Standard Chartered Expands into European Crypto Market with Luxembourg Hub

Standard Chartered has launched cryptocurrency custody services in Luxembourg after securing a digital asset license, establishing its European crypto hub. The bank will initially offer Bitcoin and Ether custody, with plans to expand services while adhering to EU's MiCA framework.

Backpack Exchange Acquires FTX EU License, Eyes European Crypto Derivatives Market

Backpack Exchange has secured FTX EU's assets and MiFID II license, planning to launch regulated crypto derivatives trading in Europe by Q1 2025. The strategic acquisition includes managing FTX bankruptcy claims distribution while positioning Backpack as a key player in Europe's underserved regulated crypto market.

Tether Maintains Market Dominance Despite EU Exchange Delistings

Despite European exchanges removing USDT to comply with MiCA regulations, CryptoQuant data shows Tether's reserves and market position remain resilient. Exchange reserve metrics indicate steady buying pressure for the leading stablecoin, contradicting fears about its declining influence.

European Stablecoin Regulations: How Tether Scrutiny Could Strengthen Crypto Markets

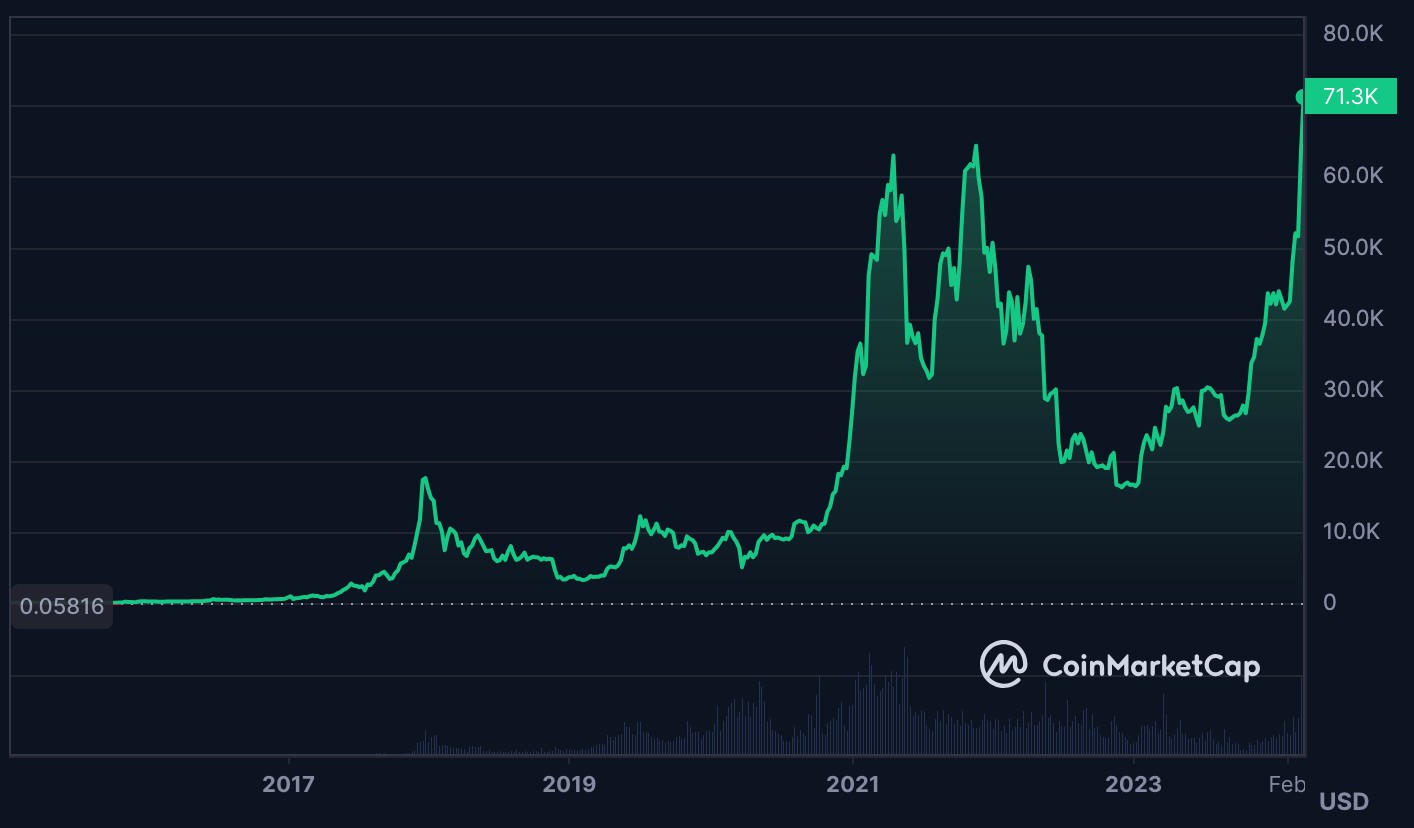

The EU's MiCA regulation is raising concerns about Tether's compliance, but historical patterns suggest market resilience. Past episodes of Tether uncertainty have led to temporary dips followed by stronger recoveries, potentially creating opportunities across the crypto ecosystem.

Coinbase Halts USDC Rewards Program in Europe to Comply with MiCA Regulations

Coinbase announces the end of its USDC rewards program across Europe by December 2024, adhering to new MiCA regulatory requirements. The decision affects users in EU member states and EEA countries, sparking debate about regulatory restrictions on crypto yield-bearing products.

Bitcoin Revolutionizes Venture Capital: A New Era for Startup Funding

Bitcoin and cryptocurrency markets are transforming traditional venture capital, creating innovative funding pathways for startups and entrepreneurs. With European tech funding projected at $45 billion for 2024, Bitcoin-based mechanisms offer alternative routes for capital raising and foster decentralized innovation.