House Republicans Advance Bill to Block Federal Digital Dollar Development

The House Financial Services Committee has approved legislation preventing the Federal Reserve from creating a central bank digital currency (CBDC), citing privacy concerns. The CBDC Anti-Surveillance State Act, led by Rep. Tom Emmer, aims to protect citizens from potential government surveillance of financial transactions.

Bitcoin Options Signal Bullish Turn Post-Fed Meeting While Ethereum Traders Stay Cautious

Bitcoin options market shows renewed optimism following the Federal Reserve's policy meeting and rate cut projections, with traders actively accumulating calls. Meanwhile, Ethereum derivatives maintain a defensive stance despite upcoming Pectra upgrade, highlighting a divergence in market sentiment.

Bitcoin Dips as Unexpected US Inflation Jump Dampens Rate Cut Hopes

Bitcoin and major cryptocurrencies declined after US January inflation hit 3.0%, exceeding forecasts and raising concerns about delayed Federal Reserve rate cuts. Fed Chair Powell's Senate testimony emphasized a cautious approach, suggesting higher rates may persist longer than markets anticipated.

Bitcoin Plunges Below $91K Amid Global Market Turbulence and Trump Trade Tensions

Bitcoin experienced a dramatic 7% drop below $91,200, triggering over $200 billion in liquidations amid economic uncertainties and Trump's aggressive trade policies. Despite the downturn, institutional interest from sovereign entities and technical indicators suggest potential for recovery if market conditions stabilize.

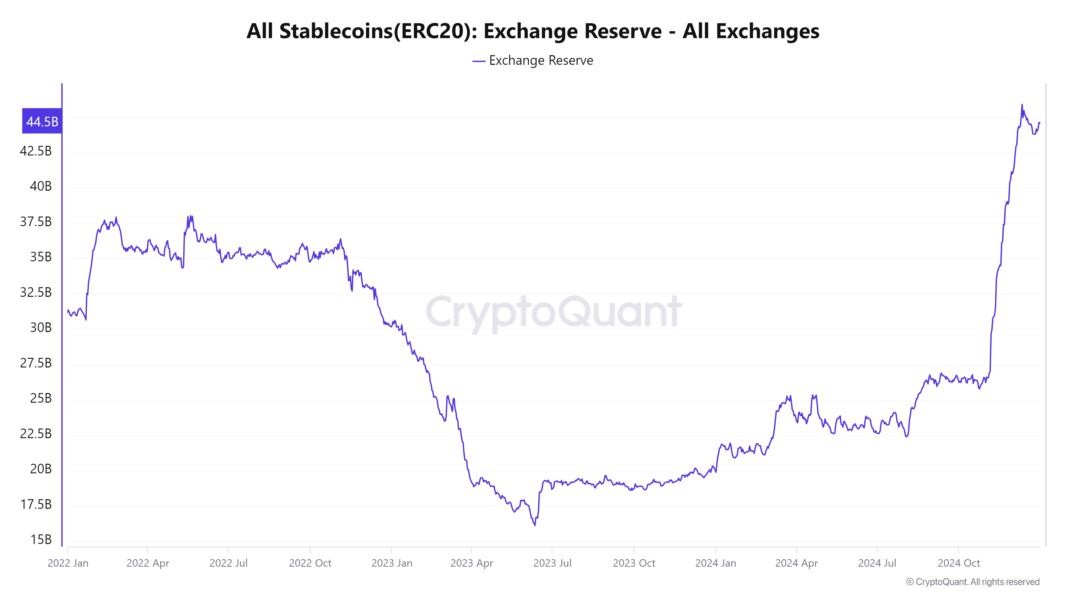

Bitcoin Eyes $117K as Record Stablecoin Liquidity Fuels Market Rally

Bitcoin's trajectory toward $117,000 gains momentum as stablecoin market cap hits an unprecedented $204 billion, signaling robust market demand. Record institutional interest, favorable Fed policies, and growing ETF adoption further strengthen Bitcoin's upward momentum in 2025.

Bitcoin Rallies to $105,000 as Fed Chair Powell Signals Support for Crypto Banking

Bitcoin surged 4.5% following the Federal Reserve's decision to maintain interest rates, reaching $105,000. The rally was amplified by Fed Chair Powell's unexpected pro-crypto comments supporting banks serving cryptocurrency customers, marking a significant shift in regulatory stance.

Bitcoin Price Could Soar to $249K According to CryptoQuant Analysis

CryptoQuant's latest research identifies three key drivers that could push Bitcoin to unprecedented heights between $145K-$249K: Trump's crypto policies, Fed rate decisions, and Bitcoin's market cycle timing. The prediction follows significant institutional accumulation and ETF launches that helped BTC reach current all-time highs.

Treasury Yields Pressure Bitcoin Below $97,000 as Economic Data Impacts Risk Assets

Bitcoin retreated from its $102,000 peak as strong U.S. services sector data pushed Treasury yields higher, dampening appetite for risk assets. The leading cryptocurrency's sensitivity to economic indicators and Fed policy continues to influence market dynamics, despite optimism around institutional adoption.

Federal Reserve's Crypto Skeptic Steps Down: Michael Barr's Exit Signals Regulatory Shift

Federal Reserve Vice Chair Michael Barr, known for his critical stance on cryptocurrencies, announces resignation amid controversy over Operation Chokepoint 2.0. His departure marks a significant change in U.S. financial regulation as investigations into alleged anti-crypto banking restrictions continue.

Global Nations Expected to Add Bitcoin to Strategic Reserves in 2025, Franklin Templeton Predicts

Investment giant Franklin Templeton forecasts widespread national adoption of Bitcoin as reserve currency in 2025, backed by surging institutional interest and U.S. Bitcoin ETFs managing $110 billion. With 13 states developing Bitcoin reserve legislation and ambitious price projections ranging from $175,000 to $350,000, this shift could reshape global financial systems.