Nasdaq Seeks SEC Approval for Direct Bitcoin Transfers in BlackRock ETF

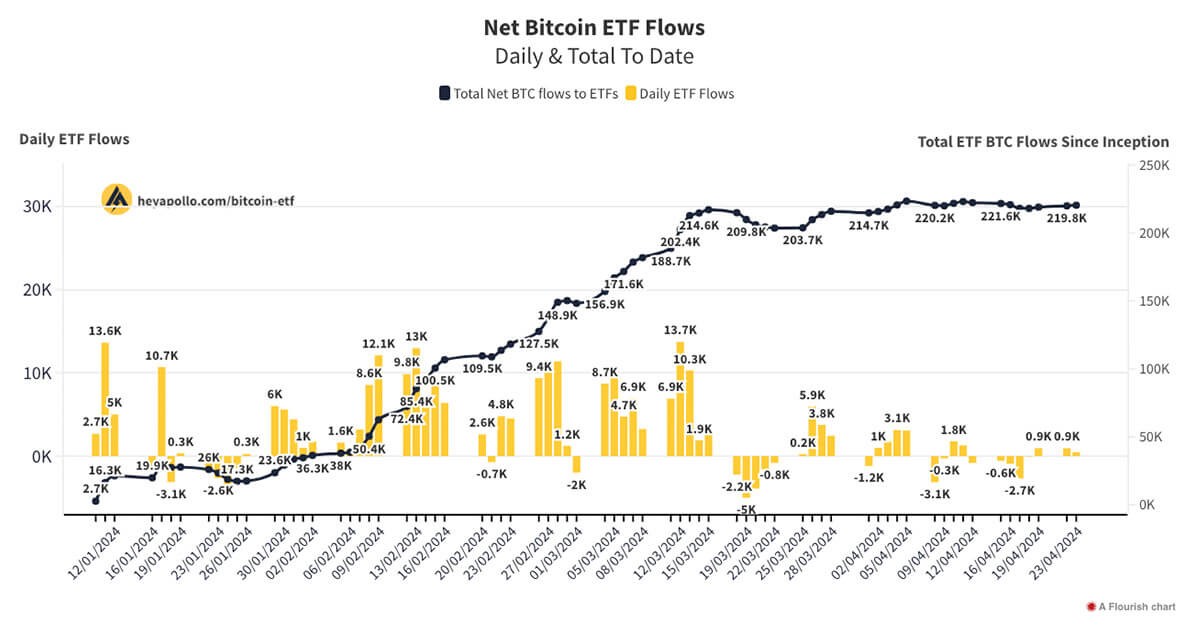

Nasdaq has filed an amended proposal with the SEC to enable in-kind Bitcoin redemptions for BlackRock's iShares Bitcoin ETF. This change would allow direct Bitcoin transfers to investors during redemptions, offering an alternative to the current cash-only model while potentially reducing tax implications.

Bitcoin ETF Enthusiasm Cools as Daily Inflows Drop 69% Amid Price Decline

Spot Bitcoin ETF inflows decreased significantly to $248.65 million as BTC retreated to $102,000, with BlackRock's IBIT fund being the only major gainer. Meanwhile, the SEC forms a new crypto task force that could pave the way for broader crypto ETF approvals.

JPMorgan Predicts Bitcoin's Market Dominance Will Extend Through 2025

JPMorgan analysts forecast Bitcoin to maintain its cryptocurrency market leadership position through 2025, citing institutional adoption and its role as digital gold. The analysis points to MicroStrategy's massive acquisition plans and Bitcoin ETFs as key drivers supporting continued dominance.

JPMorgan Predicts $15B Investment Surge for Solana and XRP Exchange Products

JPMorgan analysts forecast potential $15 billion inflows into Solana and XRP exchange-traded products, drawing parallels to Bitcoin and Ethereum adoption patterns. Despite regulatory hurdles in the US, recent data shows growing investor interest with XRP and Solana products attracting significant investments in early 2024.

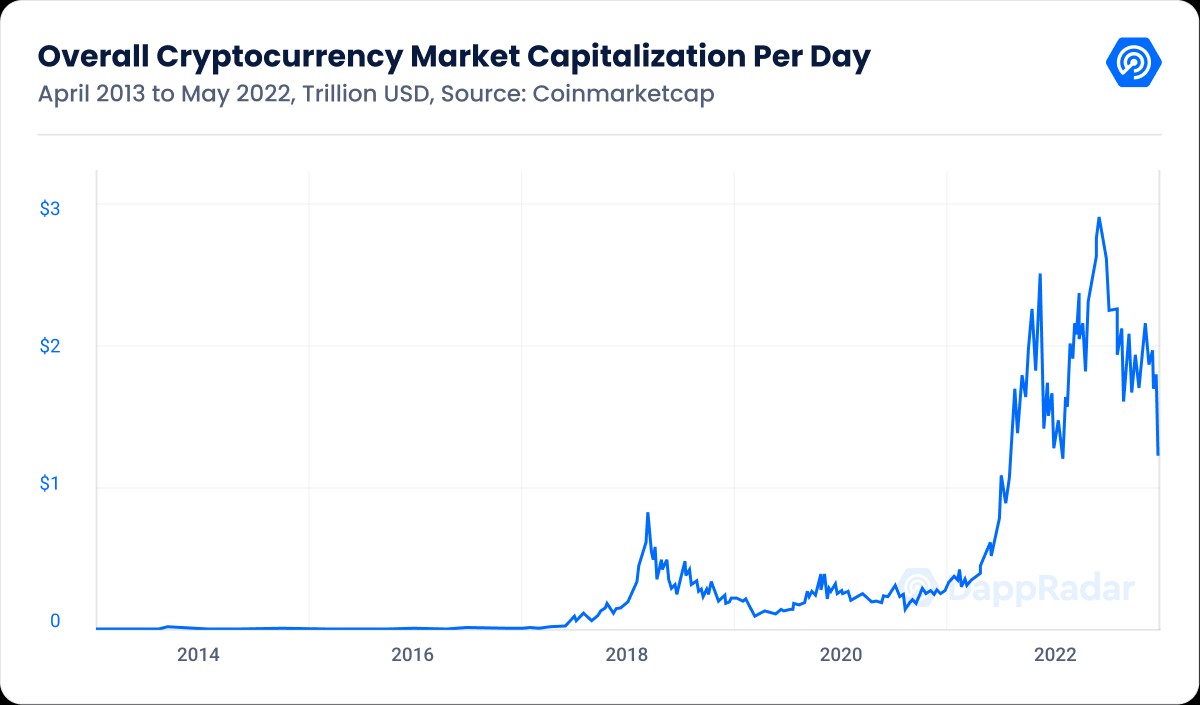

Crypto Market Tumbles as Bitcoin ETF Outflows Hit Record High

The cryptocurrency market extends its decline for the third day, with Bitcoin falling to $91,300 amid massive ETF outflows and macroeconomic concerns. Over 130,000 traders faced liquidations totaling $404 million as the total crypto market cap dropped 4.4% to $3.38 trillion.

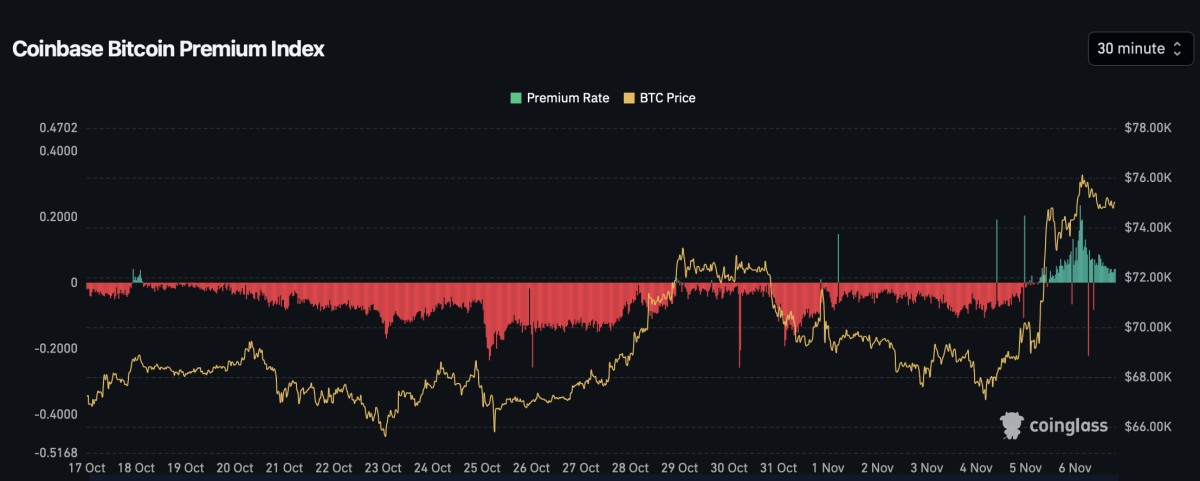

Coinbase Premium Index Turns Positive, Signaling Renewed US Bitcoin Demand

The Coinbase Premium Index has flipped positive for the first time in 2025, indicating growing US institutional interest in Bitcoin as prices surge above $102,000. This key market indicator's reversal from recent lows coincides with substantial BTC outflows and technical breakout signals, suggesting sustained bullish momentum.

Bitcoin ETF Giants Now Acquiring Crypto 20 Times Faster Than Mining Production

Major ETF issuers are dramatically reshaping the Bitcoin landscape by purchasing BTC at unprecedented rates, now exceeding 20 times daily mining output. Their aggressive accumulation has already secured over 5% of total Bitcoin supply, surpassing even Satoshi Nakamoto's holdings.

Coinbase to Pioneer Tokenized Stock Trading with COIN Shares on Base Network

Coinbase announces plans to offer tokenized versions of its COIN shares on its Ethereum Layer-2 network, Base, marking a significant step in merging traditional finance with blockchain technology. While international investors can access tokenized shares through decentralized platforms, U.S. investors await regulatory clarity for participation.

South Korea Signals Major Policy Shift: Crypto ETFs on the Horizon for 2025

South Korea's financial sector prepares for a transformative change as the Korea Exchange announces plans to explore cryptocurrency ETFs in 2025. This strategic move, following the success of US crypto ETFs, could reverse the country's 2017 ban despite ongoing political challenges.

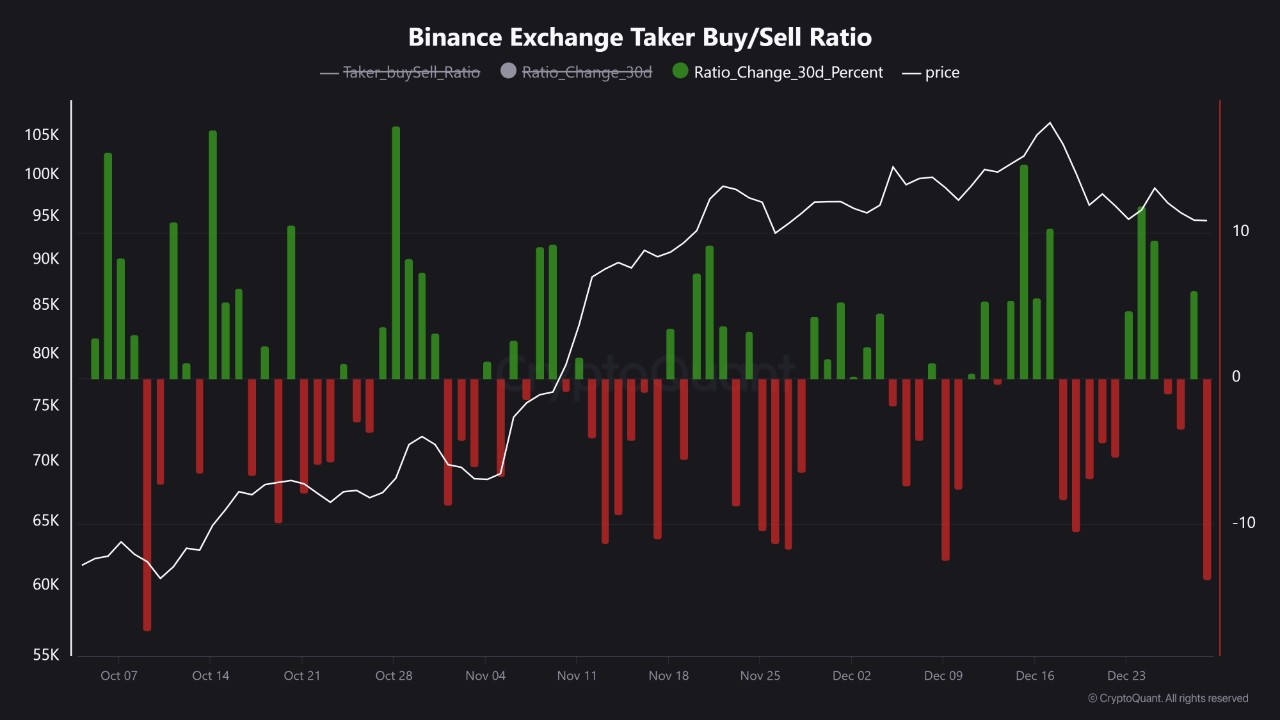

Bitcoin Market Shows Signs of Cooling as Exchange Deposits Hit New Lows

Bitcoin exchange inflows and miner outflows have significantly decreased from their November 2024 peaks, suggesting reduced selling pressure in early 2025. Combined with recovering ETF inflows of $900M, analysts remain optimistic with projected trading ranges of $95,000-$110,000.