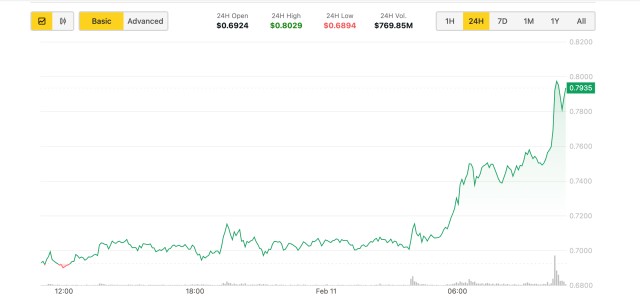

Grayscale's Cardano ETF Filing Sparks 11% Rally in ADA Price

Grayscale Investments has submitted the first-ever spot Cardano ETF application to the SEC through NYSE Arca, causing ADA's price to surge 11% to $0.74. The filing represents growing institutional interest in altcoins, with Coinbase set to serve as custodian for the proposed trust.

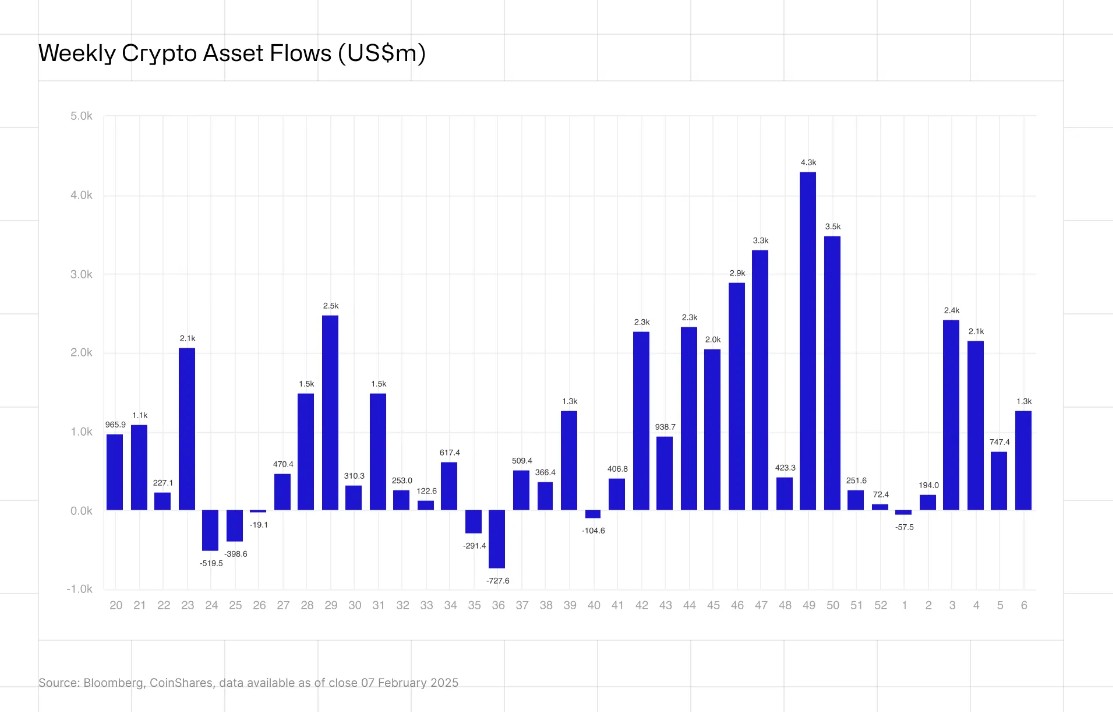

Crypto Investment Products Hit $1.3B Weekly Inflows Despite Trump Trade Tensions

Digital asset investment products maintained strong momentum with $1.3B in weekly inflows, led by Ethereum's $793M, despite market uncertainty around Trump's tariff rhetoric. The surge marks the fifth consecutive week of positive flows, pushing 2024's total to $7.3B while US dominates regional investments.

SEC Whistleblower Lawsuit Exposes Potential Conflicts in Ripple Case

A new lawsuit demands the release of an SEC investigation into alleged crypto conflicts of interest, centered on former Director William Hinman's Ethereum speech and ties to Enterprise Ethereum. The outcome could impact XRP's regulatory status and price trajectory, with potential implications for XRP-spot ETF approvals.

Cboe Takes Bold Step with Four Spot XRP ETF Applications to SEC

Cboe BZX Exchange has filed four separate applications for spot XRP ETFs with the SEC, representing major asset managers like WisdomTree and Bitwise. The applications come amid growing institutional interest and follow Ripple's partial legal victory, with the SEC having 240 days to review once acknowledged.

BlackRock Expands Crypto Footprint with First European Bitcoin ETF Launch in Switzerland

BlackRock, managing $4.4 trillion in assets, launches its first European cryptocurrency product with a Bitcoin ETF in Switzerland, following its successful U.S. spot Bitcoin ETF. This strategic expansion demonstrates growing institutional acceptance of cryptocurrencies and reinforces BlackRock's pioneering role in bridging traditional finance with digital assets.

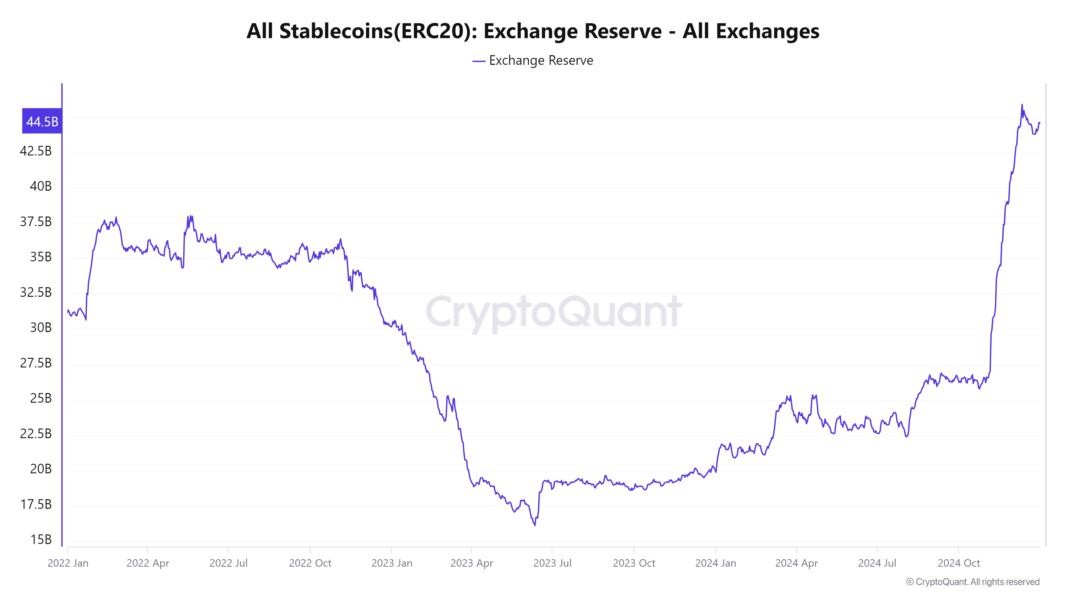

Bitcoin Eyes $117K as Record Stablecoin Liquidity Fuels Market Rally

Bitcoin's trajectory toward $117,000 gains momentum as stablecoin market cap hits an unprecedented $204 billion, signaling robust market demand. Record institutional interest, favorable Fed policies, and growing ETF adoption further strengthen Bitcoin's upward momentum in 2025.

SEC Acknowledges First Post-Ethereum Altcoin ETF: Canary Capital's Litecoin Filing

The SEC's formal acknowledgment of Canary Capital's Litecoin ETF application sets a 240-day review timeline, marking a significant milestone for altcoin ETFs. The development, which triggered a 12% LTC price surge, could serve as a benchmark for future altcoin ETF approvals.

Grayscale Unveils Bitcoin-Focused Company ETF Strategy Amid Growing Institutional Interest

Grayscale Investments seeks SEC approval for a novel Bitcoin Adapters ETF targeting companies with significant Bitcoin holdings. The fund aims to invest primarily in firms maintaining billion-dollar Bitcoin reserves, with MicroStrategy emerging as a key potential component.

Investment Giants Rush to File Crypto ETFs as SEC Leadership Changes

Major investment firms flood SEC with new cryptocurrency ETF proposals following Gary Gensler's departure as Chairman. CoinShares, Grayscale, and others seek to launch diverse crypto products amid anticipated regulatory shifts under new leadership.

Bitwise Pursues Dogecoin ETF as Musk's Department Distances from DOGE

Asset manager Bitwise prepares for a potential Dogecoin ETF filing with the SEC, while REX Shares pursues similar crypto investment vehicles. Meanwhile, Elon Musk's Department of Government Efficiency removes Dogecoin imagery amid price volatility and legal challenges.