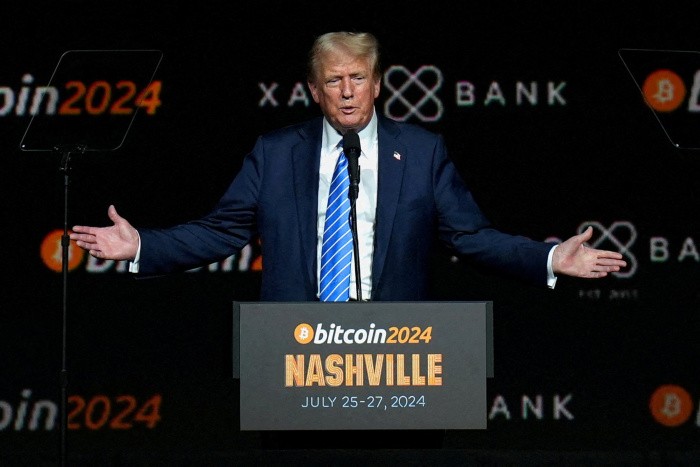

Former President Donald Trump's unexpected announcement of plans for a U.S. strategic cryptocurrency reserve triggered an initial market surge before quickly giving way to broader skepticism and selling pressure.

In a Sunday post on Truth Social, Trump revealed intentions to include XRP, Solana (SOL), and Cardano (ADA) alongside Bitcoin and Ethereum in a proposed government crypto stockpile. The news briefly energized crypto markets still reeling from their worst monthly performance since 2022.

However, the rally proved short-lived as questions emerged about the plan's implementation. By Monday morning, the major cryptocurrencies had reversed course, with XRP dropping 11%, SOL plunging 18%, and ADA falling nearly 10%. Bitcoin retreated below $90,000, declining 5%, while Ethereum shed almost 10%.

Market analysts point to multiple factors dampening enthusiasm, including uncertainty around congressional approval requirements and funding mechanisms. The White House's January statement suggested the reserve could draw from "cryptocurrencies lawfully seized by the Federal Government" - primarily Bitcoin from law enforcement operations.

Adding to market skepticism, Trump's crypto advisor David Sacks revealed he had sold his entire cryptocurrency portfolio before joining the administration in January. This disclosure came as Sacks prepares to host the White House's first crypto industry summit.

"The political calculus was clear — Trump needed a win before his approval ratings start slipping," noted crypto investment firm QCP Capital, suggesting the announcement may have been driven by political rather than policy considerations.

The crypto market's reaction highlights growing wariness among investors, who increasingly demand concrete policy details rather than broad pronouncements. As regulatory and political uncertainties persist, the long-term impact of Trump's proposed strategic reserve remains unclear.