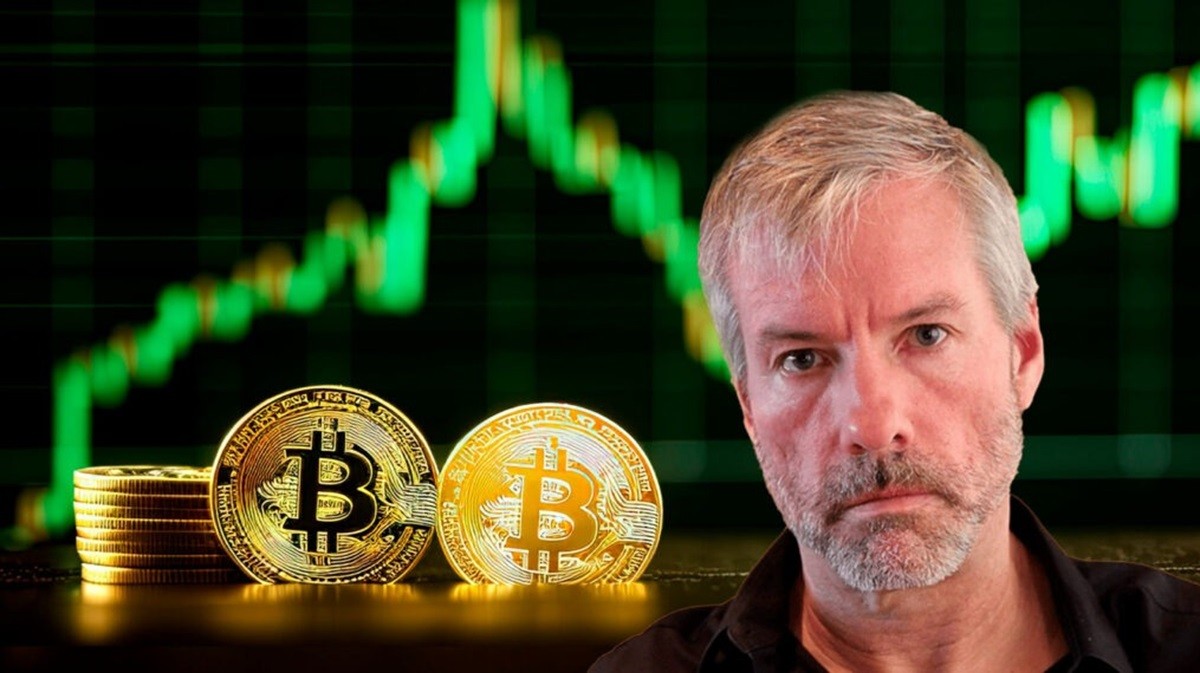

Saylor's Controversial 'Sell a Kidney' Bitcoin Statement Amid MicroStrategy Stock Decline

MicroStrategy's Michael Saylor makes waves with extreme pro-Bitcoin rhetoric, urging followers to 'sell a kidney' amid an 18% Bitcoin decline. His unwavering stance contrasts sharply with MicroStrategy's 28% stock drop, highlighting the volatile nature of crypto-linked investments.

MicroStrategy's Bitcoin Buying Spree Continues with $209M Purchase

MicroStrategy maintains its aggressive Bitcoin acquisition strategy with an eighth consecutive weekly purchase, adding 2,138 BTC worth $209 million. The software company's total holdings now reach 446,400 BTC, while its stock outperforms with a 402% gain in 2024.

MicroStrategy Unveils Bold $2 Billion Stock Offering to Fuel Bitcoin Acquisition Strategy

MicroStrategy announces plans to raise $2 billion through perpetual preferred stock to expand its massive Bitcoin holdings. The move is part of an ambitious '21/21 Plan' targeting $42 billion in total funding, as the company continues its aggressive cryptocurrency acquisition strategy.

MicroStrategy's Bitcoin Holdings Eclipse Future Mining Output in Historic Milestone

Business intelligence giant MicroStrategy now holds more Bitcoin than what will be mined between 2028-2032, owning 444,262 BTC versus the projected 328,125 BTC future output. This watershed moment highlights the growing institutional adoption of Bitcoin as a treasury reserve asset.

Bitcoin's Institutional Transformation: A Double-Edged Sword for Decentralization

As Bitcoin approaches a critical juncture in 2025, institutional giants like MicroStrategy are reshaping its landscape through massive acquisitions. This evolution raises pressing questions about maintaining Bitcoin's democratic principles amid growing corporate and government control of the cryptocurrency.

MicroStrategy Bolsters Bitcoin Portfolio with $209M Strategic Purchase

Business intelligence giant MicroStrategy expands its Bitcoin holdings to 446,400 BTC with a $209 million purchase at an average price of $97,837 per coin. The acquisition, funded through share sales, marks the company's eighth consecutive week of Bitcoin purchases under Michael Saylor's leadership.

MicroStrategy's Bold $11B Bitcoin Bet Reshapes Corporate Treasury Strategy

MicroStrategy's unprecedented acquisition of 113,000 Bitcoins worth $11 billion since November 2024 has propelled the company into the Nasdaq 100. Despite criticism over its debt-fueled strategy, the firm's total holdings now exceed 444,000 BTC valued at $44 billion.

MicroStrategy Unveils Ambitious $42 Billion Bitcoin Acquisition Strategy

MicroStrategy announces special shareholders meeting to advance its '21/21 Plan,' seeking approval to increase share authorization for a massive $42 billion Bitcoin purchase strategy. The company's recent acquisition of 42,162 BTC brings its total holdings to 444,000 Bitcoin, worth approximately $43.5 billion.

MicroStrategy's Bitcoin Holdings Surge with $561M Purchase as Company Joins Nasdaq 100

MicroStrategy continues its aggressive Bitcoin acquisition strategy, purchasing 5,262 BTC worth $561 million amid Bitcoin's new all-time high above $108,000. The software company strengthens its position as the largest corporate Bitcoin holder with 439,000 BTC while preparing to join the prestigious Nasdaq 100 Index.

Michael Saylor's Bold Vision: Bitcoin as a $81 Trillion National Asset Strategy

MicroStrategy's Michael Saylor proposes an ambitious plan for the US to establish a strategic Bitcoin reserve, potentially generating up to $81 trillion in wealth. The comprehensive strategy aims to modernize market infrastructure while addressing national debt, though it faces criticism from traditional economists.