Bitcoin's Institutional Transformation: A Double-Edged Sword for Decentralization

As Bitcoin approaches a critical juncture in 2025, institutional giants like MicroStrategy are reshaping its landscape through massive acquisitions. This evolution raises pressing questions about maintaining Bitcoin's democratic principles amid growing corporate and government control of the cryptocurrency.

Bitcoin ETFs Surpass Satoshi's Holdings: Weekly Inflows Top $2 Billion in Historic Milestone

US-listed spot Bitcoin ETFs have accumulated over 1.1 million BTC, surpassing the holdings of Bitcoin's creator Satoshi Nakamoto. BlackRock's IBIT leads with 521,375 BTC, while total weekly inflows reached $2.35 billion amid record-breaking institutional adoption.

Tether Expands Bitcoin Holdings with $700M Strategic Reserve Transfer

Tether has significantly increased its Bitcoin reserves by transferring 7,629 BTC worth $700 million, bringing total holdings to 83,758 BTC. The move comes amid European regulatory uncertainty affecting USDT's market cap, while CEO Paolo Ardoino dismisses concerns as unfounded FUD.

Swiss Bitcoin Initiative: Voters May Force Central Bank to Hold BTC Reserves

Switzerland's Federal Chancellery has approved the 'Bitcoin Initiative,' paving the way for a potential national referendum on requiring the Swiss National Bank to hold Bitcoin reserves. The groundbreaking proposal could make Switzerland one of the first countries to mandate cryptocurrency holdings for its central bank.

Bitcoin Mining Giant Foundry Returns $777,000 in Mistakenly Paid Transaction Fees

Foundry USA Pool, the leading Bitcoin mining operator, has returned 8.18 BTC to a user who accidentally paid a transaction fee 91,127 times higher than required. The incident highlights growing industry standards for fee reimbursement, with Foundry maintaining its dominant 38% market share despite recent organizational changes.

Ethiopia Emerges as Africa's Bitcoin Mining Powerhouse with Green Energy Revolution

Ethiopia has captured 2.5% of global Bitcoin mining hash rate through renewable energy initiatives, attracting over $1 billion in infrastructure investments. The nation's competitive electricity rates and hydroelectric power from the Grand Ethiopian Renaissance Dam are driving sustainable mining growth while supporting rural electrification.

Tesla Resumes Bitcoin Payments as Mining Goes Green

Tesla announces the return of Bitcoin payments for vehicle purchases as cryptocurrency mining surpasses 50% renewable energy usage. The milestone decision follows Elon Musk's previous suspension of Bitcoin transactions and reflects the industry's shift toward sustainable practices.

MicroStrategy Bolsters Bitcoin Portfolio with $209M Strategic Purchase

Business intelligence giant MicroStrategy expands its Bitcoin holdings to 446,400 BTC with a $209 million purchase at an average price of $97,837 per coin. The acquisition, funded through share sales, marks the company's eighth consecutive week of Bitcoin purchases under Michael Saylor's leadership.

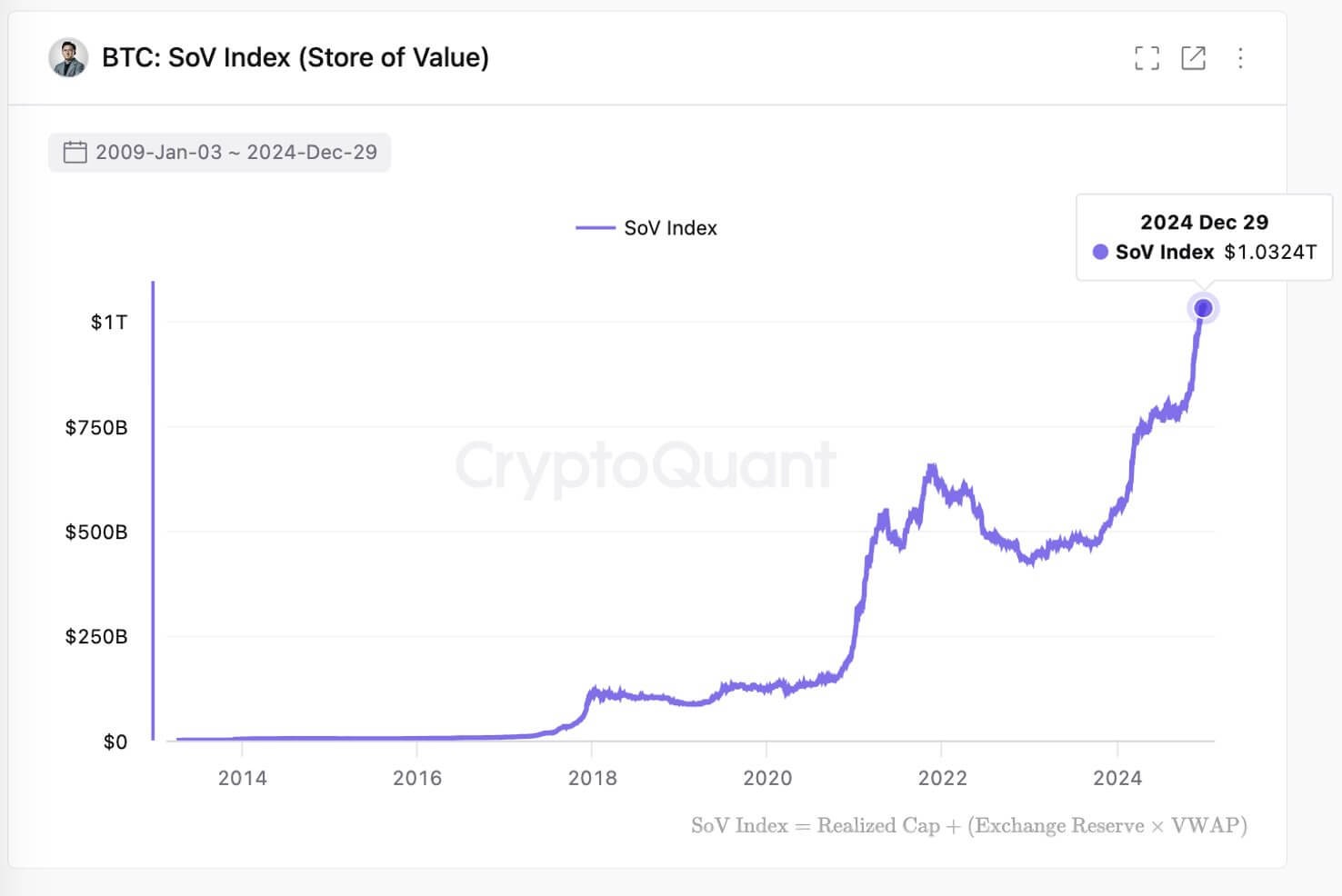

Bitcoin's Real Value Hits $1.03T: New Metric Reveals True Investment Landscape

Bitcoin's stored value surges 85% to $1.03 trillion in 2024, according to CryptoQuant analysis combining on-chain and off-chain data. This new metric offers deeper insights into actual capital invested versus market cap, suggesting growing institutional confidence in Bitcoin as a store of value.

Education Giant Genius Group Expands Bitcoin Treasury to $30M in Bold Strategic Move

NYSE-listed Genius Group has ramped up its Bitcoin holdings by 50% to reach $30M, acquiring an additional $10M worth of BTC. The AI-powered education company aims to allocate 90% of reserves to Bitcoin with an ambitious $120M investment target.