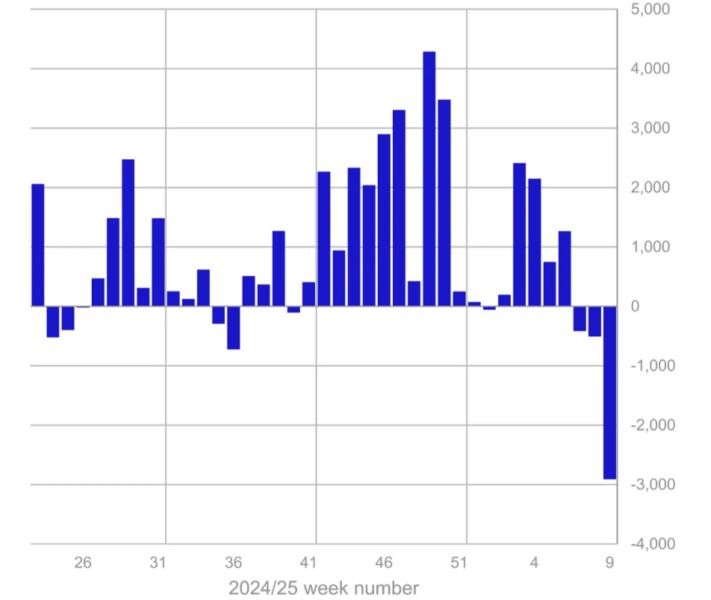

Crypto ETPs Hit by Historic $2.9B Weekly Exodus as Bitcoin Bears Strike

Cryptocurrency exchange-traded products faced unprecedented $2.9B in outflows last week, with Bitcoin taking the heaviest hit at $2.6B withdrawn. The dramatic reversal follows 19 weeks of steady inflows, impacting major providers like BlackRock and Grayscale while smaller crypto assets show resilience.

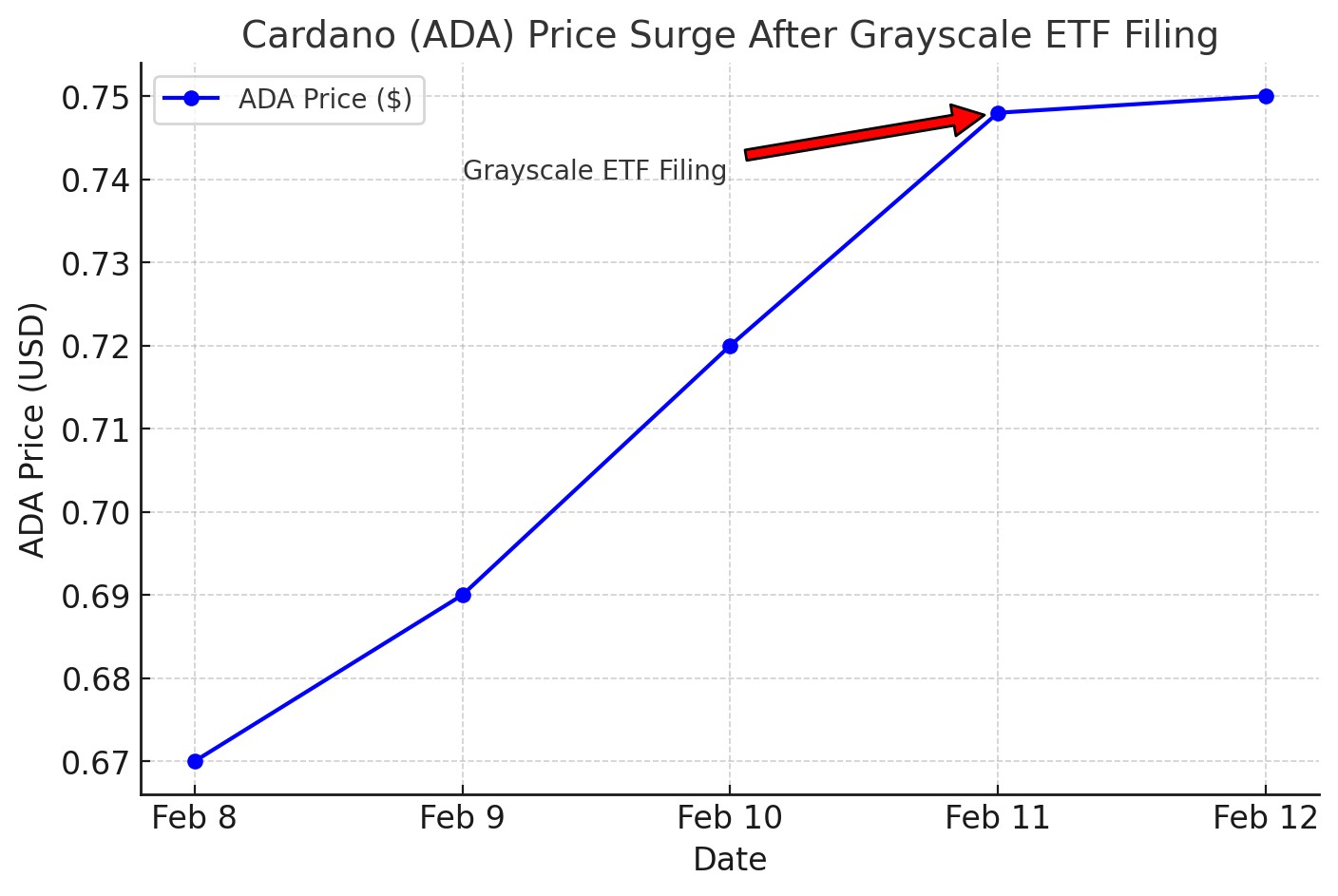

Grayscale's Cardano ETF Filing Ignites ADA Price Rally

Grayscale Investments has filed for a spot Cardano ETF with the SEC, triggering significant market interest and price movement. The proposed ETF aims to provide regulated ADA exposure through established custodians while capitalizing on growing institutional appetite for digital assets.

SEC Begins Review of Grayscale XRP Trust ETF Proposal Amid Market Rally

The SEC has initiated its evaluation of NYSE Arca's proposal to list the Grayscale XRP Trust as an ETF, beginning a 21-day public comment period. The news sparked positive market reaction, with XRP's price climbing 3.12% amid broader implications for the cryptocurrency's regulatory status.

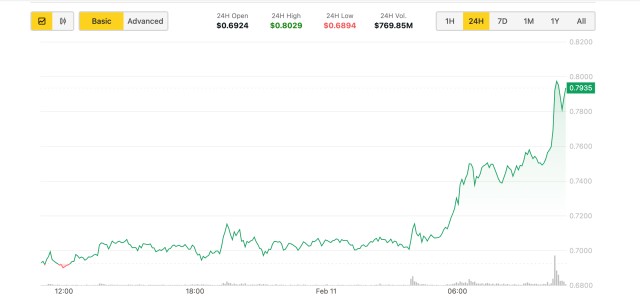

Grayscale's Cardano ETF Filing Sparks 11% Rally in ADA Price

Grayscale Investments has submitted the first-ever spot Cardano ETF application to the SEC through NYSE Arca, causing ADA's price to surge 11% to $0.74. The filing represents growing institutional interest in altcoins, with Coinbase set to serve as custodian for the proposed trust.

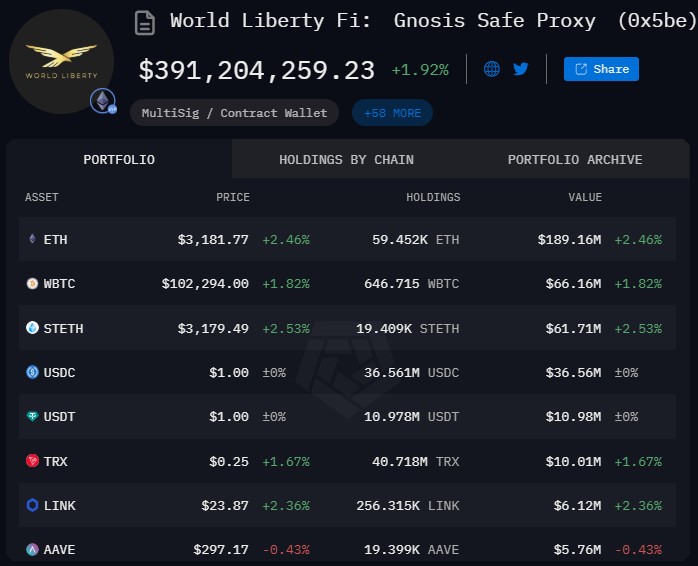

World Liberty Financial Expands Ethereum Portfolio with $130M Investment

World Liberty Financial has made a significant move in cryptocurrency markets, purchasing 39,242 ETH at an average price of $3,312 per token. The fund's total Ethereum holdings now stand at 78,722 ETH valued at $257M, despite facing short-term unrealized losses amid market volatility.

Grayscale Unveils Bitcoin-Focused Company ETF Strategy Amid Growing Institutional Interest

Grayscale Investments seeks SEC approval for a novel Bitcoin Adapters ETF targeting companies with significant Bitcoin holdings. The fund aims to invest primarily in firms maintaining billion-dollar Bitcoin reserves, with MicroStrategy emerging as a key potential component.

Cardano Surges with Grayscale Investment and FC Barcelona Partnership

Cardano's ADA token gains momentum in 2025 with major institutional backing from Grayscale Investments and a landmark partnership with FC Barcelona. Market analysts project potential 152% price increase to $2.88 by mid-March amid growing real-world adoption.

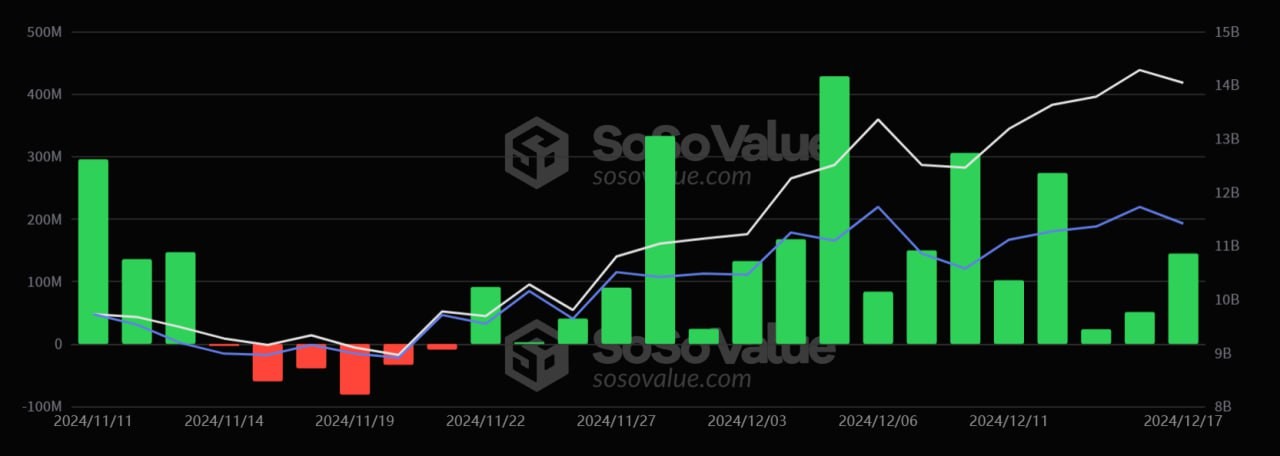

Ethereum ETFs Surge: BlackRock's ETHA Leads $145M Daily Inflow

Institutional investors demonstrate growing confidence in Ethereum with spot ETFs recording $145 million net inflow on December 17, led by BlackRock's ETHA with $135 million. The combined ETF net asset value reaches $14.04 billion, representing 3% of Ethereum's market cap.

Ethereum Surges Towards $4,000 as Network Activity Hits 8-Month Peak

Ethereum's network is experiencing unprecedented growth with daily wallet creation reaching 130,200 addresses, marking an 8-month high. The surge coincides with massive ETF inflows totaling over $3.8 billion and increased institutional activity, suggesting strong momentum as ETH approaches the $4,000 milestone.

Ethereum Soars to 3-Year Peak as Institutional ETF Interest Hits Record High

Ethereum reaches $4,089 amid unprecedented institutional investment through ETF products, with weekly inflows hitting $752.9 million. The surge coincides with major milestones including Michigan's pension fund investment and growing institutional adoption across digital assets.