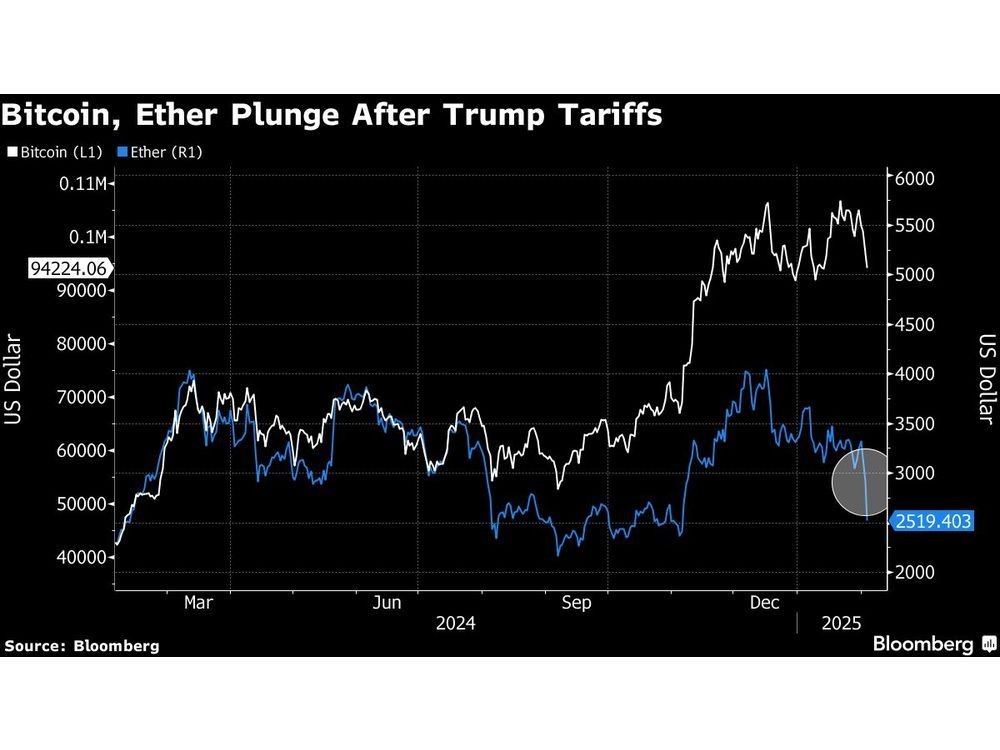

The cryptocurrency market faced severe turbulence over the weekend as President Donald Trump's announcement of extensive tariffs targeting Mexico, Canada, and China sent shockwaves through global financial markets.

Bitcoin plummeted to a three-week low of $91,441 before rebounding to $97,730, marking a 6.2% daily decline. Ethereum saw an even steeper fall, dropping 25% since Friday to $2,592.

The selloff intensified after MicroStrategy, a major institutional Bitcoin holder, announced a pause in its regular Bitcoin purchases. The company's CEO Michael Saylor reported holdings of 471,107 BTC, acquired at an average price of $64,511 per Bitcoin.

The meme coin sector bore the brunt of the market downturn. The recently launched Official Trump coin experienced a dramatic 15% drop to $17, far below its initial launch price of $73. Popular meme tokens Dogecoin and Shiba Inu each fell 14%, while Dogwifhat suffered a 26% decline.

The market reaction reflects growing disappointment in Trump's crypto policies. Despite campaign promises and a 40% post-election Bitcoin rally, concrete regulatory actions have yet to materialize since his January inauguration, when Bitcoin reached an all-time high of $107,071.86.

In a notable exception to the trade war, the UK received exemption from the new tariffs. Trump described British Prime Minister Keir Starmer as "very nice," though tensions remain with Tesla CEO Elon Musk publicly criticizing Starmer's policies.

The cryptocurrency market's response to these geopolitical developments highlights the growing interconnection between traditional trade policies and digital asset valuations. As the situation develops, traders remain cautious about potential further market impacts from escalating trade tensions.