MicroStrategy's Saylor Signals Readiness to Guide Trump on Crypto Policy

MicroStrategy's Michael Saylor expresses openness to advising former President Trump on cryptocurrency policy while navigating his company's Nasdaq-100 inclusion. The Bitcoin-focused firm aims for a $42 billion BTC target by 2025, despite potential index reclassification challenges.

MicroStrategy's Bold Move: $1.5B Bitcoin Purchase Pushes Holdings Past $46B Mark

MicroStrategy continues its aggressive Bitcoin acquisition strategy, adding 15,350 BTC worth $1.5 billion to its holdings. The company's total Bitcoin portfolio now stands at 439,000 BTC valued at $45.6 billion, while its stock value has surged 490% in 2023.

MicroStrategy Poised for Historic Bitcoin Purchase Above $100K

MicroStrategy, led by CEO Michael Saylor, signals readiness to make its first Bitcoin acquisition above the $100,000 mark, potentially expanding its massive 423,650 BTC holdings. The company's aggressive crypto strategy has driven a 500% stock surge this year, earning it a spot in the Nasdaq-100 index.

Microsoft Shareholders Reject Bitcoin Investment Proposal Despite MicroStrategy's Push

Microsoft shareholders voted against allocating up to 5% of the company's $78.4B cash reserves into Bitcoin, despite MicroStrategy's Michael Saylor advocating for the investment. The board maintained its conservative stance on crypto investments, citing volatility concerns and emphasizing stable treasury management.

Microsoft Shareholders Reject $784M Bitcoin Investment Proposal

Microsoft's shareholders decisively voted against a proposal to invest 1% of company assets in Bitcoin, choosing financial stability over cryptocurrency speculation. The decision, opposed by major institutional investors and backed by MicroStrategy's CEO, reflects Microsoft's commitment to low-risk investments and AI development.

MicroStrategy's Bold Move: Acquires $2.1B in Bitcoin, Now Holds Over 2% of Total Supply

Business intelligence giant MicroStrategy expands its Bitcoin dominance with a massive 21,550 BTC purchase, bringing its total holdings to 423,650 BTC. CEO Michael Saylor remains bullish despite Bitcoin's surge past $100,000, vowing to continue 'buying the top forever.'

Michael Saylor's Bitcoin Strategy: Keep It Simple and Hold Long-Term

MicroStrategy's Executive Chairman Michael Saylor advocates for a straightforward Bitcoin investment approach as the cryptocurrency surpasses $100,000. His time-tested strategy emphasizes regular purchases with spare capital and holding for 4-10 years, backed by MicroStrategy's impressive 476% stock gain.

Michael Saylor Urges Microsoft to Choose Bitcoin Over Stock Buybacks

MicroStrategy's Michael Saylor delivers a compelling three-minute pitch to Microsoft's board, advocating for Bitcoin adoption over traditional stock buybacks. His presentation highlights Bitcoin's superior performance and introduces Bitcoin24, a corporate adoption solution that could potentially boost Microsoft's growth and reduce risk.

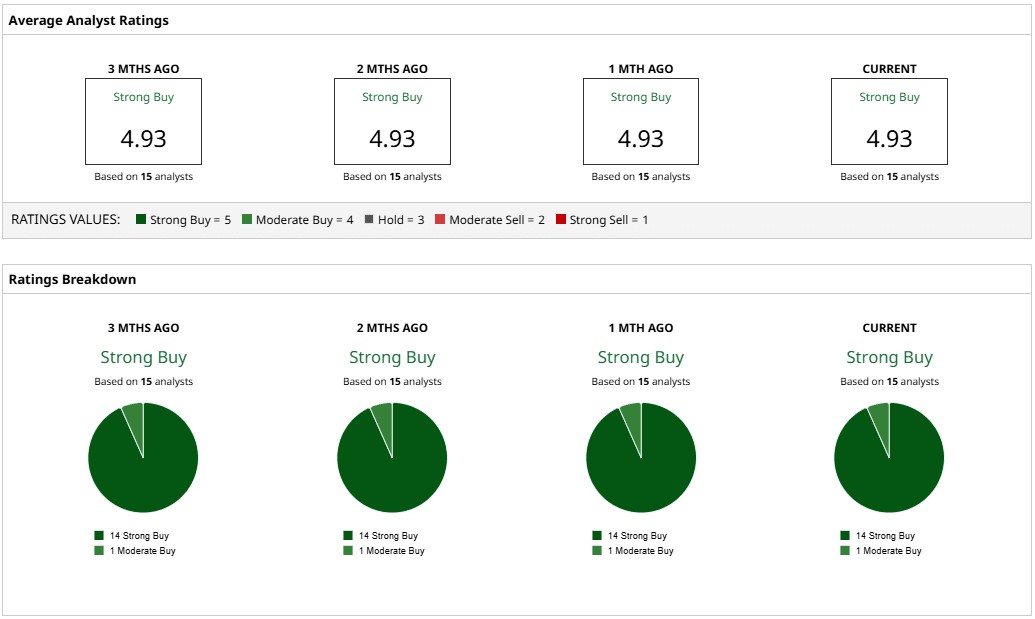

MicroStrategy's Bitcoin Gamble Yields 500% Stock Surge, Outperforming Crypto Market

Software company MicroStrategy has seen its stock soar 513% this year through an aggressive leveraged Bitcoin investment strategy led by Michael Saylor. The company's market cap has reached $87 billion, more than double its $37.6 billion Bitcoin holdings, as it continues raising capital to expand its crypto position.

MicroStrategy's Nasdaq 100 Entry Could Trigger $2B Investment Wave

Business intelligence giant MicroStrategy is set to join the Nasdaq 100 index, potentially driving up to $2 billion in fund flows as passive investors adjust their holdings. The company's massive Bitcoin holdings will bring unprecedented crypto exposure to index funds, marking a milestone for digital asset adoption in traditional markets.