The cryptocurrency market faced a severe downturn following U.S. President Donald Trump's announcement of new import tariffs, sending Bitcoin and other digital assets into a sharp decline.

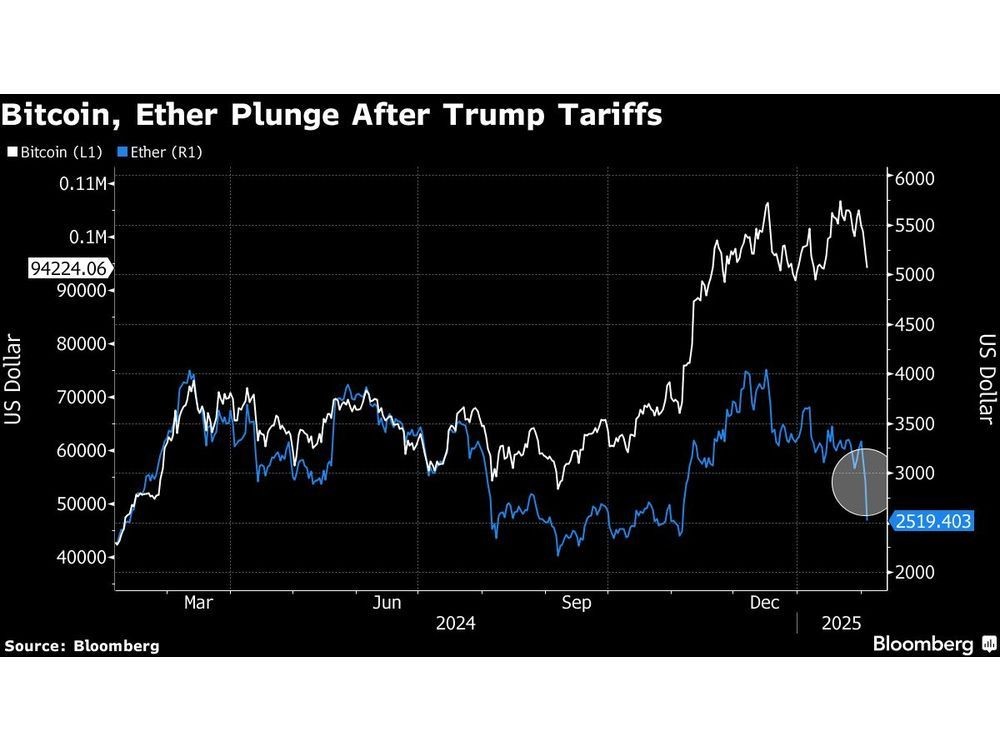

Bitcoin dropped to $95,800, marking a 4% decrease over 24 hours, while Ethereum experienced a steeper 17% fall to $2,590. The total cryptocurrency market capitalization shrank by 9% to $3.2 trillion, with liquidations reaching $2.3 billion.

The market turbulence came after Trump unveiled plans to impose 25% tariffs on Canadian and Mexican imports, along with a 10% duty on Chinese goods. The announcement sparked fears of an escalating global trade war, triggering a broad market sell-off that extended beyond cryptocurrencies.

Traditional markets also felt the impact, with Nasdaq futures declining 1.8% and S&P 500 futures falling 1.6%. The widespread market reaction highlights growing investor concerns about the potential economic implications of these trade measures.

"External pressures — like the US escalating tariffs on Mexico, Canada, and China — are rattling global markets and spilling into crypto," said Saul Rejwan, managing partner at crypto investment firm Masterkey VC.

The current market downturn marks a sharp reversal from December's optimism, when Bitcoin had surpassed $100,000 for the first time. While cryptocurrencies are often viewed as hedges against economic uncertainty, the recent price action demonstrates their vulnerability to broader market sentiment and liquidity conditions.

Market analysts predict continued price volatility in the cryptocurrency sector until major macro events, regulatory developments, or geopolitical shifts provide clearer direction. The crypto community now watches closely as these new tariffs take effect, potentially reshaping global trade dynamics and market sentiment.