlying metrics. The blockchain has collected over $660 billion in fees this year and holds more than $8 billion in total value locked. Its decentralized exchanges have recorded impressive 30-day trading volumes exceeding $151 billion - nearly double that of Ethereum.

Technical analysis indicates SOL has retreated to a key support level at $206. Chart patterns suggest a potential upward movement to $520, representing a 97% increase from current levels.

While the recent market decline has rattled investors, Solana's robust fundamentals and technical indicators suggest this may be a temporary correction rather than the end of the bull market. However, as with all cryptocurrency investments, market participants should remain aware of the inherent volatility and risks.