Trump's New Administration Could Reshape XRP's Future as Price Surges Past $2.60

XRP experiences a 15% price surge amid expectations of crypto-friendly regulatory changes under Trump's incoming administration. With new pro-cryptocurrency appointments and potential SEC leadership changes, analysts predict XRP could reach $3.55 if favorable conditions persist.

Banking Documents Expose Federal Pressure to Cut Crypto Services, Coinbase Legal Chief Reveals

Coinbase CLO Paul Grewal unveils FOIA documents showing how U.S. regulators actively pressured banks to terminate services to crypto businesses, confirming 'Operation Chokepoint 2.0'. The revelations highlight systematic efforts to restrict banking access for crypto companies despite their legal compliance.

Trump Names Former PayPal Executive as White House AI and Crypto Advisor

Donald Trump appoints tech veteran David Sacks as the new 'Crypto Czar' to oversee AI and cryptocurrency policy. The former PayPal COO will chair the Presidential Council of Advisors for Science and Technology, signaling potential shifts toward reduced industry regulation.

Trump Taps Silicon Valley Veteran David Sacks as AI and Crypto Regulation Chief

Former President Trump has appointed ex-PayPal COO David Sacks to oversee artificial intelligence and cryptocurrency regulation in a newly created czar position. The appointment signals Trump's focus on providing clear guidelines for emerging technologies as he prepares for a potential return to office.

Bitcoin Shatters $100K Record as Trump's SEC Nominee Sparks Crypto Surge

Bitcoin achieves unprecedented milestone, surpassing $100,000 amid Trump's election victory and pro-crypto regulatory appointments. The nomination of crypto-friendly Paul Atkins as SEC chair and potential national bitcoin reserve plans fuel market optimism.

Grayscale Files for Spot Solana ETF Amid Growing Institutional Interest

Grayscale Investments seeks SEC approval to convert its $134.2M Solana Trust into a spot ETF under ticker GSOL, following successful Bitcoin and Ethereum ETF launches. The move comes as Solana's network adoption surges, with SOL reaching $264 and outpacing Ethereum in DEX volumes.

Trump Taps Crypto-Friendly Paul Atkins as SEC Chair Nominee

Former SEC Commissioner Paul Atkins, known for his pro-cryptocurrency stance, has been nominated by Trump to lead the SEC following Gensler's departure. The nomination aligns with Trump's crypto-positive campaign promises and could signal a major shift in regulatory approach.

Grayscale Seeks SEC Approval to Launch Solana Spot ETF

Grayscale Investments has filed with the SEC to convert its $134.2M Solana Trust into a spot ETF under ticker GSOL. The move follows successful Bitcoin and Ether ETF conversions, while Solana's price surged 7% on the news amid growing institutional interest.

Coinbase CEO Takes Stand Against Law Firms Hiring Anti-Crypto Regulators

Brian Armstrong announces Coinbase will cut ties with law firms employing former government officials who opposed crypto during Biden administration. The move follows Milbank's hiring of ex-SEC enforcement chief Gurbir Grewal, who oversaw billions in crypto industry penalties.

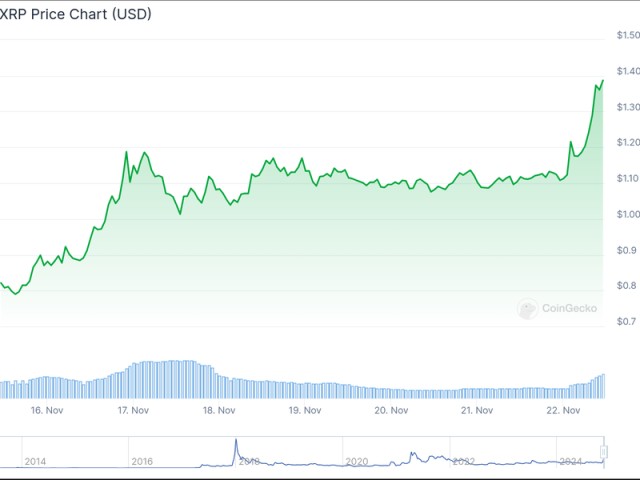

XRP Surges to Third Place in Crypto Market as Regulatory Landscape Brightens

XRP has claimed the position of third-largest cryptocurrency by market cap, reaching over $140 billion amid favorable regulatory developments. A pro-crypto U.S. administration and Ripple's legal victory against the SEC have created ideal conditions for the token's remarkable growth.