Historic Confirmation: Bitcoin-Friendly Bessent Named Treasury Secretary

Scott Bessent secures Senate confirmation as the first openly gay U.S. Treasury Secretary with bipartisan support despite tax concerns. The former hedge fund manager faces critical challenges including Trump's expiring tax cuts, debt ceiling management, and ambitious trade policies.

IRS Extends Crypto Tax Reporting Deadline to 2026 Amid Industry Adaptation

The IRS has delayed new cryptocurrency tax reporting requirements until 2026, giving brokers more time to implement necessary systems. The postponement affects both centralized and DeFi platforms, impacting up to 2.6 million taxpayers while facing legal challenges from industry groups.

IRS Extends Crypto Tax Reporting Rules to 2026, Offering Relief to Exchanges and Investors

The IRS has announced an extension of cryptocurrency tax reporting requirements through 2026, giving exchanges and taxpayers more time to adapt. The update includes flexibility in cost-basis calculation methods for 2025 and new rules for both CeFi and DeFi brokers.

Italy Sets New Crypto Tax Rate at 26% in 2025 Budget Law

Italy's Senate has approved significant changes to cryptocurrency taxation, setting a 26% rate on capital gains starting 2025, with a planned increase to 33% in 2026. The new law removes the €2,000 exemption threshold and offers an 18% substitute tax option for assets held by January 2025.

Crypto Crackdown: Indian Tax Officials Expose Wedding Planners' Digital Currency Network

Income Tax officials in Jaipur have uncovered a sophisticated cryptocurrency operation during raids on wedding planners, seizing ₹20 crore and freezing crypto wallets. The investigation revealed an elaborate scheme converting unaccounted wedding cash into digital currencies through hawala networks.

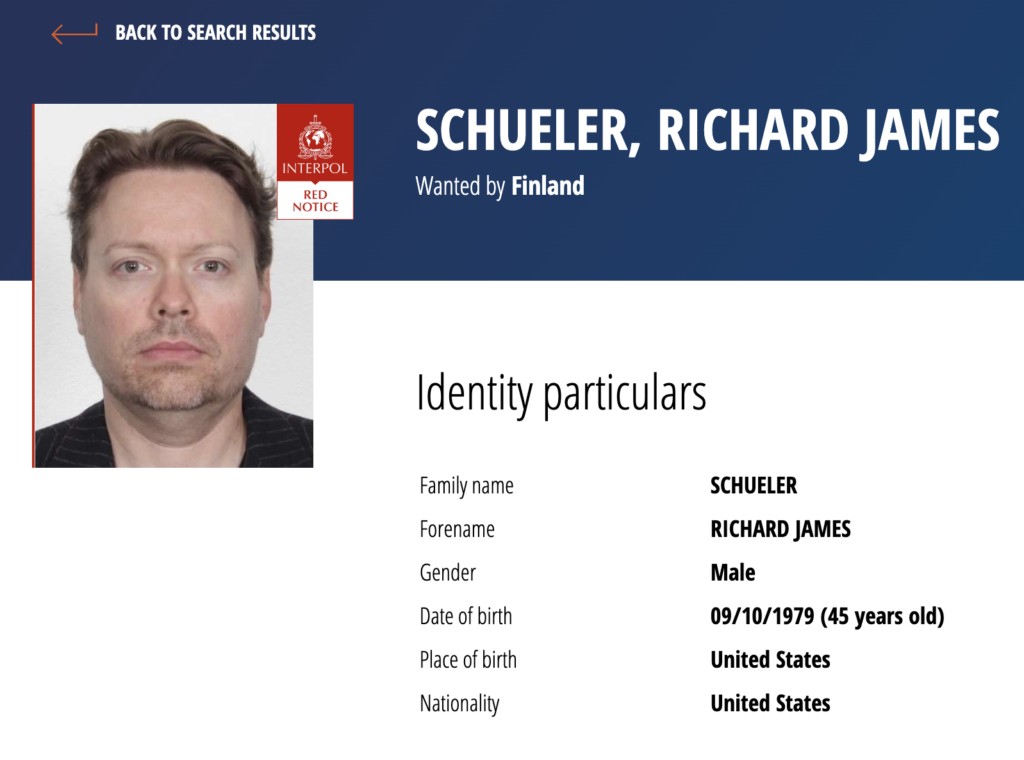

Interpol Issues Global Arrest Warrant for Cryptocurrency Founder Richard Heart Amid Tax Fraud Allegations

Interpol has issued a Red Notice for Richard Schueler (aka Richard Heart), founder of Hex and PulseChain, following Finnish authorities' allegations of tax fraud and assault. The notice comes amid an ongoing SEC lawsuit claiming Schueler raised over $1 billion through unregistered cryptocurrency offerings.

Interpol Issues Global Hunt for HEX Founder Amid Tax Fraud and Assault Allegations

Richard Heart, founder of cryptocurrency project HEX, faces an Interpol Red Notice over tax evasion and assault charges in Finland. The controversial figure simultaneously battles a $1B SEC lawsuit while maintaining an active social media presence showcasing his wealth.

Crypto Project HEX Plunges as Founder Heart Lands on Interpol's Most Wanted List

Richard Heart, founder of cryptocurrency HEX, has been added to Interpol's Red Notice list amid tax fraud charges and assault allegations in Finland. The news triggered a 25% drop in HEX's value, adding to the project's dramatic 99% decline from its peak.

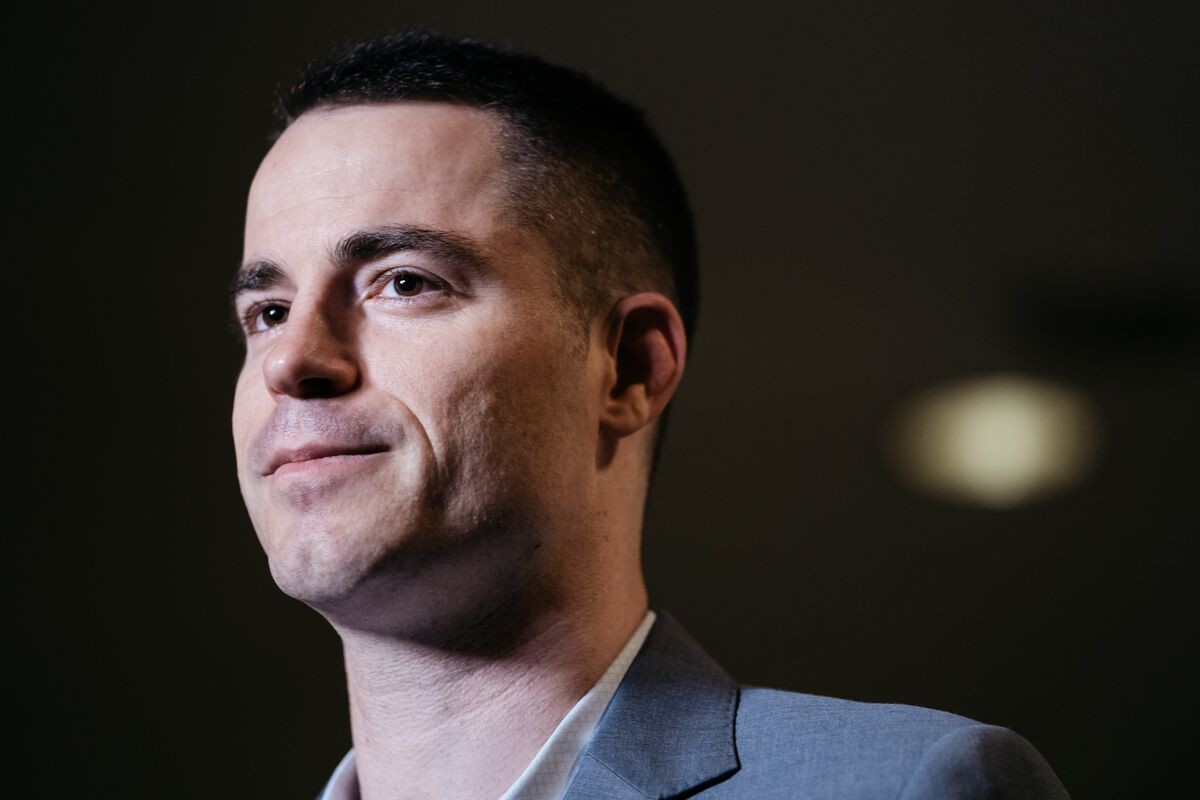

Trump's Bitcoin Tax Reform: A Game-Changing Proposal for Cryptocurrency Adoption

The cryptocurrency community urges Donald Trump to pledge eliminating capital gains taxes on Bitcoin if elected in 2024. This bold policy shift could revolutionize digital asset adoption in the US while attracting investment and innovation, though critics warn of potential revenue losses.

Bitcoin Jesus Challenges $50M Tax Evasion Case Over Cryptocurrency Transactions

Roger Ver, known as 'Bitcoin Jesus', fights an eight-count tax evasion indictment involving $50M in unreported Bitcoin gains and alleged undervaluation of companies during citizenship renunciation. His defense team claims prosecutorial misconduct and unclear crypto regulations in their motion to dismiss.