World Liberty Financial (WLF) has expanded its Ethereum holdings substantially, investing $129.95 million to acquire 39,242 ETH over the past week at an average price of $3,312 per token.

The fund's most recent purchase occurred approximately five hours ago, when it bought 3,247 ETH worth $10 million during a market dip. However, due to current market volatility, these recent acquisitions are facing an unrealized loss of $5.12 million, representing a 3.94% decline from the purchase price.

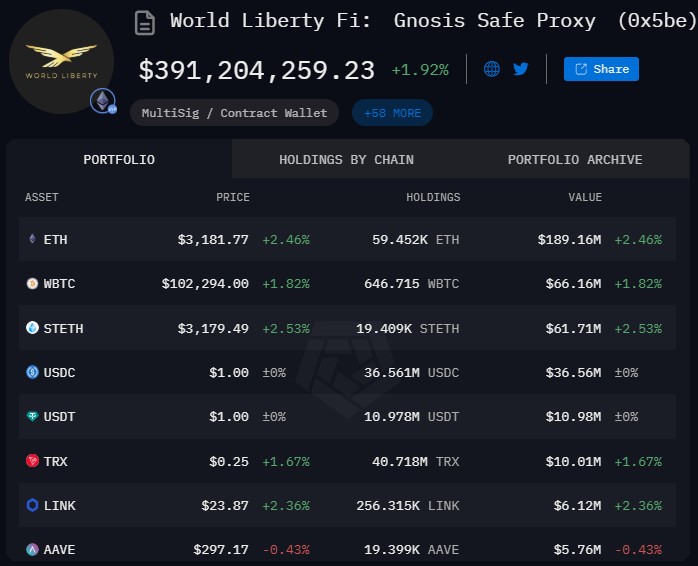

WLF's aggressive accumulation strategy has resulted in total holdings of 78,722.84 ETH, valued at approximately $257 million. The fund maintains a diversified storage approach, with 63,253 ETH held in a multi-signature wallet and 19,408 ETH staked through Lido Finance. Market observers speculate that an additional 14,611 ETH worth $46.6 million may be stored on Coinbase.

This accumulation comes during a period of increased whale activity in the Ethereum network, with 13 new mega whales - each holding over 10,000 ETH - joining in the past 24 hours. The network has also seen a surge in active addresses, reaching beyond 620,000 - the highest level recorded since March 2024.

Despite WLF's bullish stance, the broader institutional market shows mixed sentiment. Ethereum spot ETFs have experienced net outflows of $136 million, with Grayscale's ETH fund (ETHE) recording an $84.24 million single-day outflow.

Currently trading at $3,196.26, Ethereum's price movement remains volatile as the market navigates through various macroeconomic factors and institutional trading patterns.