Barclays Makes $131M Strategic Investment in BlackRock's Bitcoin ETF

Barclays Bank has invested $131 million in BlackRock's Bitcoin ETF, marking a significant milestone in institutional crypto adoption. The investment follows increased interest after the US election and aligns with other major banks expanding their Bitcoin ETF holdings.

BlackRock Expands Crypto Footprint with First European Bitcoin ETF Launch in Switzerland

BlackRock, managing $4.4 trillion in assets, launches its first European cryptocurrency product with a Bitcoin ETF in Switzerland, following its successful U.S. spot Bitcoin ETF. This strategic expansion demonstrates growing institutional acceptance of cryptocurrencies and reinforces BlackRock's pioneering role in bridging traditional finance with digital assets.

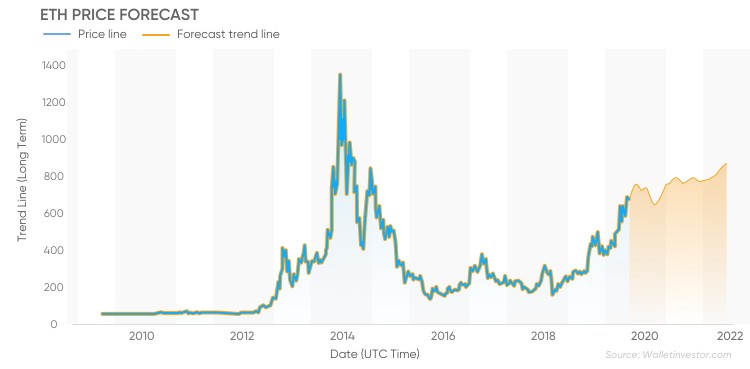

Ethereum Price Surge: Analysts Project $4,500 Target by Mid-March

Leading cryptocurrency analysts forecast Ethereum reaching $4,500 by mid-March, supported by technical indicators and institutional interest. BlackRock's recent acquisition of over 24,000 ETH and surging trading volumes signal growing market confidence despite January's price decline.

Nasdaq Seeks SEC Approval for Direct Bitcoin Transfers in BlackRock ETF

Nasdaq has filed an amended proposal with the SEC to enable in-kind Bitcoin redemptions for BlackRock's iShares Bitcoin ETF. This change would allow direct Bitcoin transfers to investors during redemptions, offering an alternative to the current cash-only model while potentially reducing tax implications.

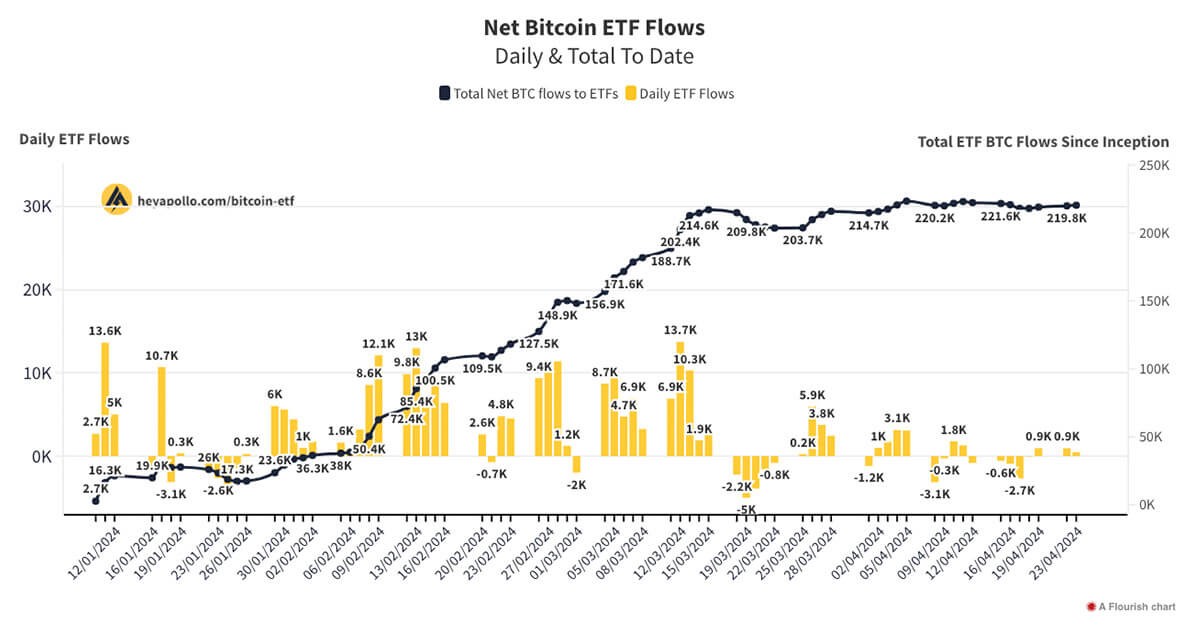

Bitcoin ETF Enthusiasm Cools as Daily Inflows Drop 69% Amid Price Decline

Spot Bitcoin ETF inflows decreased significantly to $248.65 million as BTC retreated to $102,000, with BlackRock's IBIT fund being the only major gainer. Meanwhile, the SEC forms a new crypto task force that could pave the way for broader crypto ETF approvals.

Bitcoin ETF Giants Now Acquiring Crypto 20 Times Faster Than Mining Production

Major ETF issuers are dramatically reshaping the Bitcoin landscape by purchasing BTC at unprecedented rates, now exceeding 20 times daily mining output. Their aggressive accumulation has already secured over 5% of total Bitcoin supply, surpassing even Satoshi Nakamoto's holdings.

Ethereum's 2025 Vision: Expert Forecasts $15,000 Price Target and Institutional Revolution

Leading Ethereum educator Anthony Sassano shares ambitious predictions for 2025, including a $15,000 ETH price target and massive institutional adoption through ETFs. His forecast encompasses major protocol upgrades, layer 2 developments, and unprecedented government acceptance of Ethereum as a treasury reserve asset.

Bitcoin ETFs Surpass Satoshi's Holdings: Weekly Inflows Top $2 Billion in Historic Milestone

US-listed spot Bitcoin ETFs have accumulated over 1.1 million BTC, surpassing the holdings of Bitcoin's creator Satoshi Nakamoto. BlackRock's IBIT leads with 521,375 BTC, while total weekly inflows reached $2.35 billion amid record-breaking institutional adoption.

BlackRock Emerges as Major Force in Ethereum Market with $3.5B Investment

Investment giant BlackRock has established itself as one of the world's largest Ethereum holders, accumulating nearly 1 million ETH worth $3.5 billion through its spot ETF. This strategic move signals growing institutional acceptance of digital assets while raising questions about market influence and future adoption.

Bitcoin to $350K: Kiyosaki Challenges BlackRock's ETF Strategy

Robert Kiyosaki, author of 'Rich Dad Poor Dad', reaffirms his bold Bitcoin price prediction while questioning BlackRock's ETF outflows. He suggests institutional manipulation may be enabling large investors to accumulate Bitcoin below $100K, emphasizing direct cryptocurrency ownership over ETF investments.